Oakmark International's Biggest 4th-Quarter Trades

David Herro (Trades, Portfolio)'s Oakmark International Fund recently released its portfolio update for the fourth quarter of 2019.

The Oakmark International Fund is a Chicago-based global investment fund that holds a diversified portfolio of stocks in companies outside of the U.S. Managed by Herro, the fund is a subset of Harris Associates, an investment company with over $118 billion in assets under management. The fund employs a focused approach of investing in relatively few individual securities that are trading at a discount to intrinsic value and show strong potential to increase value for shareholders.

Based on the above criteria, the fund's biggest sells of the quarter were Taiwan Semiconductor Manufacturing Co. Ltd. (TPE:2330) and ASML Holding NV (XAMS:ASML), while its biggest buys were Rolls-Royce Holdings PLC (LSE:RR.) and Naspers Ltd (JSE:NPN).

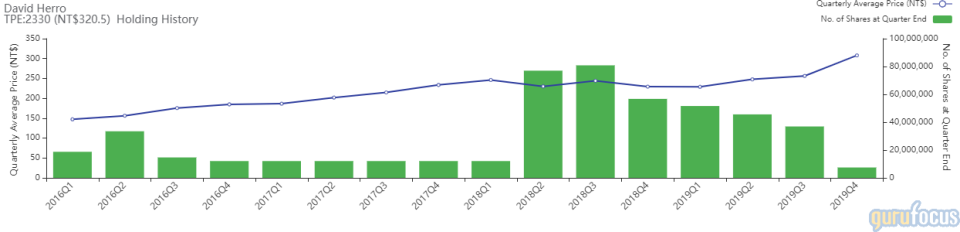

Taiwan Semiconductor

The Oakmark International Fund reduced its stake in Taiwan Semiconductor by 29,460,000 shares, or 79.82%, impacting the equity portfolio by -0.88%. Shares traded at an average price of 307.92 New Taiwan dollars ($10.29) during the quarter.

Headquartered in Hsinchu, Taiwan, Taiwan Semiconductor is the world's largest independent semiconductor producer. It derives most of its profits from smartphone components and memory, though its internet of things products have seen increasing sales in recent years.

On March 4, shares of Taiwan Semiconductor traded around NT$320.50 for a market cap of NT$8.23 trillion and a price-earnings ratio of 23.85. According to the Peter Lynch chart, the stock is trading above its intrinsic value.

Taiwan Semiconductor has a GuruFocus financial strength rating of 8 out of 10 and a profitability rating of 9 out of 10. The cash-debt ratio of 3.33 and Altman Z-score of 9.48 suggest long-term financial strength. In recent years, revenue has increased, though net income has remained mostly flat.

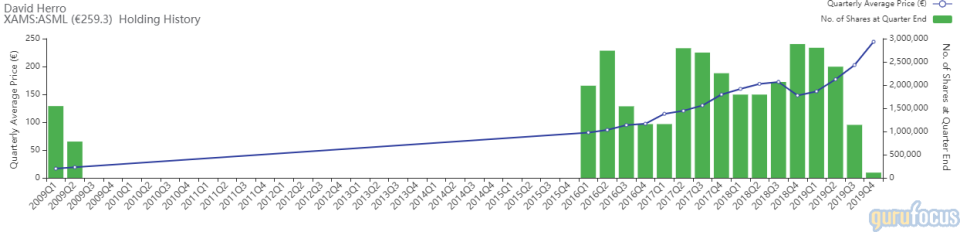

ASML Holding

The fund also reduced its ASML Holding stake by 1,029,000 shares, or 90.11%, which had a -0.86% impact on the equity portfolio. Shares traded at an average price of 244.44 euros ($272.15) during the quarter.

ASML Holding is a semiconductor company based in the Netherlands. It is the world's largest supplier of photolithography systems, though it also manufactures machines for the production of integrated circuits.

On March 4, ASML shares traded around 259.30 euros apiece for a market cap of 110.37 billion euros and a price-earnings ratio of 42.16. The Peter Lynch chart suggests that the stock is overvalued.

ASML has a GuruFocus financial strength rating of 7 out of 10 and a profitability rating of 9 out of 10. The interest coverage of 111.19% and Altman Z-score of 8.51 are outperforming 73.63% of competitors. Revenue has increased significantly in recent years, though net income was down slightly in 2019.

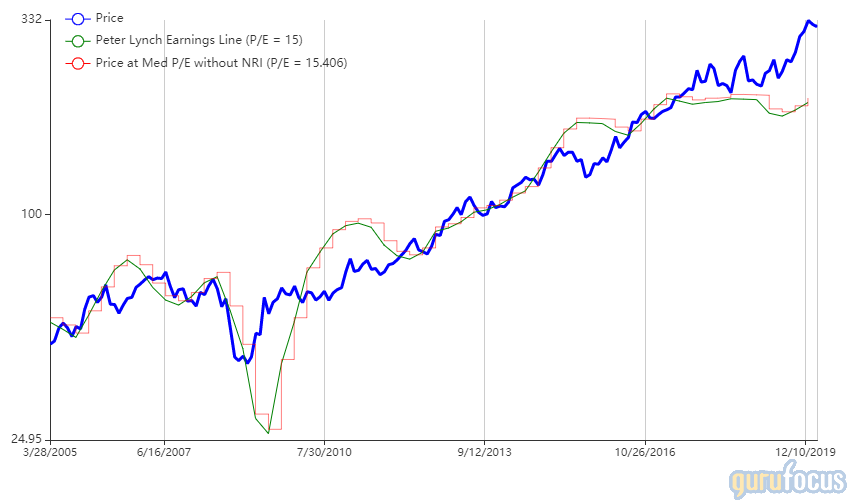

Rolls-Royce Holdings

The fund added 21,621,000 shares to its investment in Rolls-Royce Holdings, increasing the position by 31.82%. The trade had a 0.61% impact on the equity portfolio. During the quarter, shares traded at an average price of 7.21 pounds (approximately $9.28).

Rolls-Royce Holdings is a British engineering company that designs and manufactures power systems for the civil aerospace, defense and nuclear power industries. It also has a relatively new data innovation arm, R2 Data Labs, which aims to utilize artificial intelligence and machine learning to improve industrial efficiency.

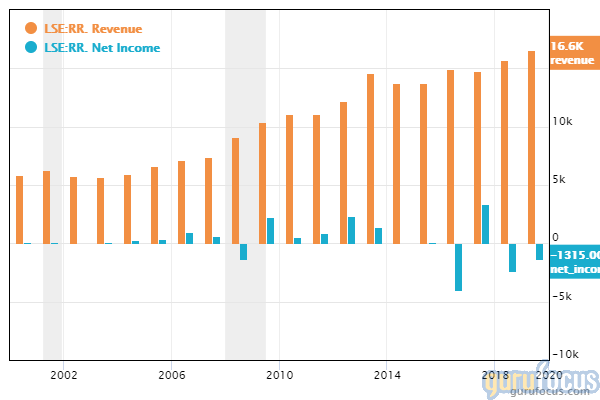

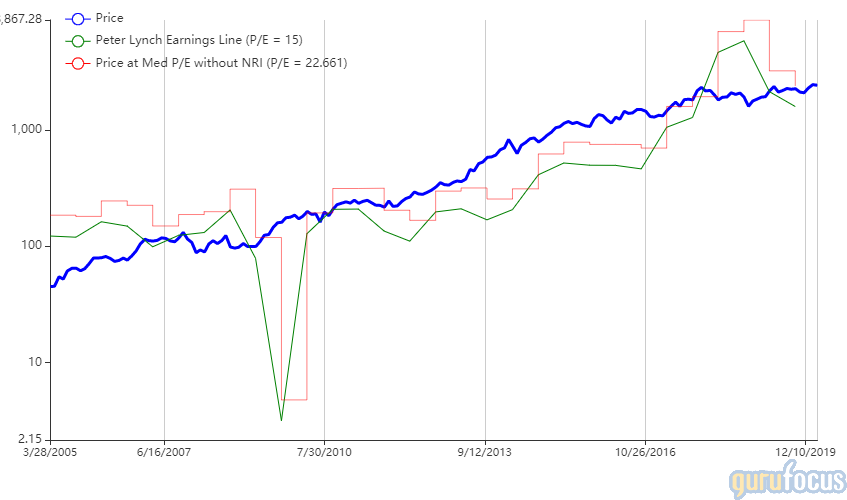

On March 4, shares of the company traded around 6.36 pounds for a market cap of 12.28 billion pounds. According to the Peter Lynch chart, the stock is trading near its fair value.

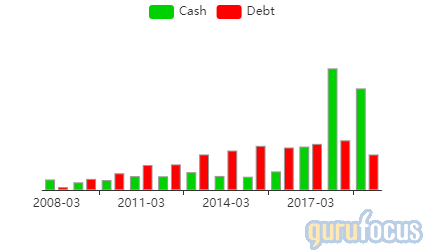

GuruFocus has assigned Rolls-Royce a financial strength rating of 3 out of 10 and a profitability rating of 7 out of 10. The cash-debt ratio of 0.78, equity-to-asset ratio of -0.11% and current ratio of 1.07 suggest that the company's debt may exceed its short-term available cash. The company has grown its revenue in recent years, though net income has been in the negatives for the past couple of years due to high cost of sales (cost of sales took up approximately 94.35% of revenue in fiscal 2019).

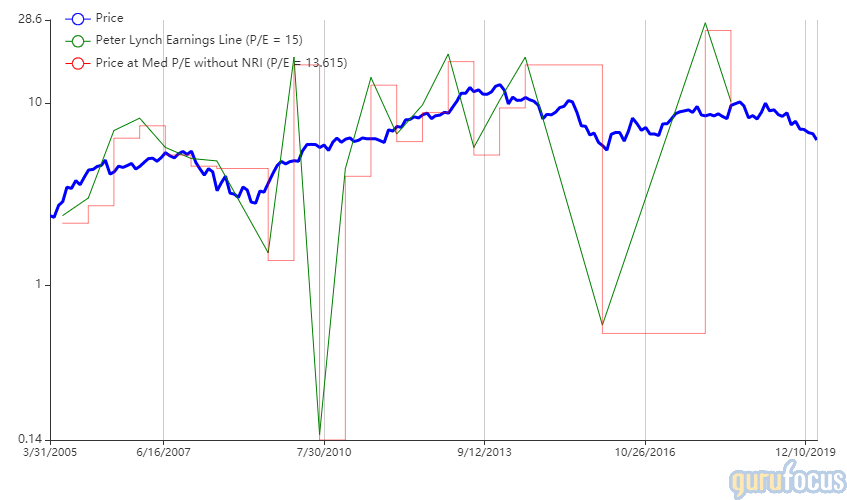

Naspers Ltd

The Oakmark International Fund increased its stake in Naspers by 40.89%, or 1,149,000 shares. The trade had a 0.59% impact on the equity portfolio. During the quarter, shares traded at an average price of 2,191.87 South African rand (approximately $73.26).

Naspers is a South Africa-based multinational e-commerce, internet communication and online entertainment group that operates and invests in markets around the world. In the third quarter of 2019, it spun off its internet consumer technology investing division into Prosus NV (XAMS:PRX), though it maintained a stake of approximately 73% in the newly independent company.

On March 4, shares of Naspers traded around 2,450 rand for a market cap of 1.07 trillion rand and a price-earnings ratio of 12.64. The Peter Lynch chart suggests that the stock is trading near its fair value.

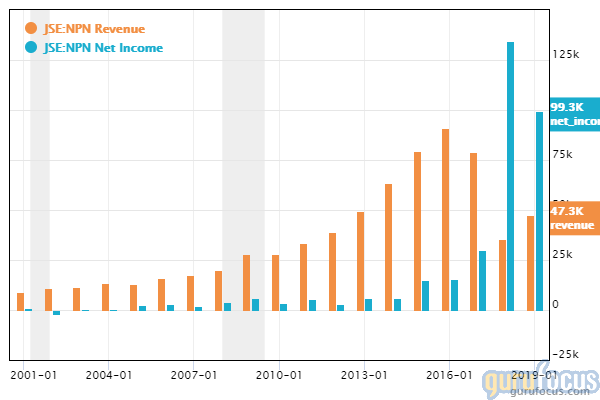

Naspers has a GuruFocus financial strength rating of 5 out of 10 and a profitability rating of 5 out of 10. The cash-debt ratio of 2.86 is average for the industry, while the high Altman Z-score of 9.69 suggests the company is financially stable in the long term.

However, the company's Beneish M-Score of -1.75 indicates that it is likely an accounting manipulator, which is confirmed by the below chart of its reported revenue and net income history. Instead, we can look at other metrics to determine the company's profitability, including free cash flow, which was up to 8.45 rand per share in fiscal 2019 compared to -8.67 rand in the previous year, and tangible book value per share, which was 831.84 rand at the end of 2019 compared to 596.43 rand at the end of 2018.

Portfolio overview

As of the quarter's end, the Oakmark International Fund was valued at $32.12 billion and held shares of 65 stocks. Its top holdings were Glencore PLC (LSE:GLEN) with 4.47% of the equity portfolio, BNP Paribas (XPAR:BNP) with 3.85% and Intesa Sanpaolo (MIL:ISP) with 3.71%.

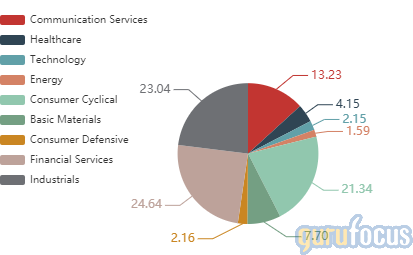

In terms of sector weighting, the fund is most heavily invested in financial services (24.64%), industrials (23.04%) and consumer cyclical (21.34%).

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research and/or consult registered investment advisors before taking action in the stock market.

Read more here:

3 Ben Graham Value Stocks to Consider as Markets Tumble

Interest Rate Cut Signals a Red Flaf for US Bank Stocks

Warren Buffett Adds to Delta Investment as Airlines Plunge to Value Territory

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.