Oceaneering (OII) Stock Up 2.8% Since Beating Q4 Estimates

Shares of Oceaneering International, Inc. OII have gone up 2.8% since the fourth-quarter 2021 earnings announcement on Feb 24.

The rise can be accredited to Oceaneering’s fourth-quarter earnings and sales beating the Zacks Consensus Estimate.

Behind the Earnings Headlines

Oceaneering reported fourth-quarter 2021 adjusted earnings of 5 cents per share, marginally beating the Zacks Consensus Estimate of a profit of 3 cents.

The bottom line was greater than the year-ago quarter figure of 2 cents per share. This improvement can be attributed to higher revenues from the Subsea Robotics, Manufactured Products, Offshore Projects Group and the Integrity Management & Digital Solutions units.

Oceaneering’s total quarterly revenues of $466.71 million beat the Zacks Consensus Estimate of $465 million and increased approximately 10% from the year-ago sales of $424.26 million.

Segmental Information

Subsea Robotics: The unit provides remotely operated submersible vehicles for drill support, vessel-based inspection, subsea hardware installation, pipeline surveys and maintenance services.

Revenues of $131.3 million compared favorably with $114.7 million in the fourth quarter of 2020. The segment reported an operating income of $21 million, higher than the year-ago quarter’s $14.5 million. Days on hire rose 2.3% year over year to 12,747, while ROV utilization increased to 55% from 54% a year ago.

Manufactured Products: The segment focuses on the manufactured products business, theme park entertainment systems and automated guided vehicles.

Revenues were $102.9 million, up from the prior-year figure of $99.9 million. The operating loss in the fourth quarter came in at $20.2 million against the year-ago quarter’s profit of $12.2 million. The backlog rose to $318 million as of Dec 31, 2021.

Offshore Projects Group: This involves OII’s former Subsea Projects segment, excluding survey services and global data solutions, and its service and rental business, excluding ROV tooling.

Revenues increased about 25.9 % to $85.4 million from $67.8 million in the year-ago quarter. Moreover, the unit’s operating income of $6.8 million came against the $9.9 million loss reported in the fourth quarter of 2020.

Integrity Management & Digital Solutions: This segment mainly covers the company’s Asset Integrity segment along with its global data solutions business.

Revenues of $60.5 million improved from the year-ago figure of $54.3 million. The segment also reported an operating income of $6 million compared with the prior-year quarter’s $892,000 as a result of operational improvements.

Aerospace and Defense Technologies: The segment is engaged in Oceaneering’s government business, which focuses on defense subsea technologies, marine services and space systems.

Revenues totaled $83.6 million, down from $87.5 million in the fourth quarter of 2020. The operating income of $10.6 million fell from $16.5 million in the year-ago quarter.

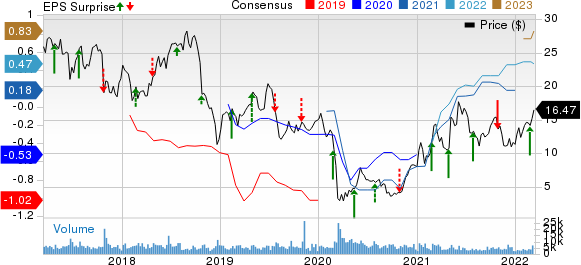

Oceaneering International, Inc. Price, Consensus and EPS Surprise

Oceaneering International, Inc. price-consensus-eps-surprise-chart | Oceaneering International, Inc. Quote

Capital Expenditure & Balance Sheet

Capital expenditure in the fourth quarter, including acquisitions, summed $14.4 million. As of Dec 31, 2021, Oceaneering had cash and cash equivalents worth $538.1 million and long-term debt of about $702 million. The total debt to total capital was 57.9 %.

Outlook

For 2022, Oceaneering projects its consolidated EBITDA in the $225 million-$275 million range. It estimates its capex guidance within the $70-$90 million band. OII projects unallocated expenses of around the mid-$30 million range per quarter for the year.

The company anticipates income tax payments in the band of $40-$45 million for 2022. Oceaneering expects full-year 2022 to yield a positive free cash flow of $75 million to $125 million.

Zacks Rank & Stocks to Consider

Oceaneering currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks from the energy space are ExxonMobil Corporation XOM, ConocoPhillips COP and Occidental Petroleum OXY, each presently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

ExxonMobil reported fourth-quarter 2021 earnings per share (EPS) of $2.05, excluding identified items, beating the Zacks Consensus Estimate of $1.96. At the end of the fourth quarter, ExxonMobil’s total cash and cash equivalents were $6.8 billion.

ExxonMobil is expected to see an earnings growth of 38.7% in 2022. XOM initiated share repurchases at the beginning of the March-end quarter this year. The buybacks are associated with the repurchase plan announced earlier, representing the program of repurchasing up to $10 billion over the next 12 to 24 months.

ConocoPhillips reported fourth-quarter 2021 adjusted EPS of $2.27, beating the Zacks Consensus Estimate of $2.20. ConocoPhillips reported preliminary 2021 year-end proved reserves at 6.1 billion barrels of oil equivalent (Boe).

ConocoPhillips’ earnings for 2022 are expected to soar 69.5% year over year. COP revised higher its expected 2022 return of capital to shareholders. The new guidance of $8 billion reflects an increase from the prior projection of $7 billion. The incremental returns to stockholders will be distributed through share repurchases and VROC tiers.

Houston, TX-based Occidental Petroleum is an integrated oil and gas company with significant exploration and production exposure. As of the 2020 end, Occidental’s preliminary worldwide proved reserves totaled 2.91 billion Boe compared with 3.9 billion Boe at the 2019 end.

Occidental Petroleum’s earnings for 2022 are expected to surge 85.9% year over year. OXY witnessed four upward revisions in the past 30 days. It beat the Zacks Consensus Estimate thrice in the last four quarters, with an earnings surprise of 41.8%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

Occidental Petroleum Corporation (OXY) : Free Stock Analysis Report

Oceaneering International, Inc. (OII) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research