Oil ETFs Rise as Crude Falls, Defying Logic

War, price caps, OPEC production cuts—this year has been a wild one for oil investors. But what if I told you that even after everything that’s happened in 2022, oil prices are lower than they were at the start of the year?

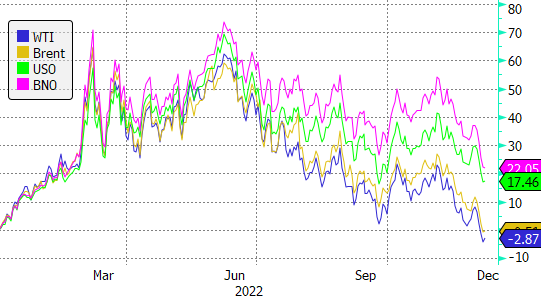

At $73 a barrel, West Texas Intermediate crude is about 3% lower than where it began the year, at $75.21. The other major oil benchmark, Brent, is also down—by 0.6%.

YTD Returns

The obvious takeaway may be that this reflects the unpredictability of commodity markets, and the thinking that the person who tries to predict prices is doomed to fail.

Still, another key point looms for exchange-traded ETF investors specifically: You can make money in commodity ETFs even if the price of the underlying commodity goes against you.

Even with WTI down 3% this year, the United States Oil Fund (USO)—which holds oil futures—has gained 18%. Similarly, the United States Brent Oil Fund (BNO) is 22% higher.

The reason for the oil ETFs’ outperformance is the shape of the oil futures curve. Fears of oil supply disruption due to the Russia-Ukraine war pushed the oil futures curve into so-called backwardation, where near-month oil prices are higher than later-month oil prices.

This is a good thing, because it allows oil ETFs to roll their positions from higher-priced oil futures contracts to lower-priced oil futures contracts. It’s the equivalent of selling high and buying low.

As worries about supply disruptions have eased in recent months, the WTI futures curve has shifted into backwardation’s opposite: contango. This is when near-month contracts are priced lower than later-month contracts, while Brent is holding on to a modest backwardation.

Contango has the opposite impact as backwardation on futures-based ETFs—it reduces returns as lower-priced contracts are exchanged for higher-priced contracts.

The magnitude of contango and backwardation also matters for returns. The steeper the backwardation, the better for returns, while the steeper the contango, the worse for returns.

Resilient Russian Supplies

Though oil prices are currently down modestly on the year, those losses belie the year’s volatility.

At their highest levels of 2022 in March and June, both WTI and Brent were up close to 60%. They’ve since fallen 40% from those levels, erasing the gains.

The initial spike was catalyzed by Russia’s February invasion of Ukraine, which sparked supply concerns given that Russia is the world’s second-largest oil exporter. But even as some countries shunned Russia in retaliation for its invasion, the oil kept flowing.

Compared with early fears, Russia’s oil supplies have proven to be resilient. While Russian exports to the U.S., Europe, Japan and Korea have slowed to a trickle because of sanctions, thirsty consumers in China, India and Turkey have bought those barrels.

The result is a small net decrease in Russian oil supplies this year. At the same time, oil supplies from other countries have surged in 2022 by 4.6 million barrels per day, according to the International Energy Agency, well above the 2.1 million barrel per day increase in demand.

The growth in oil demand has been weighed down by lockdowns and slowing economic growth in China, the world’s second-largest oil consumer.

Economic weakness in Europe and other parts of the world have also sapped demand, while a drawdown of emergency oil reserves in the U.S. and other IEA-member countries has further added supplies onto the market.

Looking Ahead

Though it’s surprising to look at oil prices today and see them down from where they started the year, this is just a moment in time.

For much of 2022, consumers faced sky-high prices, especially for the end products they use. Both gasoline and diesel prices briefly hit record highs this year, even though oil prices remained below their record levels set in 2008.

Price Change Since July 2008

A shortage of refining capacity pushed prices for those refined products to all-time-high premiums compared to oil itself. Today gasoline prices are back down to where they started the year, but diesel is still holding on to a 40% gain, reflecting the tightness in refining capacity.

Incidentally, the United States Gasoline Fund (UGA) is up 24% year to date (and it would have been an even better year for the United States Diesel-Heating Oil Fund (UHN) if it were still around).

So, what might next year bring? Well, if there’s anything we learned from this year, it’s that predicting energy prices is foolish, because more likely than not, you’ll end up wrong.

But it’s safe to say that if we do get a global economic recession in 2023, then all bets are off and oil prices will probably fall more.

On the other hand, if the economic outlook brightens, demand might pick up and prices might rise.

That doesn’t necessarily mean we’ll see a surge in prices at the pump. Just as diesel prices have sharply outperformed oil this year, if more refining capacity comes online next year, we could see the opposite.

Fortunately, there’s good news on that front. According to the IEA, three large refinery projects in Kuwait, Nigeria and Mexico are coming online by the end of 2023, which could significantly increase refining capacity.

Email Sumit Roy at sumit.roy@etf.com or follow him on Twitter @sumitroy2

Recommended Stories