Oil & Gas Stock Q1 Earnings Roster for Apr 30: XOM, CVX, PSX, IMO

Investors gained a brief idea on how key energy firms have fared in the recently-concluded first quarter from earnings announcements of BP plc BP and Hess Corporation HES. With oil price improving remarkably, the upstream business of energy giants is likely to have gained in the March quarter.

Oil Price Rises in Q1

In the first quarter of this year, the price of crude oil improved significantly, thanks to the rolling out of coronavirus vaccines, which brightened up the outlook of global fuel demand. In fact, for the first time amid the coronavirus crisis, the commodity’s price reached the pre-pandemic mark in the March quarter.

What Does it Mean for Energy Majors?

The healthy crude pricing scenario encouraged explorers and producers to gradually return to shale plays in the first quarter. As revealed by data provided by Baker Hughes Company BKR, the count of rigs in the United States increased in each of the three months of the March quarter of this year. Hence, it is quite evident that improved crude oil price is likely to have favored the upstream business of energy giants.

Along with the upstream business, downstream operations improved during the quarter. In fact, during the last three months, there has been remarkable growth in refining margins and product demand, thanks to easing of the social-distancing measures.

Key Releases

Given the backdrop, let us take a look at how the following four energy companies are placed ahead of their first-quarter earnings releases slated for Apr 30.

Our proprietary model clearly indicates that a company needs to have the right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — to increase the odds of an earnings beat. You can see the complete list of today’s Zacks #1 Rank stocks here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Based in Irving, TX, Exxon Mobil Corporation XOM is geared up to release results, before the opening bell.

Our proven model predicts an earnings beat for ExxonMobil this time around as it has an Earnings ESP of +8.09% and a Zacks Rank #1.

Exxon Mobil Corporation Price and EPS Surprise

Exxon Mobil Corporation price-eps-surprise | Exxon Mobil Corporation Quote

Chevron Corporation CVX is set to report earnings before the opening bell. The chances of Chevron delivering an earnings beat this time around are high as it has an Earnings ESP of +3.32% and a Zacks Rank #3.

Chevron Corporation Price and EPS Surprise

Chevron Corporation price-eps-surprise | Chevron Corporation Quote

Phillips 66 PSX is scheduled to report earnings before the opening bell. Notably, the chances of the diversified energy manufacturing and logistics company delivering an earnings beat this time around are low as it has an Earnings ESP of 0.00% and a Zacks Rank #4 (Sell).

Phillips 66 Price and EPS Surprise

Phillips 66 price-eps-surprise | Phillips 66 Quote

Imperial Oil Limited IMO is set to report earnings before the opening bell. The chances of Imperial Oil delivering an earnings beat this time around are slim as it has an Earnings ESP of 0.00% and a Zacks Rank #1.

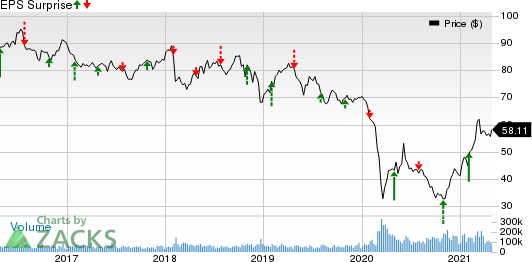

Imperial Oil Limited Price and EPS Surprise

Imperial Oil Limited price-eps-surprise | Imperial Oil Limited Quote

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Chevron Corporation (CVX) : Free Stock Analysis Report

Hess Corporation (HES) : Free Stock Analysis Report

Imperial Oil Limited (IMO) : Free Stock Analysis Report

BP p.l.c. (BP) : Free Stock Analysis Report

Phillips 66 (PSX) : Free Stock Analysis Report

Baker Hughes Company (BKR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research