Oil & Gas Stocks' Q3 Earnings Due on Oct 30: BKR, CLR & More

The third-quarter earnings season has been lackluster so far for oil and gas stocks, primarily due to softness in commodity prices. Intensifying trade tensions between the United States and China, which resulted in slowdown of the global economy, significantly hurt energy demand. With several energy companies expected to report quarterly results in mid-week, let’s delve into the factors that played major roles in driving their earnings and impacted the firms.

Factors That Affected Third-Quarter Results So Far

WTI crude price in third-quarter 2019 was lower than the year-ago period. In July, August and September, WTI averaged $57.35, $54.81 and $56.95 per barrel, respectively, per the U.S. Energy Information Administration. In comparison, WTI had averaged $70.98, $68.06 and $70.23 per barrel, respectively, in the comparable three months of 2018. Markedly, natural gas prices also followed a similar pathway, with lower year-over-year figures.

Low domestic GDP growth rate and global economic slowdown resulted in weak demand for energy products in third-quarter 2019. Moreover, takeaway capacity constraints in domestic shale plays, primarily in the prolific Permian Basin, put pressure on third-quarter production.

Impact on Companies

The year-over-year decline in oil and gas prices is primarily discouraging for exploration and production companies, as it reduced their profit levels. Energy infrastructure providers — which usually have long-term contracts with upstream companies — are expected to have been unaffected by short-term fluctuations in commodity prices in the third quarter. However, given surging hydrocarbon output potential (powered by North American shale boom) and the lack of transportation facilities, pipeline companies have been missing out on a bunch of stable fee-based revenue-providing contract signing opportunities.

Refineries and downstream companies have been reaping short-term benefits from lower commodity prices, as it led to low cost of production. However, fall in demand for energy products might have affected their sales and profit levels in the third quarter.

Expectations & Present Earnings Scenario

Our latest Earnings Outlook shows that the Oil/Energy sector’s profit is expected to fall 34.8% year over year in third-quarter 2019, following a 36.2% and 22.4% decline in the second and first quarters, respectively. The Energy sector is thus poised to see three consecutive quarters of earnings deterioration, after recording strong earnings growth in each of the four quarters of 2018. Third-quarter revenues of the sector are expected to fall 4.8% from the year-ago level.

Earnings of the majority of the energy companies that have already reported third-quarter results show a year-over-year decline. However, several energy majors like Schlumberger Limited SLB, BP plc BP and others have exceeded expectations.

Oilfield service behemoth Schlumberger reported third-quarter 2019 earnings of 43 cents per share, beating the Zacks Consensus Estimate of 40 cents, aided by higher wireline activities in Russia and Australia, along with contributions from drilling operations in the international market.

Integrated energy behemoth, BP reported third-quarter adjusted earnings of 66 cents per American Depositary Share, surpassing the Zacks Consensus Estimate of 53 cents. Its results were aided by higher oil equivalent production volumes.

Energy Stocks Reporting on Oct 30

Given the bleak year-over-year backdrop, let us take a look at how the following five energy players are placed ahead of their third-quarter earnings, slated to release tomorrow.

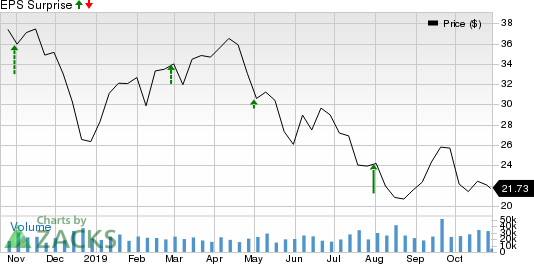

Baker Hughes Company BKR: It is set to report quarterly results before the opening bell. Since oilfield service firms assist explorers and drillers in setting up oil and gas wells, the ramp up in international drilling operations is likely to have contributed to the firm’s third-quarter earnings. However, conservative capital spending by North American drillers is expected to have dented demand for oilfield service contracts in the continent. (Read more: Baker Hughes to Report Q3 Earnings: What's in Store?)

The oilfield service firm delivered an average negative earnings surprise of 0.21% over the last four quarters.

Baker Hughes, a GE company Price and EPS Surprise

Baker Hughes, a GE company price-eps-surprise | Baker Hughes, a GE company Quote

Our research shows that companies with the combination of a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP have higher chances of beating earnings estimates. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Our proven model does not conclusively predict an earnings beat for Baker Hughes this time around, as it does not have the favorable combination of the key ingredients. The company has an Earnings ESP of -1.87% and a Zacks Rank #3.

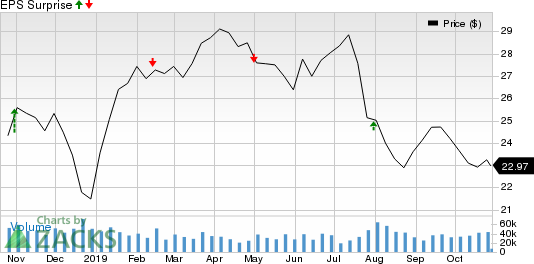

Continental Resources, Inc. CLR: This upstream company is set to release quarterly results after the market closes. Its expanding operations in the Southern region of the United States, comprising the prolific SCOOP and STACK plays, are expected to have boosted production volumes in the third quarter. As such, its quarterly earnings are expected to be 44 cents per share.

It beat the Zacks Consensus Estimate twice in the last four quarters, with an average positive earnings surprise of 6.1%.

Continental Resources, Inc. Price and EPS Surprise

Continental Resources, Inc. price-eps-surprise | Continental Resources, Inc. Quote

This time around, things are looking up for Continental Resources, as the firm carries a Zacks Rank of 3 and an Earnings ESP of +4.60%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Apache Corporation APA: This multi-billion exploration and production company is set to report quarterly results after the closing bell. Rising stock inventories, intensifying trade tensions and slowdown of global economy are expected to have weighed on oil, gas and natural gas liquids prices in the quarter. This downside might in turn reflect on Apache’s overall results.

As far as earnings surprises are concerned, this U.S. energy company’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters, with the average being 64.2%.

Apache Corporation Price and EPS Surprise

Apache Corporation price-eps-surprise | Apache Corporation Quote

Apache currently carries a Zacks Rank #4 (Sell) and has an Earnings ESP of -0.52%.

Hess Corporation HES: The company, primarily involved in upstream operations, is expected to post loss per share of 3 cents in third-quarter 2019. Year-over-year fall in overall production volumes and declining commodity prices might have dampened the company’s growth in the third quarter of 2019. (Read more: Hess Gears Up for Q3 Earnings: What's in the Cards?)

As far as earnings surprises are concerned, the company beat earnings estimates in all the trailing four quarters, with the average surprise being 258.5%.

Hess Corporation Price and EPS Surprise

Hess Corporation price-eps-surprise | Hess Corporation Quote

It has a Zacks Rank #3 and an Earnings ESP of 0.00%.

The Williams Companies, Inc. WMB: The midstream company is slated to release quarterly results after the closing bell. Extensive natural gas exposure raises its sensitivity to the commodity’s price. In particular, lower gas prices in the third quarter are likely to have had an adverse impact on volumes and distribution growth potential of Williams Partners, the company's largest income generating business segment.

As far as earnings surprises are concerned, the midstream player has a mixed record, having outpaced the Zacks Consensus Estimate twice in the last four reports.

Williams Companies, Inc. (The) Price and EPS Surprise

Williams Companies, Inc. (The) price-eps-surprise | Williams Companies, Inc. (The) Quote

It has a Zacks Rank #5 (Strong Sell) and an Earnings ESP of -3.69%.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Baker Hughes, a GE company (BKR) : Free Stock Analysis Report

Schlumberger Limited (SLB) : Free Stock Analysis Report

BP p.l.c. (BP) : Free Stock Analysis Report

Williams Companies, Inc. (The) (WMB) : Free Stock Analysis Report

Continental Resources, Inc. (CLR) : Free Stock Analysis Report

Apache Corporation (APA) : Free Stock Analysis Report

Hess Corporation (HES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research