Olin (OLN) to Temporarily Curtail Epoxy Resin Production

Olin Corporation OLN announced that it is temporarily curtailing integrated epoxy production at its Stade, Germany facility. Olin witnessed weaker than expected epoxy resin demand in Europe during the first quarter of this year. This has been aggravated post the invasion of Ukraine by Russia.

The company is disinclined to sell incremental volume into a poor-quality market and sees functioning the epoxy resin facility at lower than 50% operating rates as unreasonable.

Olin decided to suspend Stade epoxy resin production due to these factors, the record-high natural gas and electrical power costs in Europe as well as facility maintenance.

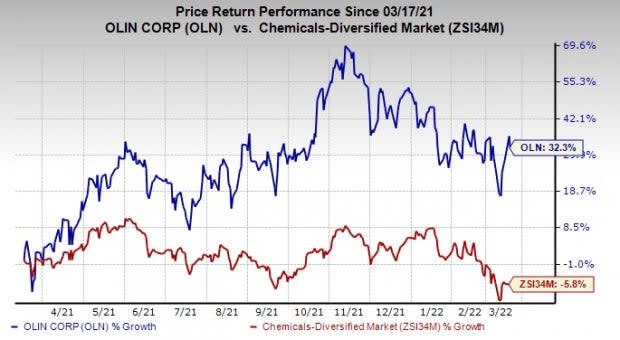

Shares of Olin have gained 32.3% in the past year against a 5.8% decline of the industry.

Image Source: Zacks Investment Research

Olin, in its last earnings call, stated that it expects sequentially higher raw material and operating costs, particularly increased natural gas and electrical power costs, in early 2022. It sees results from its Chemical businesses in first-quarter 2022 to be similar to fourth-quarter 2021 levels. The company also envisions first-quarter results in the Winchester business to rise from fourth-quarter 2021 levels.

Olin Corporation Price and Consensus

Olin Corporation price-consensus-chart | Olin Corporation Quote

Zacks Rank & Key Picks

Olin currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are The Mosaic Company MOS, AdvanSix Inc. ASIX and Allegheny Technologies Incorporated ATI.

Mosaic has a projected earnings growth rate of 106.4% for the current year. The Zacks Consensus Estimate for MOS' current-year earnings has been revised 22.2% upward in the past 60 days.

Mosaic beat the Zacks Consensus Estimate for earnings in three of the last four quarters while missing once. It has a trailing four-quarter earnings surprise of roughly 3.7%, on average. MOS has rallied around 72.5% in a year and currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AdvanSix has a projected earnings growth rate of 30.6% for the current year. The Zacks Consensus Estimate for ASIX’s current-year earnings has been revised 25.1% upward in the past 60 days.

AdvanSix beat the Zacks Consensus Estimate for earnings in three of the trailing four quarters, the average being 23.6%. ASIX has surged 75.1% in a year. The company carries a Zacks Rank #1.

Allegheny, currently carrying a Zacks Rank #1, has an expected earnings growth rate of 661.5% for the current year. The Zacks Consensus Estimate for ATI's earnings for the current year has been revised 45.6% upward in the past 60 days.

Allegheny beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 127.2%. ATI has rallied around 19.8% over a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allegheny Technologies Incorporated (ATI) : Free Stock Analysis Report

The Mosaic Company (MOS) : Free Stock Analysis Report

Olin Corporation (OLN) : Free Stock Analysis Report

AdvanSix (ASIX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research