Olstein Capital Management's Top 1st-Quarter Trades

- By James Li

Robert Olstein (Trades, Portfolio), chairman and chief investment officer of Olstein Capital Management, disclosed earlier this month that his firm's top trades during the first quarter included a new holding in L3Harris Technologies Inc. (NYSE:LHX), the closure of its DuPont de Nemours Inc. (NYSE:DD) position and the reduction in its stakes in Discovery Inc. (NASDAQ:DISCK) and ViacomCBS Inc. (NASDAQ:VIAC).

The New York-based firm selects stocks by looking behind the numbers of a company's financial statements to measure a company's financial strength and downside risk. To qualify for Olstein Capital Management's defense first approach, a company must have solid cash flows, avoid aggressive accounting principles and have solid balance sheet fundamentals.

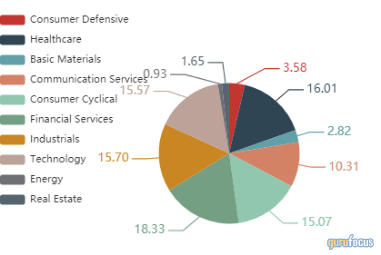

As of March 31, Olstein's $715 million equity portfolio contains 100 stocks, with eight new positions and a turnover ratio of 11%. The top three sectors in terms of weight are financial services, health care and industrials, representing 18.33%, 16.01% and 15.70% of the equity portfolio.

L3Harris

Olstein purchased 39,000 shares of L3Harris (NYSE:LHX), giving the position 1.1% weight in the equity portfolio. Shares averaged $187.59 during the first quarter; the stock is modestly undervalued based on Tuesday's price-to-GF Value ratio of 0.87.

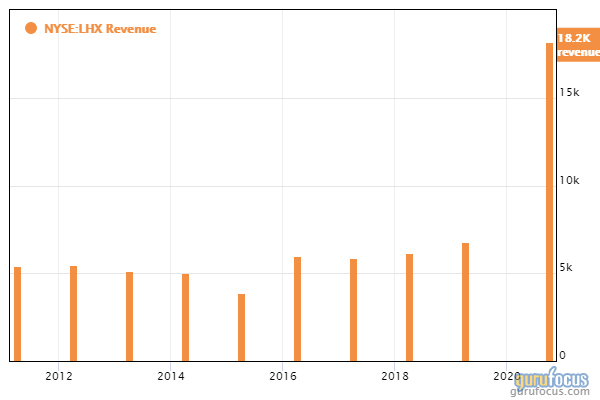

GuruFocus ranks the Melbourne, Florida-based aerospace and defense company's profitability 8 out of 10 on the back of a high Piotroski F-score of 7 and a three-year revenue growth rate that outperforms more than 89% of global competitors.

Gurus with large positions in L3Harris include the T Rowe Price Equity Income Fund (Trades, Portfolio) and Diamond Hill Capital (Trades, Portfolio).

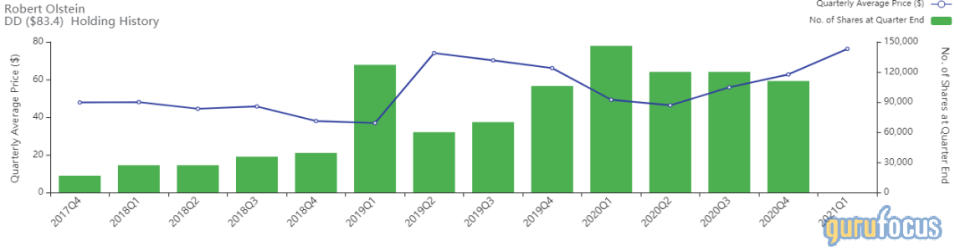

DuPont de Nemours

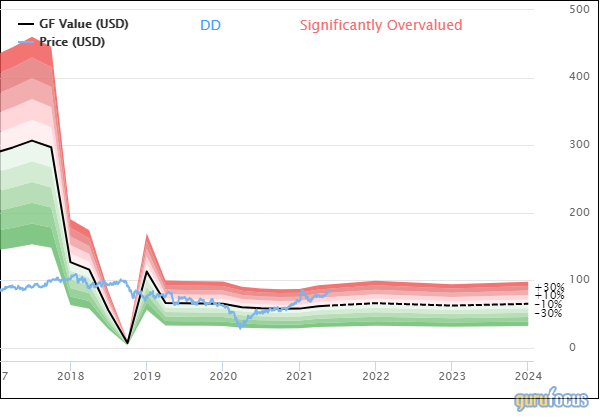

Olstein sold 111,000 shares shares of DuPont de Nemours (NYSE:DD), trimming 1.26% of the equity portfolio. Shares averaged $76.28 during the first quarter; the stock is significantly overvalued based on Tuesday's price-to-GF Value ratio of 1.33.

GuruFocus ranks the Wilmington, Delaware-based chemical company's financial strength 5 out of 10: Although the company has a high Piotroski F-score of 7, DuPont has a weak Altman Z-score of 1.19 and interest coverage ratios underperforming over 86% of global competitors.

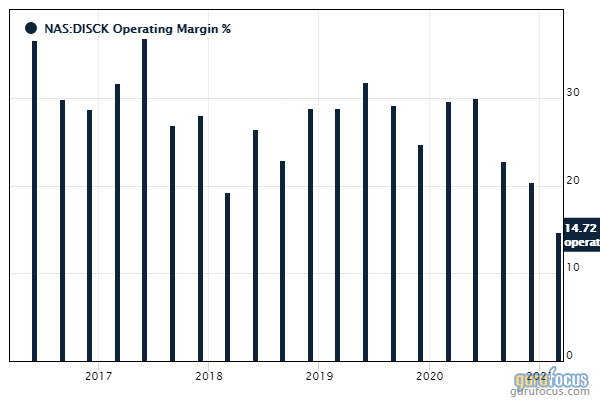

Discovery

Olstein sold 250,933 Class C shares of Discovery (NASDAQ:DISCK), trimming the position by 34.67% and the equity portfolio by 1.05%. Shares averaged $42.38 during the first quarter; the stock is fairly valued based on Tuesday's price-to-GF Value ratio of 1.07.

GuruFocus ranks the Silver Spring, Maryland-based diversified media company's profitability 8 out of 10 on the back of profit margins and returns outperforming more than 76% of global competitors.

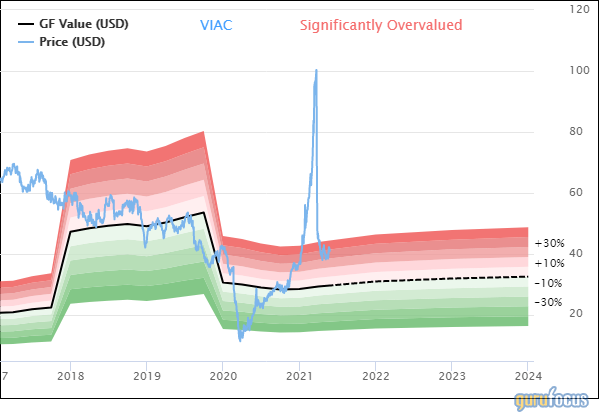

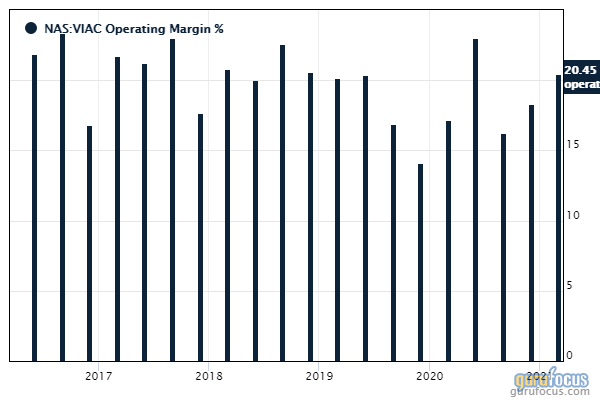

ViacomCBS

Olstein sold 144,200 Class B shares of ViacomCBS (NASDAQ:VIAC), trimming 41.53% of the position and 0.86% of the equity portfolio. Shares averaged $61.05 during the first quarter; the stock is significantly overvalued based on Tuesday's price-to-GF Value ratio of 1.38.

GuruFocus ranks the New York-based media company's profitability 8 out of 10 on the back of profit margins and returns outperforming over 77% of global competitors.

Despite good profitability, ViacomCBS' financial strength ranks 4 out of 10 driven on interest coverage and debt ratios underperforming more than 70% of global diversified media companies.

Disclosure: No positions.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.