Did You Blow Your Once-In-A-Generation Chance To Buy A Home?

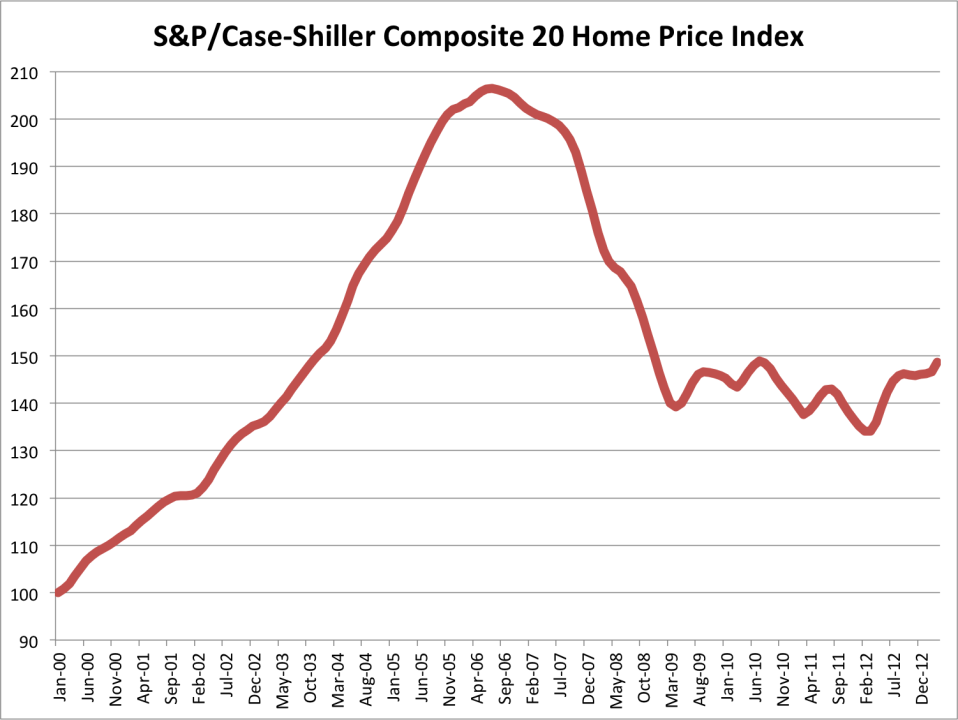

The U.S. housing market crash of 2007-2008 presented a big opportunity for those in the market to buy a home.

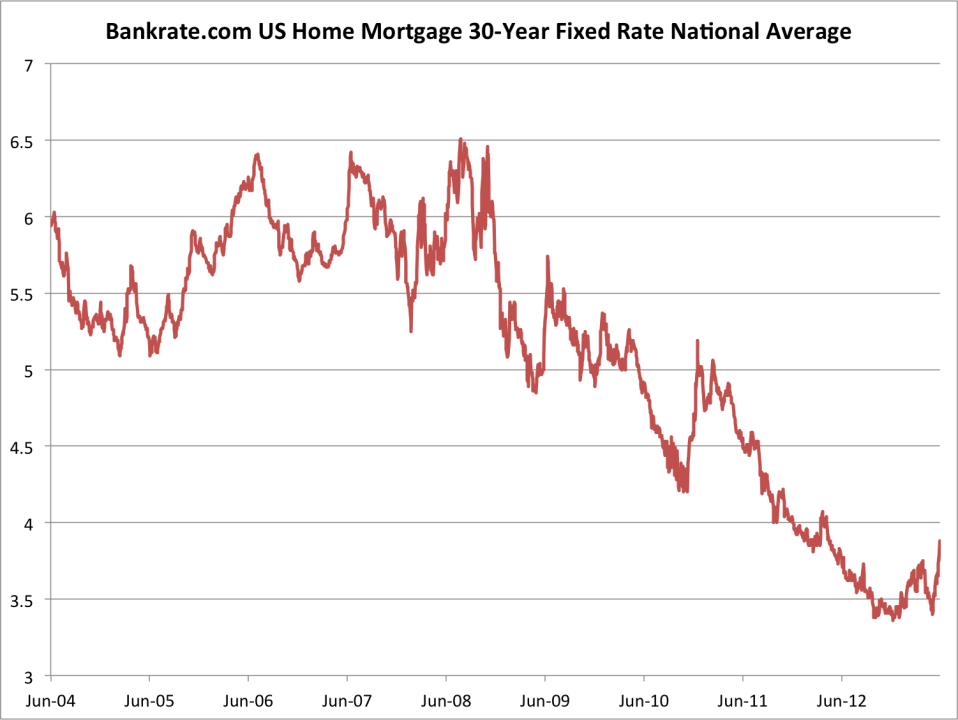

Mortgage rates lurched lower, continuing their downward trajectory to historic lows reached in late 2012. And, of course, home prices came way down.

Here are mortgage rates.

Business Insider/Matthew Boesler, data from Bloomberg

And here are home prices.

Business Insider/Matthew Boesler, data from Bloomberg

The combination has propelled the "Housing Affordability Index" published by the National Association of Realtors to all-time highs.

Business Insider/Matthew Boesler, data from Bloomberg

Note from NAR's website: To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.

Now, there is concern that these trends are starting to reverse. Increased talk of tapering of monetary stimulus by the Federal Reserve has provided the impetus for the rise in interest rates in recent weeks.

There is rift of opinion over where interest rates go next, but some prominent voices in the market – Goldman Sachs, for example – say the sell-off in the bond market is "for real" this time, and rates will continue to rise from here.

Meanwhile, house prices have been flying higher, and it looks like the market has carved out a bottom.

"After making a peak to trough decline of 33.8% from April 2006 to March 2012, the Case-Shiller home price index (C-S) has since advanced +10.9%," wrote Deutsche Bank Chief U.S. Economist Joe LaVorgna in a note yesterday. "The fact that C-S gains have been so broad-based suggests to us that they should persist, because we have found that breadth is often a sign of durability."

If both interest rates and house prices continue to rise, housing affordability will go down, and the historic opportunity will be over.

However, the good news is that housing affordability shouldn't go down all that much, even if it comes off its peak levels, according to LaVorgna:

The housing affordability index, which includes interest rates as well as income and prices in its calculation, remains just shy of its all-time record high. This was not the case in the last downturn, when affordability was very low, owing to a bubble-like rise in home prices that did not jibe with the fundamentals. But what about interest rates—are they not artificially low and therefore the primary reason why affordability is so high?

We think the short answer to this question is “No”.

While rates are being depressed by QE, home prices are still about 27% below their previous peak according to C-S. Over this same period, personal income is up sharply. In fact, if mortgage rates went up 100 basis points from their current level, all else being equal, affordability would still remain higher than it has been in every year prior to 2010. Secondly, all else is probably not equal because a 100 basis point rise in mortgage rates would likely be associated with a meaningful economic improvement, including a step-up in income growth (i.e., faster job gains). Therefore, the negative hit to housing affordability would be partly mitigated.

Click here to read LaVorgna's full note >

More From Business Insider