The One Stop Systems (NASDAQ:OSS) Share Price Is Down 57% So Some Shareholders Are Wishing They Sold

Taking the occasional loss comes part and parcel with investing on the stock market. Unfortunately, shareholders of One Stop Systems, Inc. (NASDAQ:OSS) have suffered share price declines over the last year. The share price has slid 57% in that time. One Stop Systems may have better days ahead, of course; we've only looked at a one year period. Shareholders have had an even rougher run lately, with the share price down 16% in the last 90 days. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for One Stop Systems

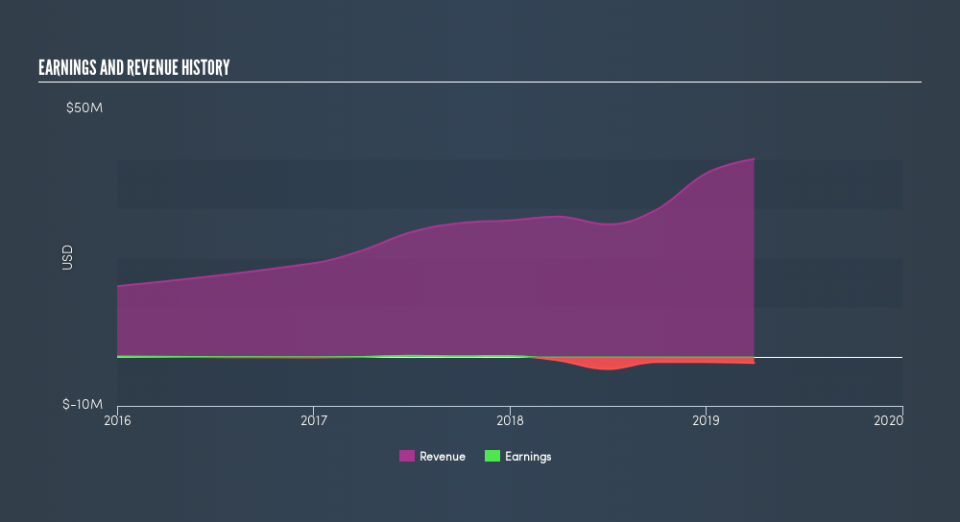

One Stop Systems isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

One Stop Systems grew its revenue by 41% over the last year. We think that is pretty nice growth. Unfortunately it seems investors wanted more, because the share price is down 57% in that time. It is of course possible that the business will still deliver strong growth, it will just take longer than expected to do it. For us it's important to consider when you think a company will become profitable, if you're basing your valuation on revenue.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

Balance sheet strength is crucual. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Given that the market gained 5.1% in the last year, One Stop Systems shareholders might be miffed that they lost 57%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 16% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Before spending more time on One Stop Systems it might be wise to click here to see if insiders have been buying or selling shares.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.