ONEOK (OKE) Q3 Earnings Beat Estimates, Revenues Rise Y/Y

ONEOK Inc OKE posted third-quarter 2021 operating earnings of 88 cents per share, surpassing the Zacks Consensus Estimate of 83 cents by 6%. Also, the bottom line improved 25.7% year over year.

Improving economic conditions led to an increase in volumes of natural gas and natural gas liquids, thus benefiting the quarterly results.

Revenue Results

Total revenues of $4,536.2 million missed the Zacks Consensus Estimate of $5,324 million by 14.8%. However, the top line improved 108.6% from $2,174.3 million in the prior-year quarter.

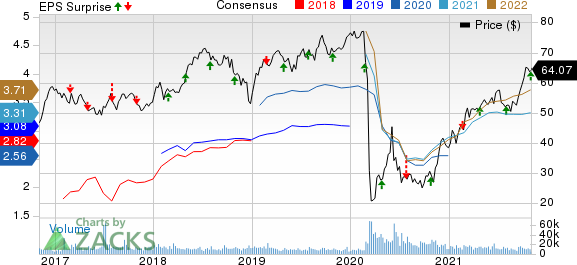

ONEOK, Inc. Price, Consensus and EPS Surprise

ONEOK, Inc. price-consensus-eps-surprise-chart | ONEOK, Inc. Quote

Highlights of the Release

The company spent $3,449.1 million on cost of sales and fuel, up 172.5% from the year-ago quarter’s level.

In the third quarter, ONEOK’s adjusted earnings before interest, tax, depreciation and amortization (EBITDA) were $865.2 million, up 15.8% year over year.

The company incurred interest expenses worth $184 million, up 4.4% from the prior-year quarter’s level.

Its operating income came in at $667.9 million in the third quarter, up 21.3% from the prior-year quarter’s reading.

The company completed the 200-million cubic feet per day (MMcf/d) Bear Creek natural gas processing plant expansion and its related infrastructure in the Williston Basin. In September 2021, it announced plans to reduce greenhouse gas emissions (combined Scope 1 and Scope 2 emissions) by 30% within 2030 from the 2019 levels.

Financial Highlights

As of Sep 30, 2021, ONEOK had cash and cash equivalents worth $224.3 million compared with $524.5 million as of Dec 31, 2020.

Long-term debt (excluding current maturities) was $13,640.5 million as of Sep 30, 2021, down from $14,228.4 million as of Dec 31, 2020.

The company’s cash provided by operating activities in the first nine months of 2021 was $1,491.2 million, up from $1,103.1 million in the comparable period of last year.

Capital expenditures (including maintenance) amounted to $166.2 million in the third quarter of 2021, down from $380 million in the corresponding quarter of last year.

Guidance

ONEOK increased its 2021 net income and adjusted EBITDA to the range of $1,430-$1,550 million and $3,325-$3,425 million, respectively, up from the earlier guided range of $1,200-$1,500 million and $3,050-$3,350 million. Maintenance capital expenditures are likely to be $190-$210 million in 2021.

Zacks Rank

ONEOK carries a Zacks Rank #3 (Hold), currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Release

ONE Gas Inc. OGS reported third-quarter 2021 earnings of 38 cents per share, on par with the Zacks Consensus Estimate.

Upcoming Releases

Sempra Energy SRE is scheduled to release third-quarter 2021 operating earnings on Nov 5. The Zacks Consensus Estimate for the metric is pegged at $1.70 per share.

Atmos Energy Corporation ATO is scheduled to release fourth-quarter fiscal 2021 operating earnings on Nov 10. The Zacks Consensus Estimate for the same is pegged at 37 cents per share.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sempra Energy (SRE) : Free Stock Analysis Report

ONEOK, Inc. (OKE) : Free Stock Analysis Report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

ONE Gas, Inc. (OGS) : Free Stock Analysis Report

To read this article on Zacks.com click here.