ONEOK (OKE) Q4 Earnings and Revenues Miss Estimates

ONEOK Inc. OKE recorded fourth-quarter 2021 operating earnings per share (EPS) of 85 cents, which missed the Zacks Consensus Estimate of 88 cents by 3.4%. However, the bottom line improved 23.2% from the year-ago quarter’s tally of 69 cents.

ONEOK reported operating EPS of $3.35 in 2021, up 136% from $1.42 in 2020. Total earnings lagged the Zacks Consensus Estimate of $3.39 by 1.2%.

Total Revenues

Operating revenues of $5,420.5 million missed the Zacks Consensus Estimate of $6,106 million by 11.2%. However, the top line improved 111% from $2,571 million in the prior-year quarter.

ONEOK reported total revenues of $16,540 million in 2021, up 94% from $8,542 million in 2020. Total revenues missed the Zacks Consensus Estimate of $17,230 million by 4%.

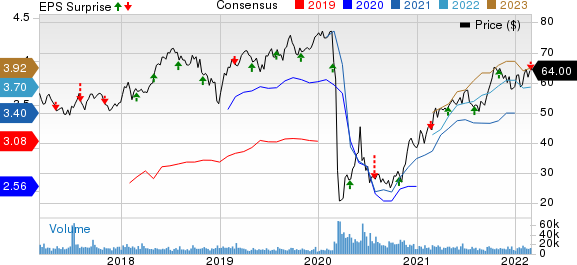

ONEOK, Inc. Price, Consensus and EPS Surprise

ONEOK, Inc. price-consensus-eps-surprise-chart | ONEOK, Inc. Quote

Highlights of the Release

ONEOK spent $4,319 million on the cost of sales and fuel, up 165.4% from the year-ago quarter’s level.

In the fourth quarter, OKE’s adjusted EBITDA was $847 million, up 14% year over year.

ONEOK’s operating income came in at $652.2 million in the fourth quarter, up 21.1% from the prior-year quarter’s reading.

ONEOK incurred interest expenses worth $178.4 million, up 0.8% from the prior-year quarter’s level.

In November 2021, ONEOK announced the restart of construction activities in Demicks Lake III, the 200 million cubic feet per day natural gas processing plant in the Williston Basin and the MB-5, 125,000 barrels per day NGL fractionator in Mont Belvieu, which is expected to cost $390 million to complete both the constructions.

Financial Highlights

As of Dec 31, 2021, ONEOK had cash and cash equivalents worth $146.4 million compared with $524.5 million as of Dec 31, 2020.

Long-term debt (excluding current maturities) was $12,747.6 million as of Dec 31, 2021, down from $14,228.4 million as of Dec 31, 2020.

ONEOK’s cash provided by operating activities for 2021 was $2,546.3 million, up from $1,899.1 million in 2020.

Capital expenditures (including maintenance) amounted to $206.6 million in the fourth quarter of 2021, down from $271.4 million in the corresponding quarter of the last year.

Guidance

ONEOK expects 2022 net income and adjusted EBITDA in the range of $1,550-$1,830 million and $3,470-$3,770 million, respectively. Growth and maintenance capital expenditures are likely to be in the range of $685-$815 and $215-$235 million, respectively, in 2022.The midpoint of the total capital expenditure for 2022 is expected at $975 million.

ONEOK expects 2022 EPS in the range of $3.45-$4.07. The Zacks Consensus Estimate for 2022 earnings of $3.70 per share is lower than $3.76, the midpoint of the guided range.

Zacks Rank

ONEOK carries a Zacks Rank #3 (Hold) currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Algonquin Power & Utilities AQN is slated to report fourth-quarter 2021 earnings on Mar 3 after market close. The Zacks Consensus Estimate for the fourth quarter’s EPS is pegged at 21 cents.

Algonquin Power & Utilities’ long-term (three to five years) earnings growth is currently pegged at 8.7%. The Zacks Consensus Estimate for AQN’s 2022 earnings implies year-over-year growth of 4.5%.

Pampa Energia PAM is slated to report fourth-quarter 2021 earnings on Mar 10 after market close. The Zacks Consensus Estimate for the fourth quarter’s EPS is pegged at 82 cents.

Pampa Energia’s long-term earnings growth is currently pegged at 52.4%. The Zacks Consensus Estimate for PAM’s 2021 earnings implies year-over-year growth of 126.6%.

Global Water Resources Inc. GWRS is slated to report fourth-quarter 2021 earnings on Mar 10 before market open. The Zacks Consensus Estimate for the fourth quarter’s EPS is pegged at 1 cent.

Global Water Resources’ long-term earnings growth is currently pegged at 15%. The Zacks Consensus Estimate for GWRS’ 2022 earnings implies year-over-year growth of 6.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ONEOK, Inc. (OKE) : Free Stock Analysis Report

Pampa Energia S.A. (PAM) : Free Stock Analysis Report

Global Water Resources, Inc. (GWRS) : Free Stock Analysis Report

Algonquin Power & Utilities Corp. (AQN) : Free Stock Analysis Report

To read this article on Zacks.com click here.