ONEOK (OKE) Tops Q4 Earnings & Sales Estimates, Issues View

ONEOK Inc. OKE reported fourth-quarter 2017 operating earnings of 52 cents per share, beating the Zacks Consensus Estimate of 51 cents by a penny. Earnings increased 20.9% year over year.

Excluding one-time charge of 36 cents for enactment of the Tax Cuts and Jobs Act, ONEOK’s earnings were 16 cents.

Total Revenues

Total revenues were $3,792.2 million, which surpassed the Zacks Consensus Estimate of $3,683 million by 2.96%. Revenues also surged 42.9% from $2,654.4 million in the prior-year quarter.

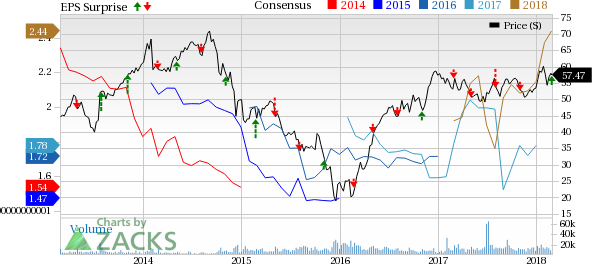

ONEOK, Inc. Price, Consensus and EPS Surprise

ONEOK, Inc. Price, Consensus and EPS Surprise | ONEOK, Inc. Quote

Quarterly Highlights

In the quarter under review, ONEOK’s adjusted earnings before interest, tax, depreciation and amortization (EBITDA) was $547.7 million, up 15.5% year over year.

In the fourth quarter, the company spent $3,073.8 million on cost of sales and fuel, which rose 52% from the year-ago quarter.

The company incurred interest expenses of $124.2 million, up 8.8%. Operating income was $397.8 million in the fourth quarter, up 20.7%.

The quarterly results improved on the back of natural gas and natural gas liquids (NGL) volume growth and higher average fee rates in the natural gas gathering and processing segment.

Financial Highlights

In 2017, ONEOK had cash and cash equivalents of $37.2 million, compared with $248.9 million in 2016.

Long-term debt (excluding current maturities) was $8,091.6 million in 2017, down from the 2016-end level of $7,920 million.

The company’s cash flow from operating activities in 2017 was $1,315.4 million, down from $1,353.3 million in 2016.

Capital expenditures (less allowance for equity funds used during construction) amounted to $512.4 million, down from $624.6 million in the year-ago period.

Guidance

For 2018, ONEOK's adjusted EBITDA guidance is estimated in the range of $2,215-$2,415 million. Net income is estimated in the range of $955-$1,155 million.

Capital-growth expenditures for 2018 are expected in the range of $1,950-$2,300 million.

Peer Releases

South Jersey Industries, Inc. (SJI reported fourth-quarter 2017 adjusted earnings of 50 cents per share, beating the Zacks Consensus Estimate of 41 cents by 21.95%.

National Fuel Gas Company NFG reported first-quarter fiscal 2018 adjusted earnings of $1.02 per share, beating the Zacks Consensus Estimate of 82 cents by 24.4%.

Upcoming Peer Release

Chesapeake Utilities Corporation (CPK is expected to report fourth-quarter 2017 results on Mar 2. The Zacks Consensus Estimate for earnings is pegged at 85 cents.

Zacks Rank

ONEOK carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp. and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ONEOK, Inc. (OKE) : Free Stock Analysis Report

Chesapeake Utilities Corporation (CPK) : Free Stock Analysis Report

South Jersey Industries, Inc. (SJI) : Free Stock Analysis Report

National Fuel Gas Company (NFG) : Free Stock Analysis Report

To read this article on Zacks.com click here.