Onmicell (OMCL) Q4 Earnings Beat Estimates, Margin Contracts

Omnicell, Inc. OMCL reported fourth-quarter 2020 adjusted earnings per share (EPS) of 91 cents, up 18.2% year over year. The metric also exceeded the Zacks Consensus Estimate by 5.8%.

The adjustments include one-time expenses like share-based compensation, amortization expenses, severance and other.

On a GAAP basis, earnings per share were 37 cents for the quarter under review compared with EPS of 51 cents in the year-ago quarter.

For the full year, adjusted earnings were $2.54 per share, 9.6% down from the year-ago period. It, however, beat the Zacks Consensus Estimate by 1.6%.

Revenues in Detail

Fourth-quarter revenues of $249.2 million rose 0.36% year over year on a reported basis. The figure, however, beat the Zacks Consensus Estimate by 3.31%.

Total revenues for 2020 were $892.2 million, down 0.5% from the year-ago period. This also surpassed the Zacks Consensus Estimate by 0.9%.

Segmental Details

On a segmental basis, Product revenues fell 6.1% year over year to $175.7 million in the reported quarter.

Service and other revenues climbed 20.2% year over year to $73.5 million.

Although the company’s year-over-year revenues declined largely due to delays in bookings and implementations related to COVID-19, there was a 16.1% sequential improvement with the economy gradually getting back to normalcy.

Operational Update

In the quarter under review, adjusted gross profit edged up 0.04% to $123.7 million. However, gross margin contracted 16 basis points (bps) to 49.6%.

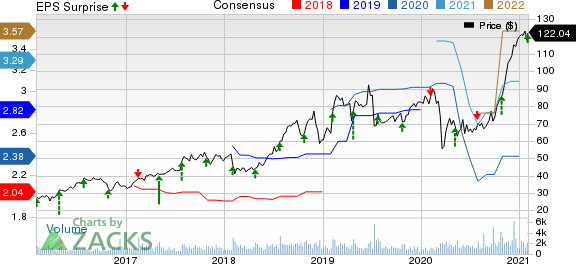

Omnicell, Inc. Price, Consensus and EPS Surprise

Omnicell, Inc. price-consensus-eps-surprise-chart | Omnicell, Inc. Quote

Operating expenses were $103.4 million in the fourth quarter, up 1.9% year over year. Operating profit totaled $20.2 million, reflecting an 8.9% fall from the prior-year quarter. Operating margin in the fourth quarter contracted 82 bps to 8.1%.

Financial Update

Omnicell exited the full year with cash and cash equivalents of $485.9 million compared with $127.2 million at the end of 2019.

Cumulative cash flow from operating activities at the end of 2020 was $185.8 million compared with $145 million a year ago.

Q1 and 2021 Guidance

Omnicell noted that its customers resumed their pre-COVID purchasing patterns. The company also stated that its customers are still navigating the impact of COVID-19 and are in dire need for the company’s medication management automation solutions more strategically.

Based on this assumption, the company is confident about its outlook for 2021. For the first quarter of 2021, Omnicell expects revenues between $243 million and $248 million. The Zacks Consensus Estimate for the metric is pegged at $243.8 million.

Product revenues are forecasted between $171 million and $174 million while service revenues are projected within $72-$74 million for the quarter.

First-quarter adjusted EPS is envisioned in the band of 64-69 cents. The Zacks Consensus Estimate for the same is pegged at 53 cents.

For the full year, the company expects product bookings between $1.09 billion and $1.15 billion. Revenues are estimated between $1.08 billion and $1.10 billion.

For 2021, the anticipated ranges for product and service revenues are $770-$785 million and $315-$320 million, respectively.

Full-year adjusted EPS is expected between $3.40 and $3.60 for 2021. The Zacks Consensus Estimate for the metric stands at $3.29.

Our Take

Omnicell exited the fourth quarter with better-than-expected revenues and earnings. The top line rose year over year and improved sequentially. The improvement in Service and other revenues despite the pandemic-led business challenges is impressive. However, contraction of both margins in the reported quarter was discouraging.

Overall, the company’s optimism about the gradual resumption of elective surgeries and some on-site sales activities in regions less impacted by the pandemic is encouraging. The company is progressing as it is advancing autonomous pharmacy by expanding portfolio and investing in the digital cloud-based platform. On the assumption that its customers have resumed their pre-COVID purchasing patterns, the company has provided its product bookings guidance for 2021.

Zacks Rank and Key Picks

Some better-ranked stocks in the broader medical space that have already announced their quarterly results are NextGen Healthcare, Inc. NXGN, Abbott Laboratories ABT and AngioDynamics, Inc. ANGO. While AngioDynamics sports a Zacks Rank of 1 (Strong Buy), both Abbott and NextGen Healthcare carry a Zacks Rank #2 (Buy). You can see the complete list of Zacks #1 Rank stocks here.

NextGen Healthcare reported third-quarter fiscal 2021 adjusted EPS of 26 cents, beating the Zacks Consensus Estimate by 8.3%. Revenues of $141.7 million surpassed the consensus mark by 0.6%.

AngioDynamics reported second-quarter fiscal 2021 adjusted EPS of a penny against the Zacks Consensus Estimate of a loss per share of 2 cents. Revenues of $72.8 million beat the consensus mark by 8%.

Abbott reported fourth-quarter 2020 adjusted EPS of $1.45, which surpassed the Zacks Consensus Estimate by 6.6%. Fourth-quarter worldwide sales of $10.7 billion outpaced the consensus mark by 7.9%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicell, Inc. (OMCL) : Free Stock Analysis Report

AngioDynamics, Inc. (ANGO) : Free Stock Analysis Report

Abbott Laboratories (ABT) : Free Stock Analysis Report

NEXTGEN HEALTHCARE, INC (NXGN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research