Optimism Runs High for MacroGenics

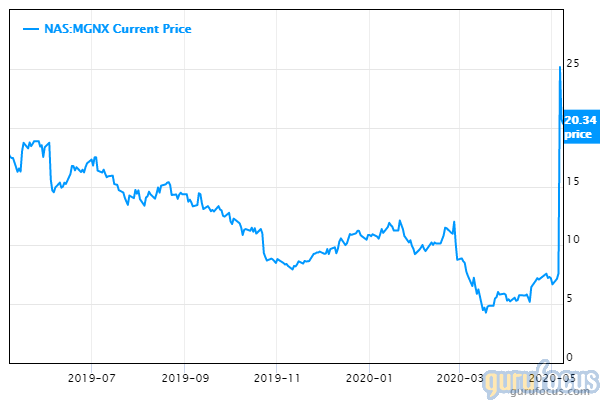

The price of MacroGenics Inc. (MGNX) shares has recently seen a huge jump. After providing an early glimpse of some of the earnings results on May 6, MacroGenics's stock soared by more than 230% to a two-year high, bringing its market value to nearly $1 billion.

More information on the drugs being studied will be released this week in the form of abstracts. However, in my opinion, we will need to wait for the American Society of Clinical Oncology (aka ASCO) meeting on May 29 to 31 to see whether the increase is justified. At the virtual conference, the Rockville, Maryland-based biotech will share data on three of its key clinical programs.

Some wonder if investors are getting ahead of themselves considering the data that's been released has been described as merely "directionally encouraging," according to an article on EvaluatePharma. Moreover, the updates will be only early looks at how well the drugs are working.

MacroGenics is developing antibody-based therapeutics to treat cancer. The objective is finding treatments that will stimulate the patient's immune system to attack cancer cells.

One of the main ASCO presentations will be on the company's antibody drug that has shown promise in treating prostate cancer. Another will focus on the breast cancer treatment margetuximab, which the company had high hopes for at one time. Unfortunately, the treatment has been a disappointment, causing investors to sour on MacroGenics shares until last week. Later this year, the effectiveness of the drug will be evaluated to determine if it has a future.

It seems to me that the company needs to demonstrate that it's much more than margetuximab. However, for last week's share price gains to prove durable, these hints of clinical activity must also prove robust.

MacroGenics derives most of its revenue from collaborations with other drug companies. The company has research and license agreements with Incyte Corp. (INCY), Roche (RHHBY), Zai Lab Ltd. (ZLAB), I-MAB (IMAB) and GC Pharma (XKRX).

For the quarter ended March 31, MacroGenics reported revenue of $13.7 compared to $9.7 million for the same period a year earlier. Its net loss was $44.7 compared to $45.million for the quarter ended March 31, 2019.

Eight Yahoo Finance analysts currently expect revenues in 2020 to be nearly $69 million, approximately in line with the last 12 months. Loss per share is forecast to be $3.23. The consensus price target for the company's shares is $18.90, nearly $1.50 lower than where the stock closed Friday.

Disclosure: The author holds no positions in any of the company's mentioned in this article

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.