Option Bull Shrugs Off Apache Analyst Note

The shares of Apache Corporation (NYSE:APA) are lower this afternoon, after Barclays initiated coverage on the energy stock with an "underweight" rating and a $29 price target -- a discount to APA stock's current price. Nevertheless, it appears one options speculator placed a big, bullish bet on Apache shares today.

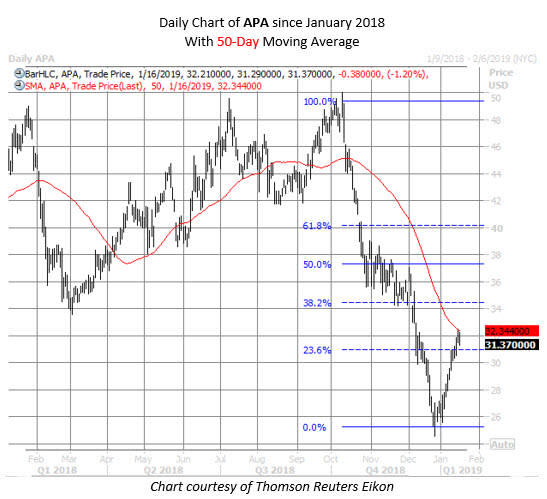

At last check, the equity was down 1.2% to trade at $31.37. A close in the red would be the first for APA in 2019, with the security on pace to snap a 10-session winning streak. In fact, the shares have rebounded nearly 28% since touching a 16-year low of $24.56 on Dec. 26. However, APA is now struggling to surmount its 50-day moving average, and the stock is trading around a 23.6% Fibonacci retracement of its plummet from October highs above $50 to the aforementioned low.

So far today, the oil stock has seen roughly 46,000 calls and 43,000 puts change hands -- 27 times and 47 times the average intraday volume, respectively. Most of the action has transpired around the weekly 3/1 31.50-strike put and 32.50-strike call. Specifically, symmetrical blocks of 42,160 contracts crossed the tape at each strike this morning, with both blocks marked "spread."

Digging deeper, it appears the trader may have bought to open the calls for $1.53 apiece, and then funded the bullish position by selling to open the puts for $1.58 each, resulting in a net credit of $0.05 per spread, or $210,800 total (credit x number of spreads x 100 shares per contract). The trader can pocket this credit if APA ends atop $31.50 (the put strike) when the options expire on Friday, March 1.

The primary goal of the split-strike synthetic long strategy, though, is for the shares to rocket above $32.50 (call strike) within the options' lifetime, as the calls will move into the money. The higher APA goes, the more the trader stands to gain. Losses for the speculator, however, will increase the further APA sinks beneath the sold put strike.

Had the trader simply bought to open the weekly 32.50-strike calls, they'd have paid a whopping $6.45 million for the options ($1.53 per call x number of calls x 100 shares per contract), which would represent the maximum risk. Further, their position wouldn't begin to profit unless APA stock topped $34.03 (call strike plus premium paid) within the options' lifetime.

Despite the energy stock's impressive winning streak in 2019, analysts are obviously very skeptical, per today's Barclays note. Prior to today, in fact, APA sported just four "buy" or better endorsements, compared to nine tepid "holds" and five "sell" or worse ratings. Should the security resume its recent rebound, a round of bullish analyst notes could propel the equity higher.

Likewise, short interest on APA grew 14.3% during the past two reporting periods, and now represents 8.2% of the stock's total available float. At APA's average daily trading volume, it would take a week to buy back these bearish bets. If the stock can extend its bounce, there's plenty of fuel for a short squeeze to act as a tailwind.