Option Bulls Flock to Penny Stock After Weed Deal

Biotechnology stock Amyris Inc (NASDAQ:AMRS) is near the top of the Nasdaq today, after the company announced a big weed deal. Specifically, Amyris said it's partnering with an undisclosed party in a cannabinoid development, licensing, and commercialization plan valued at as much a $255 million. AMRN stock was up 39.1% at $4.40, at last check, and is pacing for its best day ever.

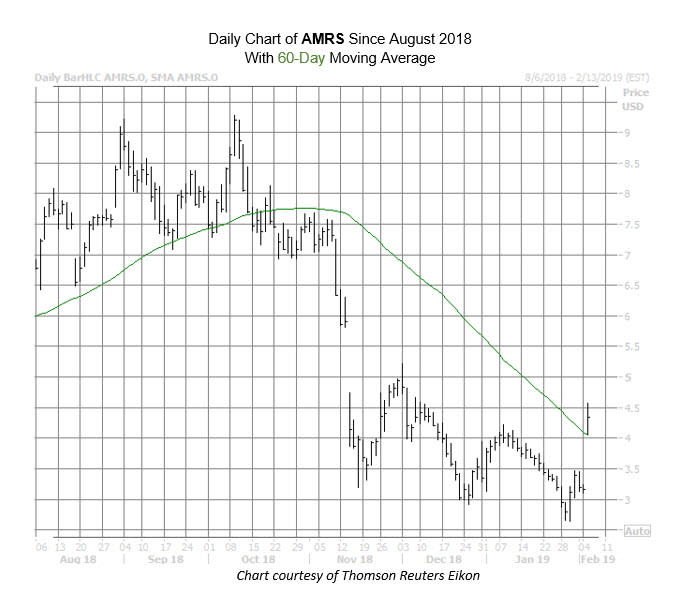

Prior to today, a mid-November bear gap brought on by a third-quarter revenue miss had AMRS stock trading in a channel of lower highs and lows -- bottoming out at a 17-month low of $2.64 on Jan. 30. However, the equity has nearly doubled since then, and is set to top its 60-day moving average for the first time since its October highs.

Today's news is causing unusual options activity, too, with nearly 8,000 AMRS calls changing hands -- roughly 70 times the average intraday volume. Puts, while dwarfed by calls, are trading at a much quicker clip than usual, as well, with 600 contracts traded -- representing roughly eight times the expected intraday pace. Total option volume is on pace for an annual high.

It looks like much of the action is transpiring around the February 5 and June 7.50 calls, with buy-to-open action detected. Buyers of the front-month call expect AMRS stock to surpass $5 by the close on Friday, Feb. 15, when the options expire. The June-dated call buyers expect the shares to surpass $7.50 by June options expiration.

Some of those out-of-the-money call buyers, however, could be short sellers seeking an options hedge. In the past two reporting periods, short interest shot up 7.3% to 9.27 million shares, and now represents a whopping 26.3% of the stock's available float. At AMRS' average daily trading volume, it would take almost three weeks for traders to buy back these bullish bets -- plenty of fuel for a short squeeze, should the stock continue its rally.