Options Bears Bet On Bigger Losses for GM Stock

General Motors Company (NYSE:GM) stock is lower, after Sunday's negotiations between the automaker and the United Auto Workers (UAW) union took a "turn for the worse," according to Terry Dittes, who is the UAW vice president of the GM division. Specifically, the UAW rejected GM's offer of a new four-year labor contract, which Dittes said "did nothing to advance a whole host of issues." Talks between the two sides picked back up this morning as the weeks-long strike continues.

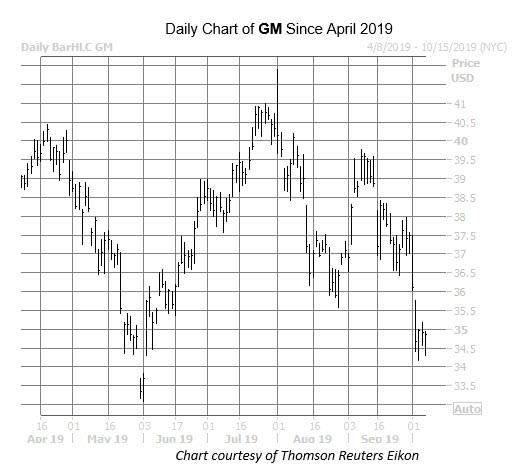

In response, GM stock is down 0.6% at $34.71. It's been a choppy year on the charts for the equity, which is currently trading just 3.8% above its year-to-date breakeven mark, after gapping south of previous support at the $36 region last week. And while the security has found its footing atop the $34 level this month -- site of an early June bull gap -- it's now off roughly 17% from its early August peak.

Despite this recent price action, options traders have been optimistic, with 2.65 calls bought to open for every put on the the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) during the last 10 days. This ratio sits in the 84th percentile of its annual range, suggesting that the rate of call buying relative to put buying has been accelerated.

Today, however, traders are showing a preference for puts over calls. So far, 9,400 puts have exchanged hands, compared to 9,000 calls. Most of this action is centered at the weekly 10/11 34.50-strike put, followed by the 34-strike put from the same series. Positions are likely being bought to open at both contracts, suggesting these put buyers are expecting even more downside for GM through expiration at the close this Friday, Oct. 11.