Options Bulls Blast Red-Hot Oil ETF

Skyrocketing oil prices have sparked heavy options trading on United States Oil Fund (USO). The energy-focused exchange-traded fund (ETF) is up 0.9% today to trade at $13.79 -- and 10.3% higher month-to-date -- and calls are in high demand, with one bull betting on even bigger gains over the next month.

Taking a quick step back, roughly 77,500 calls and 38,000 puts have traded on USO so far today -- 1.8 times what's usually seen at this point in the session. The May 14.50 call is most active, due to one trader buying to open a 25,000-contract block for an initial cash outlay of $275,000 (number of contracts * $0.11 premium paid * 100 shares per contract.

This is the most the call buyer stands to lose, should USO settle below the strike price at the close on Friday, May 17, when front-month options expire. Profit, meanwhile, will accumulate on a move above breakeven at $14.61 (strike plus premium paid) -- a level not toppled on a weekly closing basis since Oct. 22.

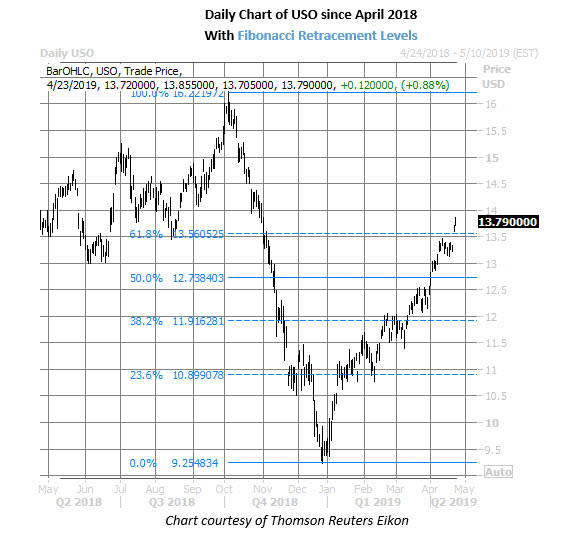

However, the fund has rallied hard off its Dec. 26 17-month low of $9.23, up almost 50%. This week's 3.5% surge has USO clearing recent congestion near $13.50, which is also a 61.8% Fibonacci retracement of its fourth-quarter sell-off. And while it's just Tuesday, the shares are pacing for an eight straight weekly win, which would mark the longest streak of its kind since early 2014.