Options Traders React to Disney Stock Bull Note

Walt Disney Co (NYSE:DIS) is by far the best Dow stock today, up 4.3% at $141.55. This comes after Morgan Stanley lifted its DIS price target to $160 from $135 -- a nearly 18% premium to last night's close -- and boosted its Disney+ subscriber growth forecast in part due to brand familiarity, saying it believes "the market has often overstated the risk and underappreciated the reward of the transition to streaming."

Traders are flooding Disney's options pits, as a result, with 238,000 calls and 41,000 puts on the tape -- five times what's typically seen at this point, and volume pacing in the 98th annual percentile. The June 140 call is most active, and it looks like new positions are being purchased here for a volume-weighted average price of $1.64. If this is the case, breakeven for the call buyers at the close next Friday, June 21, is $141.64 (strike plus premium paid).

This bullish bias just echoes the broader trend for DIS options traders. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock's 10-day call/put volume ratio of 2.77 ranks in the 84th annual percentile, meaning calls have been bought to open over puts at a quicker-than-usual clip.

This optimism is seen elsewhere, with almost 93% of covering analysts maintain a "buy" or better rating. Plus, the 17.47 million DIS shares currently sold short account for a slim 1.2% of the equity's available float.

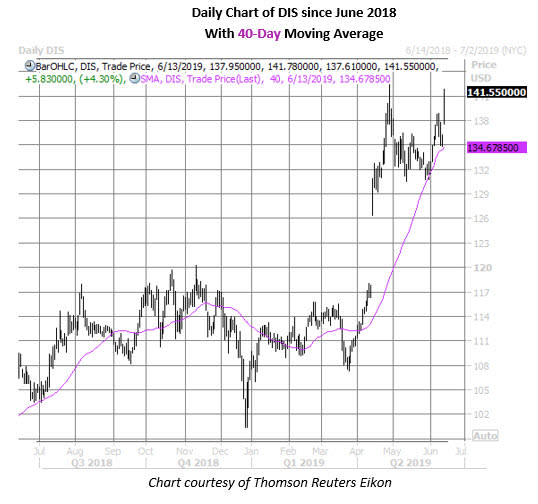

Looking at the charts, it's no surprise to see why Wall Street's so enamored with Walt Disney. The shares have added more than 41% since their late-December test of the century mark. Plus, a recent bounce off familiar support at their rising 40-day moving average has DIS closing in quick on its April 29 record high of $142.37.