Oracle Corp Posts Best Growth in 2 Years

After the market closed on March 12, Oracle Corp. (NYSE:ORCL) reported the earnings results for its third quarter of fiscal 2020, which ended on Feb. 29.

The software company reported net income of $2.6 billion for the quarter, or 79 cents per share. Revenue was $9.8 billion, up 1.9% from the third quarter of fiscal 2019 and representing the biggest jump in revenue in nearly two years. Adjusted earnings per share came in at 97 cents, compared to 87 cents in the prior-year quarter. Analyst consensus estimates had predicted revenue of $9.75 billion and adjusted earnings of 96 cents per share.

Following the news, shares were up 2% to around $41.37 apiece in after-hours trading for a market cap of $127.66 billion, making up for a similar loss in regular trading for the day.

Quarter highlights

Oracle is a computer software company based in Redwood City, California. It sells database software and management systems, cloud engineered systems and enterprise software products.

Cloud services and license support revenue, which account for approximately two-thirds of the company's sales, grew 4% year over year. Fusion ERP cloud revenues grew 37%.

Chairman and Chief Technology Officer Larry Ellison offered the following explanation about the strong earnings results:

"Oracle Autonomous Database is also both serverless and elastic. It's the only database that can instantaneously scale itself to an optimal level of CPU and IO resources. You only pay for what you use. Security and economy are two fundamental reasons why thousands of customers are now using the revolutionary new Oracle Autonomous Database in our Generation 2 Public Cloud."

By region, revenue was up by $103 million to $5.36 billion in the Americas, $32 million to $1.59 billion in Asia Pacific and $54 million to $2.83 billion in the Europe/Middle East/Africa region.

Valuation

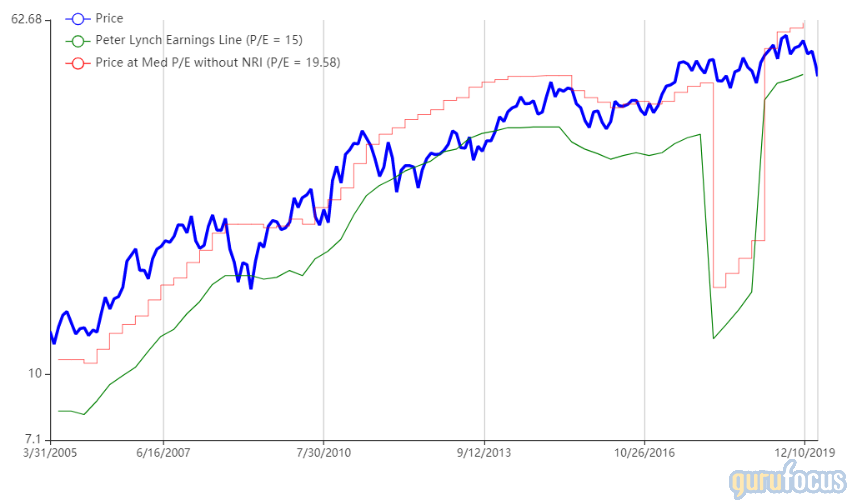

On March 12, shares of Oracle traded with a price-earnings ratio of 12.65. According to the Peter Lynch chart, the stock is undervalued.

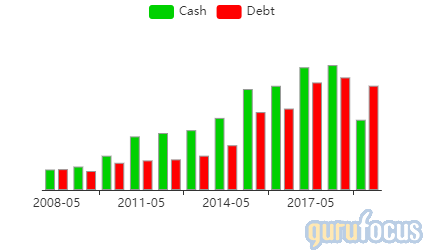

GuruFocus gives Oracle a financial strength rating of 4 out of 10 and a profitability rating of 9 out of 10. The cash-debt ratio of 0.66 and interest coverage of 7.07% are underperforming 73.26% of competitors, while the Altman Z-Score of 2.04 indicates that the company is in the grey zone in terms of long-term financial strength.

Oracle's operating margin of 35.72% and return on capital of 232.7% are higher than 90.16% of industry competitors. Revenue growth has been slow but steady in recent years, and so has net income (with the exception of 2018, which was negatively impacted by the Tax Cuts and Jobs Act).

Outlook

Oracle has not yet offered guidance for its fourth quarter of fiscal 2020.

"The future of Oracle's Cloud Infrastructure business rests upon our highly-secure Gen2 Cloud Infrastructure featuring the world's first and only Autonomous Database," Ellison said. "By the end of Q3 we had nearly 1,000 paying Autonomous Database customers and we added around 4,000 new Autonomous Database trials in Q3. It's early days, but this is the most successful introduction of a new product in Oracle's forty year history."

As a software service company where many employees work from home and more could work remotely if need be, Oracle is not expecting its earnings to be impacted by the novel coronavirus (Covid-19).

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research and/or consult registered investment advisors before taking action in the stock market.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.