Oracle (ORCL) is the Right Stock at the Wrong Time

Just a few weeks ago, yours truly suggested that Bank of America Corp (NYSE:BAC) was a great company to own, but BAC stock wasn’t exactly an ideal stock to buy at the moment. However,

BAC is hardly the only right-stock/wrong-time ticker floating in the market’s ether right now. Database giant Oracle Corporation (NYSE:ORCL) — a name many have erroneously presumed missed out on the advent of cloud computing — is another one of those companies you have to respect, but don’t want to invest in just yet simply because the price of ORCL stock is likely to move lower before moving higher again.

Right Stock

Oracle is the kind of company everyone’s heard of, but nobody’s exactly sure what they do. The quick and dirty explanation is, Oracle helps enterprises manage and meaningfully use the massive amounts of data they’re capable of collecting now.

It’s an arena that’s changed dramatically in just the past few years. As broadband matured and mobile broadband became a reality, it became possible for others like Microsoft Corporation (NASDAQ:MSFT) and Amazon.com, Inc. (NASDAQ:AMZN) to deliver their own such solutions in the cloud. More often than not, these solutions were superior to Oracle’s local server-based solution.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Technology is always evolving, though, as are companies. While it’s true Oracle was late to the party, so to speak, it too has become a viable cloud player.

Case in point: Just this week, Oracle founder and CTO explained at an event held at the company’s headquarters that its new IaaS and PaaS cloud stack layers could not only be priced in line with similar platforms from Amazon’s web services offering, but would operate much faster than Amazon’s platform. The end result for its users is about half the cost of using AWS.

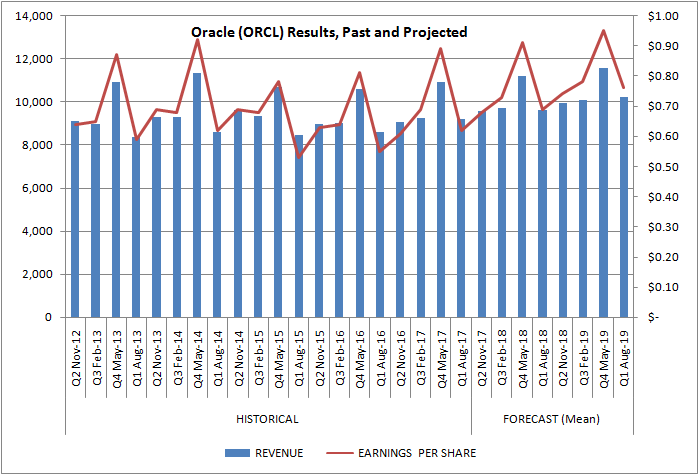

And that was hardly Oracle’s first foray into the competitive cloud arena. It’s been quietly shoving its way into the market for some time now. The revenue and earnings chart below shows the turnaround Oracle Corporation has achieved since the middle of last year (when it finally got serious about the cloud).

It’s still slow going to be sure, but the trajectory is compelling. You may not want to jump into an ORCL trade just yet, however.

Wrong Time

Truth be told, ORCL stock is inherently volatile, even though its underlying results are relatively unchanged from one year to the next.

It’s counterintuitive on the surface, but it makes sense when given some though. When stability is the biggest draw to a stock, even the slightest deviation from fiscal expectations can wreak havoc on it — that’s ORCL, to be sure.

Lackluster guidance pulled the rug out from underneath Oracle shares a couple of weeks ago. ORCL dropped 8% right out of the gate on Sept. 15, and has since lost more ground.

The outlook was just the catalyst, though. The stage was set for a pullback no matter what Oracle had to say that day and it is still set for more downside.

The longer-term weekly chart of ORCL stock below illustrates this point very well. Though it’s a multi-year cycle, Oracle stock is trapped in a long-term trading range. The upper edge of that range was brushed right before earnings were announced, largely thanks to the 39% advance since early this year. It was unlikely ORCL had any more room to rally following its fiscal first quarter. In fact, there’s room for it to keep falling, as it has in the past after that ceiling was touched.

The lower end of that range is currently at $41, though the floor isn’t as clearly defined as the ceiling is. Also bear in mind that the lower edge of that range, wherever it is, is also rising pretty fast.

Bottom Line for ORCL Stock

On the off chance it’s not completely clear yet, while the potential downside is big, it’s also a buying opportunity into a great turnaround, regained-relevance story. At a price of $41, the coming year’s expected earnings of $3.17 per share translates into a forward-looking P/E ratio of 15.1. That’s a great value by technology stock standards.

Even if it wasn’t a great value after a sizeable pullback, though, any dip would still be a great reason to scoop it up and take part of what’s been a long, undeniable uptrend. And now that trend is supported by earnings growth.

As of this writing, James Brumley did not hold a position in any of the aforementioned securities. You can follow him on Twitter.

The post Oracle (ORCL) is the Right Stock at the Wrong Time appeared first on InvestorPlace.