Oracle Slips on Fiscal 3rd-Quarter Revenue Miss

- By James Li

Shares of Oracle Corp. (NYSE:ORCL), a major enterprise resource planning software manufacturer, slipped over 5% in aftermarket trading on Wednesday on the heels of reporting fiscal third-quarter revenue performance that is slightly below consensus estimates and announcing a dividend increase.

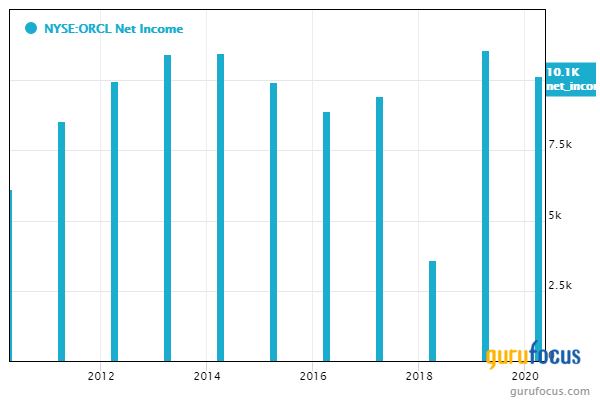

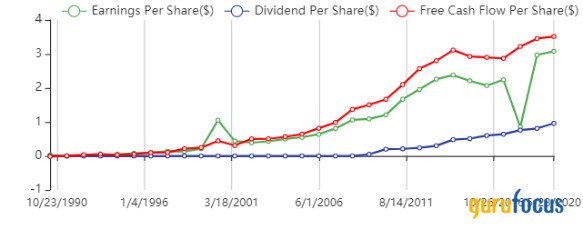

The company relocated its headquarters from Redwood City, California, to Austin, Texas in December. For the quarter ending Feb. 28, the company reported net income of $5.021 billion, or $1.68 in diluted earnings per share, compared with net income of $2.571 billion, or 79 cents in diluted earnings per share in the prior-year quarter. Adjusted earnings of $1.16 per share topped the Refinitiv estimate of $1.11 per share.

Company earnings summary

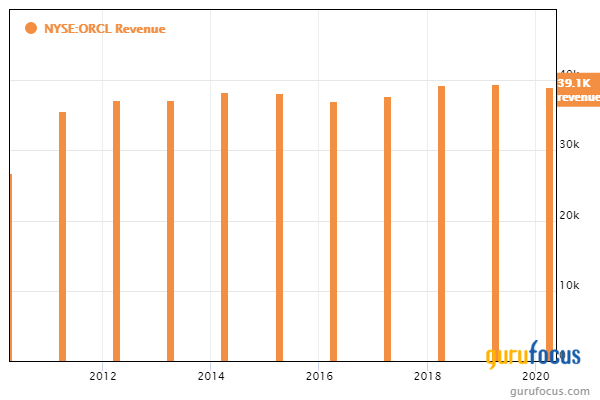

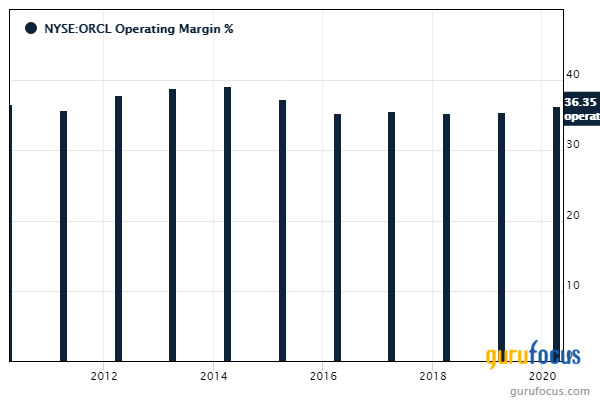

Oracle CEO Safra Catz said that company subscription revenue and operating income increased 5% and 10%, boosted by strong growth in enterprise resource planning software products like Fusion ERP and NetSuite ERP. Despite this, cloud services and license support revenues of $7.25 billion increased 5% year over year, yet fell slightly short of the consensus estimate of $7.28 billion.

The company mentioned several technical innovations, including Oracle Database 21c and the expansion of Oracle Cloud portfolio with Oracle Roving Edge Infrastructure.

Company approves 33% dividend hike while shares fall

Oracle's board of directors approved a 33% dividend increase, declaring a dividend of 32 cents per share that is payable on April 22 with a record date of April 8.

Shares of Oracle traded around $67.80, down close to 6% from the closing price of $72.12. The stock is modestly overvalued based on Wednesday's price-to-GF Value ratio of 1.12.

GuruFocus ranks Oracle's profitability 9 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank and profit margins and returns outperforming over 90% of global competitors.

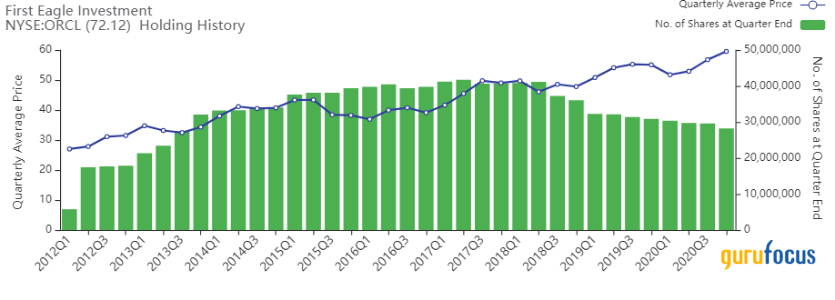

Gurus with large holdings in Oracle include First Eagle Investment (Trades, Portfolio), Ken Fisher (Trades, Portfolio) and PRIMECAP Management (Trades, Portfolio).

Disclosure: No positions.

Read more here:

4 Profitable and Predictable Companies With High Free Cash Flow Growth

4 High-Quality Technology Stocks Trading at Attractive GF Valuations

Value Screeners Identify Opportunities for March

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.