Osisko: There's a Lot of Gold in Them Hills

Osisko Mining Inc. (TSX:OSK) is a gold exploration company exploring and developing gold deposits in Quebec, Canada.

The company's flagship project is the high-grade world class Windfall gold deposit, located between Val-d'Or and Chibougamau in Quebec, Canada. The deposit is currently one of the highest-grade undeveloped gold projects in the world.

Osisko also holds a 100% undivided interest in a large area of claims in the Urban-Barry area and in the Quevillon area that includes the Osborne-Bell gold deposit totaling 260,758 hectares.

Osisko's strategy is to advance and develop the Windfall deposit towards a production decision while continuing to explore for additional deposits in the emerging districts of Urban-Barry and Quevillon.

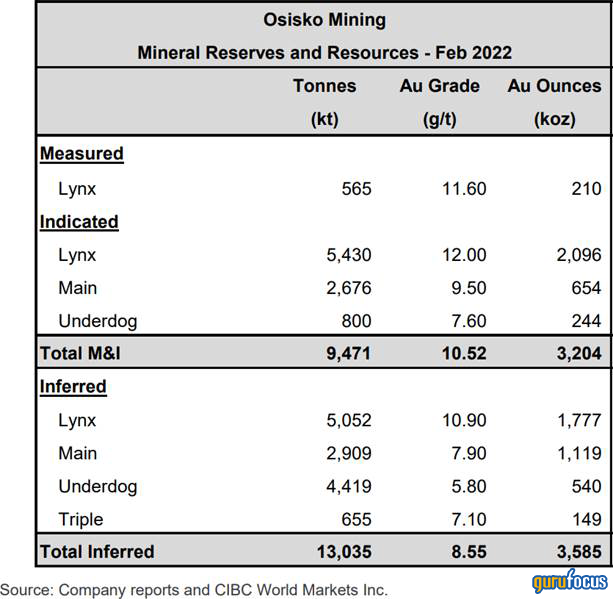

The company recently announced an updated resource estimate for Windfall of 3.2 million ounces of measured and indicated resource at 10.5 grams per ton of gold, and 3.6 million ounces of inferred resource at 8.6 grams per ton of gold. Resource estimates grew significantly from the prior year.

The stock has reacted strongly to this news, as shown in the chart below:

To execute its strategy, Osisko is currently undertaking a significant drill program to accelerate the advancement of the Windfall deposit towards the feasibility stage and, following positive results, its subsequent construction and operation. In addition, advancement of an exploration ramp allowed the completion of bulk samples in Zone 27 and in the Main Lynx zone, as well as the development of underground drilling bays to accelerate the drilling program. Finally, ramp advancement and additional underground drill bays are being developed in preparation of a third bulk sample in the Triple Lynx Zone. The focus of drilling activities is infill drilling in Lynx, the upper portion of Triple Lynx and Lynx 4, Main zones and Underdog while continuing the expansion of the deposit footprint through new discoveries.

Since Osisko's projects are entirely based in its home country of Canada, there is very low geo-political risk.

Canada's The Globe and Mail newspaper reported that between Jan. 13 and Jan. 24, chairman and CEO John Burzynski invested over $460,000 in shares of Osisko. He bought a total of 115,000 shares at an average cost per share of approximately $4.01, increasing this particular accounts position to 943,700 shares.

Year-to-date, the share price is up nearly 8%. The positive price momentum began last quarter. Since the beginning of the fourth quarter of 2021, the share price has rallied 75%.

Analysts believe the share price has significant upside potential. The stock has a unanimous buy recommendation from 10 analysts on Wall Street. The average 12-month target price is $5.67, implying the share price may increase 20% over the next year.

Source: CIBC Investors Edge

Conclusion

Osisko Mining appears to be a strong emerging gold mining company based in a geopolitically stable country that it calls home. As such, for investors interested in junior gold mining stocks, this appears to be great option.

This article first appeared on GuruFocus.