OTIS Benefits From Solid R&D Investments, Orders & Backlog

Otis Worldwide Corporation OTIS is benefiting from solid R&D investments as well as strong order and backlog growth in the New Equipment segment. Also, solid contributions from the Service segment add to its uptrend.

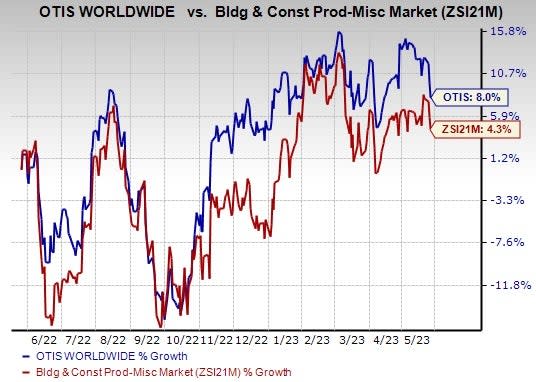

Shares of OTIS have risen 8% in the past year compared with the Zacks Building Products - Miscellaneous industry’s growth of 4.3%.

Recently, OTIS reported impressive first-quarter 2023 results, with earnings and revenues beating the Zacks Consensus Estimate by 8.1% and 2.1%, respectively. Also, the bottom line grew year over year by 5.3%. The upside was backed by operational improvements and a favorable segment mix.

OTIS has a trailing four-quarter earnings surprise of 5.9%, on average. Earnings estimates for 2023 have moved north to $3.45 per share from $3.43 per share over the past 30 days. This depicts analysts' optimism over the company’s growth prospects.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for OTIS 2023 earnings indicates growth of 8.8% from the previous year’s reported levels.

Let us delve deeper into the growth factors.

What is Favoring OTIS?

OTIS’ primary focus on innovation is core to its strategy. Otis connects global research and development (R&D) efforts through an operating model that sets global and local priorities based on customer and segment needs. In 2021, it launched the successors to the Gen2 family of elevators, the Gen3 and Gen360 digital elevator platforms. The technology expands predictive and remote maintenance capabilities to support improved elevator up-time and service productivity. In 2022, the company invested $150 million in R&D, particularly in product innovation with its Gen3 offering. At 2022-end, it had 11 R&D centers and 17 factories across the world, primarily in China, India, France, Spain and the United States.

The company remains focused on strong portfolio growth and generating a solid New Equipment backlog. In first-quarter 2023, the New Equipment segment of OTIS witnessed order growth of 7% at constant currency. The metric was up 27% in Asia Pacific, 1% in EMEA and 15% in the Americas. The segment’s backlog was up 3% in the quarter. Adjusted backlog at constant currency increased 10%.

The Service segment of OTIS also highly contributed to the first quarter of 2023 performance. Its net sales grew 2.4% to $2.04 billion and adjusted revenues improved 2.7% year over year. Adjusted operating margin registered an improvement of 40 bps year over year to 23.5%, driven by higher volume, favorable pricing and productivity.

OTIS intends to expand operating margins, return cash to shareholders through a capital-allocation strategy and pursue additional progress toward ESG goals. For 2023, the company anticipates net sales to be within $13.9-$14.2 billion, indicating 2.5-4.5% year-over-year growth. Adjusted earnings per share are anticipated to be in the range of $3.40-$3.50 compared with $3.35-$3.50 expected earlier, suggesting 7-10% year-over-year growth.

Zacks Rank & Other Key Picks

OTIS currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Here are some other top-ranked stocks that investors may consider from the Zacks Construction sector.

Martin Marietta Materials, Inc. MLM currently sports a Zacks Rank #1. MLM delivered a trailing four-quarter earnings surprise of 31%, on average. Shares of the company have gained 10.6% in the past six months.

The Zacks Consensus Estimate for MLM’s 2023 sales and EPS indicates growth of 19% and 32.1%, respectively, from the previous year’s reported levels.

Vulcan Materials Company VMC currently carries a Zacks Rank #1. VMC has a trailing four-quarter earnings surprise of 7.1%, on average. Shares of the company have gained 7.8% in the past six months.

The Zacks Consensus Estimate for VMC’s 2023 sales and EPS indicates growth of 5.9% and 26.2%, respectively, from the previous year’s reported levels.

Watsco, Inc. WSO currently sports a Zacks Rank #1. WSO delivered a trailing four-quarter earnings surprise of 5.3%, on average. Shares of the company have gained 21% in the past six months.

The Zacks Consensus Estimate for WSO’s 2023 sales and EPS indicates growth of 3.1% and 2.1%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Watsco, Inc. (WSO) : Free Stock Analysis Report

Vulcan Materials Company (VMC) : Free Stock Analysis Report

Martin Marietta Materials, Inc. (MLM) : Free Stock Analysis Report

Otis Worldwide Corporation (OTIS) : Free Stock Analysis Report