Outsourcing Stays Afloat Amid Coronavirus Crisis: 4 Picks

Coronavirus-induced strict lockdowns across the globe have dealt a huge blow to almost every industry and outsourcing is no exception. With growing adoption of the work-from-home model, operational challenges such as availability of laptops, Internet connectivity and data-security issues are concerns for the industry players.

But with people gradually adapting to the new normal, the outsourcing industry now stands on a solid footing. The work-from-home transition has been backed by increased adoption of cloud computing and other emerging technologies, which have led to operational efficiency and reduced expenses. These are driving competitive advantage and increasing innovation and speed-to-market.

Let’s delve deeper into how each of these aforementioned factors has been favoring the industry.

Pandemic Alters Outsourcing Industry Dynamics

The industry has witnessed a shift in its operating model with an increase in the number of remote workers. Despite the operational challenges (related to working from home), remote working continues to be a driving force. Also, it is leading to cost savings for many firms by bringing down their spending on real estate. Remote work is also altering the offshore-onshore delivery capabilities of industry players. This is anticipated to create a hybrid-work-culture (a hybrid model of working from office and home), which should enhance the talent pool of the industry.

Most of the industry participants are also considering emerging technologies such as cloud computing to drive competitive advantage, increase innovation, improve speed-to-market and drive performance within the industry. Wider application of artificial intelligence (AI) is expected to be the biggest change due to the pandemic. Adoption of AI should lower complications and simplify operations.

Notably, industry players are in the process of modernizing their traditional legacy-oriented business processes so as to be flexible in any kind of operating environment.

4 Outsourcing Stocks to Bet On

Adding stocks from the industry looks like a smart move to enhance your portfolio as the pandemic rages on. The buoyancy in the industry is further confirmed by its Zacks Industry Rank #34, which places it in the top 14% of more than 250 Zacks industries.

We have zeroed in on four promising outsourcing stocks with a favorable Zacks Rank #1 (Strong Buy) or 2 (Buy) and a VGM Score of A or B.The selected companies appear to be compelling investment propositions at the moment.

Additionally, these stocks have solid expected earnings growth rate for the current year, witnessed upward estimate revisions in the past 60 days and showed significant growth in their share price movement in the past six months. You can see the complete list of today’s Zacks #1 Rank stocks here.

Let’s have a look at the four picks:

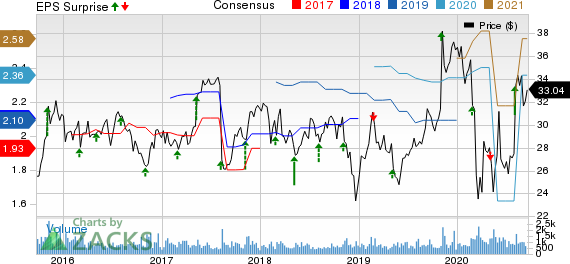

Sykes Enterprises, Incorporated SYKE: This Florida-based provider of multichannel demand generation and customer engagement solutions and services sports a Zacks Rank #1 and has a VGM Score of A.

The company’s expected earnings growth rate for the current year is 11.9%. The Zacks Consensus Estimate for the current year has improved 45.7% in the past 60 days. The company has a trailing four-quarter earnings surprise of 58.2%, on average.The stock has rallied 33.5% in the past six months.

Sykes Enterprises, Incorporated Price, Consensus and EPS Surprise

Sykes Enterprises, Incorporated price-consensus-eps-surprise-chart | Sykes Enterprises, Incorporated Quote

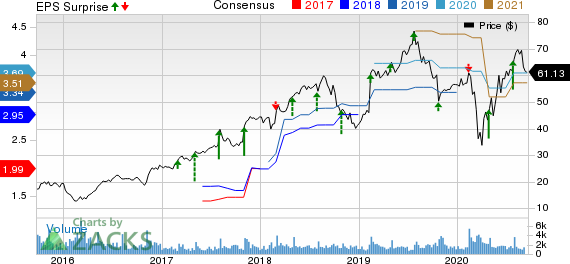

TriNet Group, Inc. TNET: This California-based provider of human resources (HR) solutions for small and midsize businesses sports a Zacks Rank #1 and has a VGM Score of B.

The company’s expected earnings growth rate for the current year is 10.8%. The Zacks Consensus Estimate for the current year has improved 7.9% in the past 60 days. The company has a trailing four-quarter earnings surprise of 33.4%, on average.The stock has rallied 88.9% in the past six months.

TriNet Group, Inc. Price, Consensus and EPS Surprise

TriNet Group, Inc. price-consensus-eps-surprise-chart | TriNet Group, Inc. Quote

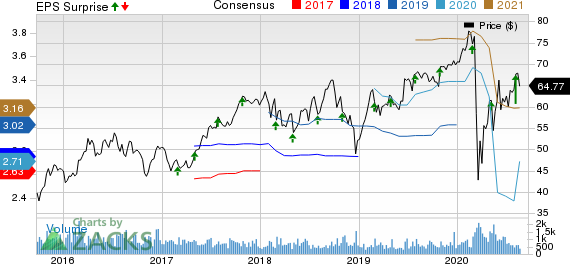

ExlService Holdings, Inc. EXLS: This New York-based provider of operations management and analytics services sports a Zacks Rank #1 and has a VGM Score of B.

The company’s expected earnings growth rate for the current year is 1.9%. The Zacks Consensus Estimate for the current year has improved 32.9% in the past 60 days. The company has a trailing four-quarter earnings surprise of 23.8%, on average.The stock has rallied 51.4% in the past six months.

ExlService Holdings, Inc. Price, Consensus and EPS Surprise

ExlService Holdings, Inc. price-consensus-eps-surprise-chart | ExlService Holdings, Inc. Quote

Atento S.A.ATTO: This Luxembourg-based provider of customer relationship management, and business process outsourcing services and solutions carries a Zacks Rank #2 and has a VGM Score of A.

The company’s expected earnings growth rate for the current year is 42.2%. The Zacks Consensus Estimate for the current year has improved 19.8% in the past 60 days. The stock has rallied 84.1% in the past six months.

Atento S.A. Price, Consensus and EPS Surprise

Atento S.A. price-consensus-eps-surprise-chart | Atento S.A. Quote

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

With users in 180 countries and soaring revenues, it’s set to thrive on remote working long after the pandemic ends. No wonder it recently offered a stunning $600 million stock buy-back plan.

The sky’s the limit for this emerging tech giant. And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sykes Enterprises, Incorporated (SYKE) : Free Stock Analysis Report

ExlService Holdings, Inc. (EXLS) : Free Stock Analysis Report

TriNet Group, Inc. (TNET) : Free Stock Analysis Report

Atento S.A. (ATTO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research