S&P 500 Volatility In 2017 Was The Lowest In History (SPY)

From Dana Lyons: As measured by the VIX, stocks have never enjoyed a less volatile year than 2017.

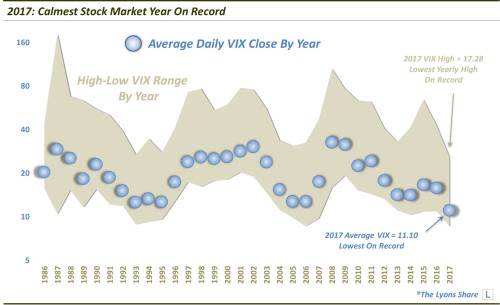

In this week’s posts, we’ll be looking back at the key developments and characteristics that defined the past year in financial markets. And undoubtedly the most notable phenomenon of 2017 was the extremely smooth ride enjoyed by U.S. stocks — unprecedented, in fact. One way to measure just how smooth (or volatile) the market was is by looking at the readings of stock volatility expectations, in this case the S&P 500 Volatility Index, aka, the VIX. And based on VIX readings, 2017 was the least volatile year ever in the stock market.

Specifically, the average daily closing price of the VIX in 2017 was 11.10 (through 12/26/17). That is the lowest of any year — by more than one and a half points — since the VIX inception in 1986 (by comparison, the “average yearly average” is over 20).

Furthermore, as the chart states, the maximum level reached by the VIX in 2017 was 17.28. That is the lowest maximum level attained in any year since inception — and 60% lower than the “average yearly max”. Obviously 2017 was an extraordinary year in its lack of stock volatility.

That’s interesting, but it’s also history at this point. What does it mean, if anything, for 2018? Are stocks now due for some serious volatility reversion?

Well, certainly stock market bulls cannot reasonably expect the unprecedentedly smooth ride to continue forever. Volatility levels were so far below historic norms that some increase should materialize in this next year. However, there is no reason that the relative low-volatility environment cannot persist further. There is no law suggesting that an imminent spike in volatility is likely. In fact, in our view, at this point it is more likely that the low volatility will continue in the near to intermediate-term.

Eventually, storm clouds will gather and the stock market seas will get choppy again. But for now, it is smooth sailing for investors.

The SPDR S&P 500 ETF Trust (SPY) rose $0.53 (+0.2%) in premarket trading Thursday. Year-to-date, SPY has gained 21.92%.

SPY currently has an ETF Daily News SMART Grade of A (Strong Buy), and is ranked #1 of 140 ETFs in the Large Cap Blend ETFs category.

Wondering when volatility will return? Check out our “all-access” service, The Lyons Share. When we begin to see the signs of a potential volatility uptick, or elevated risk in the stock market, TLS members will be the first to know. Also, sign up by January 1 and save 20% off an Annual Membership during our Holiday Sale. Considering the sale price — and the unlikelihood that this unprecedentedly smooth investment ride can continue — there has never been a better time to reap the benefits of this service. Thanks for reading!

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

This article is brought to you courtesy of Dana Lyons, JLFMI and My401kPro.