S&P Global (SPGI) Surpasses Q2 Earnings & Revenue Estimates

S&P Global Inc. SPGI reported strong second-quarter 2018 results wherein both earnings and revenues surpassed the Zacks Consensus Estimate.

Adjusted earnings per share of $2.17 beat the Zacks Consensus Estimate by 4 cents and increased 26% on year-over-year basis. The improvement can be attributed to revenue growth, operating leverage and U.S. tax reform that decreased the company’s adjusted effective tax rate to 23.9% from 28.9% in the year-ago quarter.

Revenues of $1.6 billion outpaced the consensus mark by a mere $0.6 million and increased 6.6% year over year. The top-line improvement was driven by growth in all business segments.

So far this year, shares of S&P Global have gained 26.8%, outperforming the industry’s 19% rally.

Let’s delve deeper into the numbers

Segmental Revenues

Ratings revenues increased 4% year over year to $775 million driven by strength across bank loan ratings, structured finance, non-transaction revenues and transaction revenues.

Bank loan ratings and structured finance grew 22% and 18%, respectively on a year-over-year basis. Non-transaction revenues increased 7% to $378 million owing to growth in fees associated with surveillance, new entity ratings and Rating Evaluation Service fees. Transaction revenues expanded 1% to $397 million as increased bank loan ratings revenues offset a decline in bond ratings revenues.

While revenues from the United States increased 3%, international revenues increased 5%. Notably, the segment derived 43% of total revenues internationally.

Market Intelligence revenues were up 8% year over year to $447 million, primarily driven by growth across Desktop, Risk Services, and Data Management Solutions.

Platts revenues increased 7% to $205 million owing to growth in the core subscription business, which was partially offset by a decline in Global Trading Services.

S&P Dow Jones Indices revenues surged 13% to $209 million driven by an increase in asset-linked fees and revenue associated with exchange-traded derivatives. Revenues associated with exchange-traded derivatives activity increased 17%.

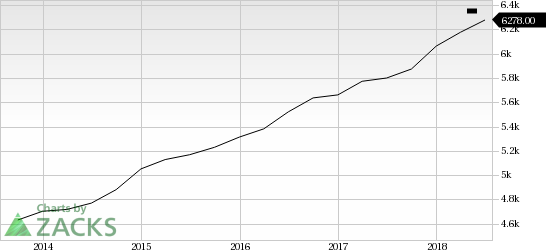

S&P Global Inc. Revenue (TTM)

S&P Global Inc. Revenue (TTM) | S&P Global Inc. Quote

Operating Results

The company’s adjusted operating profit margin expanded 230 bps to 49% due to revenue growth and operating leverage.

Going by segments, Ratings adjusted operating profit margin improved 400 bps to 57% due to revenue growth, lower incentives and productivity improvements. S&P Dow Jones adjusted operating profit margin increased 70 bps to 66%. The same for Market Intelligence increased 40 bps to 33% and for Platts, it grew 190 bps to 50%.

Balance Sheet and Cash Flow

At the end of the quarter, S&P Global had cash, cash equivalents, and restricted cash of $1.9 billion. Long-term debt was $3.66 billion, compared with $3.17 billion in the preceding quarter.

The company generated $543 million cash from operating activities. Free cash flow was $488 million.

During the quarter, the company returned $126 million to shareholders through dividend payment. The $1 billion accelerated share repurchase (ASR) agreement (which was started in the first quarter) continues. The company is hopeful of completing the ASR in the third quarter.

2018 Guidance

S&P Global reaffirmed its adjusted earnings per share (EPS) guidance for full-year 2018. The company expects adjusted earnings in the range of $8.45-$8.60 per share. The Zacks Consensus Estimate of $8.53 is in line with the midpoint of the guided range.

The company, however, lowered its GAAP EPS guidance. The company now expects GAAP EPS in the range of $7.75-$7.90 per share, compared with the previously guided range of $7.95-$8.10.

Zacks Rank & Upcoming Releases

S&P Global currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Investors interested in the broader Business Services sector are keenly awaiting second-quarter earnings reports from key players like Verisk Analytics VRSK, Aptiv APTV and Fiserv FISV. All the companies are slated to report their quarterly numbers on Jul 31.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report

S&P Global Inc. (SPGI) : Free Stock Analysis Report

Fiserv, Inc. (FISV) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research