PacBio's (PACB) New Method for TR Profiling Now Available

Pacific Biosciences of California, Inc. PACB, popularly known as PacBio, recently announced the availability of a new computational analysis method — Tandem Repeat Genotyping Tool (TRGT) — for profiling a huge volume of tandem repeats (TRs) across the human genome (the complete set of genes or genetic material present in a cell or organism) using its long-read HiFi sequencing data. The TRGT is intended to provide scientists with the ability to obtain a full characterization of the sequence and methylation (a chemical reaction in the body in which a small molecule called a methyl group gets added to DNA, proteins or other molecules) status of TRs genome-wide.

PacBio expects that TRGT will enable scientists to better understand the role of known TRs in human disease and could also lead to the discovery of novel disease-causing TRs.

The latest availability of PacBio’s TRGT is expected to significantly boost its Computational Biology business globally.

Significance of the Availability

Per an expert familiar with the TRGT method, it is a key improvement on repeat expansion analysis and will likely aid them in discovering new and potentially vital variants associated with disease in samples from individuals with inherited disorders.

Per the management, TRGT has been developed to characterize the genetic and epigenetic variation in TRs, which is one of the most difficult variant classes. Prior to the availability of TRGT, TRs have been understudied due to limitations in the ability of short-read sequencing technologies to sequence these regions of the genome. However, with the combination of HiFi sequencing and TRGT, PacBio intends to provide scientists with the ability to overcome this difficulty and better understand the biological impact.

Industry Prospects

Per a report by Allied Market Research, the global computational biology market was valued at $5.5 billion in 2021 and is anticipated to reach $31.5 billion in 2031 at a CAGR of 19.5%. Factors like growing demand for pharmacovigilance, an uptick in adoption and development of advanced software for drug discovery, and demand for predictive models are likely to drive the market.

Given the market potential, the latest launch is expected to significantly strengthen PacBio’s global business.

Notable Developments

Last month, PacBio announced its second-quarter 2022 results, registering robust increases in its overall top line and both its Product, and Service and other revenues. The company also gained from strength in its Instrument and Consumables revenues during the reported quarter. Robust performance in the Americas was also witnessed.

In May, PacBio announced a collaboration with genome analysis company iLAC, Inc. and Robotic Biology Institute, Inc. to develop fully automated end-to-end workflows for PacBio’s Sequel II and Sequel IIe HiFi long-read sequencing systems by employing advanced robotics.

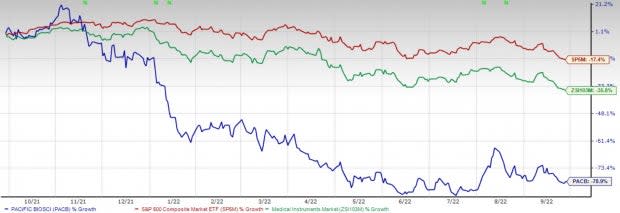

Price Performance

Shares of the company have lost 78.9% in the past year compared with the industry’s 35.8% decline and the S&P 500's 17.4% fall.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, PacBio carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are AMN Healthcare Services, Inc. AMN, ShockWave Medical, Inc. SWAV and McKesson Corporation MCK.

AMN Healthcare, flaunting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 3.2%. AMN’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 15.7%.

You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has lost 9.4% compared with the industry’s 39.9% fall in the past year.

ShockWave Medical, sporting a Zacks Rank #1 at present, has an estimated growth rate of 33.1% for 2023. SWAV’s earnings surpassed estimates in all the trailing four quarters, the average beat being 180.1%.

ShockWave Medical has gained 27% against the industry’s 35.8% fall over the past year.

McKesson, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 10.1%. MCK’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the average beat being 13%.

McKesson has gained 66.2% against the industry’s 19.3% fall over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Pacific Biosciences of California, Inc. (PACB) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research