PACCAR (PCAR) Q4 Earnings Surpass Estimates, Revenues Rise

PACCAR Inc.’s PCAR fourth-quarter 2018 earnings were $1.65 per share, surpassing the Zacks Consensus Estimate of $1.57. Results were aided by quality products and services, record heavy-duty truck market share in Europe, strong global truck markets, and solid aftermarket parts’ results. Earnings per share in the prior-year quarter were $1.67. Excluding the one-time tax benefits, earnings per share in fourth-quarter 2017 were $1.18.

PACCAR posted quarterly consolidated net sales and revenues of $5.93 billion, up from the prior-year quarter figure of $5.12 billion. The Zacks Consensus Estimate of revenues was $5.8 billion.

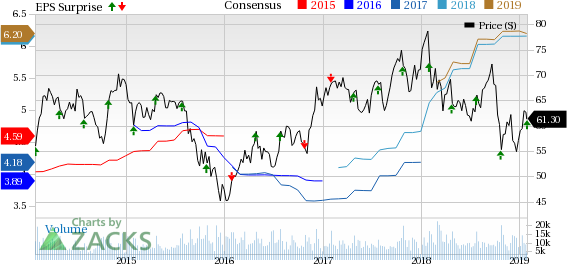

PACCAR Inc. Price, Consensus and EPS Surprise

PACCAR Inc. Price, Consensus and EPS Surprise | PACCAR Inc. Quote

2018 Results

Net sales and revenues for 2018 were at a record $23.50 billion, up 21% from the 2017 figure.

Segmental Results

Revenues from the Truck, Parts and Other segment increased to $5.93 billion in fourth-quarter 2018 from $5.12 billion in fourth-quarter 2017. The segment’s pre-tax income increased to $645.3 million from $522.9 million recorded a year ago.

Revenues from the Financial Services segment rose to $347 million from $332.2 million a year ago. Pre-tax income increased to $87.2 million from $71.9 million in the year-ago quarter.

Financial Position

PACCAR’s cash and marketable debt securities amounted to $4.30 billion as of Dec 31, 2018, compared with $3.62 billion as of Dec 31, 2017.

Class 8 Truck View

In the United States and Canada, Class 8 truck industry retail sales were 285,000 units in 2018, up 30% from 218,000 vehicles sold in 2017. For 2019, the United States and Canada Class 8 truck industry retail sales are anticipated to rise to a range of 285,000-315,000.

Zacks Rank & Stocks to Consider

PACCAR currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the auto space are Allison Transmission Holdings, Inc. ALSN, Dana Incorporated DAN and General Motors Company GM, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Allison Transmission has an expected long-term growth rate of 10%. Over the past six months, shares of the company have surged 15.2%.

Dana has an expected long-term growth rate of 2.9%. Over the past three months, shares of the company have risen 17.2%.

General Motors has an expected long-term growth rate of 8.5%. Over the past three months, shares of the company have risen 14.6%.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Motors Company (GM) : Free Stock Analysis Report

Dana Incorporated (DAN) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

To read this article on Zacks.com click here.