Is Pain in Store for Gold Mining ETFs on Muted Earnings?

The gold mining space remained in the red after mixed-to-downbeat earnings reports for the fourth quarter. Below we highlight Q4 earnings results of Barrick Gold Corp ABX, Goldcorp Inc. GG and Newmont Mining Corp. NEM. Among the trio, Barrick was the first to report earnings after regular trading on Feb 14, 2018.

Let’s dig a little deeper (read: Gold Mining ETF Investing Guide).

Newmont Q4 Earnings in Focus

Gold mining giant Newmont Mining Corporation logged net loss from continuing operations of $534 million or 99 cents per share in fourth-quarter 2017, wider than net loss of $391 million or 73 cents recorded a year ago.

Without one-time items, adjusted earnings were 40 cents per share for the quarter, which came in line with the Zacks Consensus Estimate.

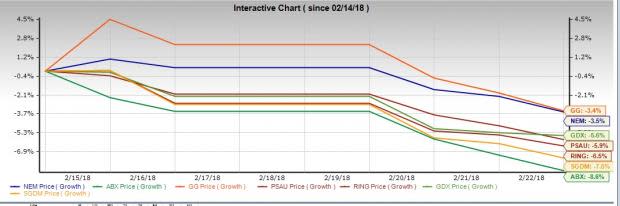

Newmont reported revenues of $1.935 billion, up around 8.2% year over year. The figure missed the Zacks Consensus Estimate of $1.958 billion. Since Feb 15, 2018, the stock has slipped 3.5% (as of Feb 22, 2018).

Goldcorp Q4 Earnings in Focus

Goldcorp reported net earnings of $242 million or 28 cents per share for fourth-quarter 2017 compared with $101 million or 12 cents recorded a year ago.

Excepting one-time items, adjusted earnings for the quarter came in at 10 cents per share, which missed the Zacks Consensus Estimate of 11 cents.

Goldcorp recorded revenues of $853 million in the fourth quarter, down roughly 5% year over year. The figure also missed the Zacks Consensus Estimate of $870 million.

Gold sales went down around 17.6% year over year to 633,000 ounces in the fourth quarter and production fell 15.1% to 646,000 ounces. The stock is down 3.4% since Feb 15, 2018.

Barrick Gold Q4 Earnings in Focus

Barrick Gold Corporation recorded net loss (attributable to equity holders) of $314 million or 27 per share for fourth-quarter 2017 against net earnings of $425 million or 36 cents a year ago.

Barring one-time items, adjusted net earnings came in at $253 million or 22 cents per share for the quarter. Earnings per share beat the Zacks Consensus Estimate of 20 cents.

Revenues fell roughly 3.9% year over year to $2.228 billion in the fourth quarter but beat the Zacks Consensus Estimate of $2.181 billion. The stock has lost about 8.6% since Feb 14, 2018.

ETF Impact

The aforementioned companies have considerable exposure in large-cap funds like VanEck Vectors Gold Miners ETF GDX, iShares MSCI Global Gold Miners ETF RING, PowerShares Global Gold & Precious Metals ETF PSAU and Sprott Gold Miners ETF SGDM (see all Materials ETFs here).

In PSAU, NEM (8.39%), ABX (7.46%) and GG (6.54%) take the top three positions. RING invests more than 15% each in NEM and more than 11% in ABX, while GG takes 8.02%.

In GDX also, NEM, ABX and GG take 9.40%, 7.30% and 5.41% share, respectively. SGDM puts about 10.92% in NEM, 10.8% in GG and 4.34% in ABX. PSAU, RING, GDX and SGDM has lost about 5.9%, 6.5%, 5.6% and 7.5% since Feb 14, 2018.

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week. Get it free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

VANECK-GOLD MNR (GDX): ETF Research Reports

SPROTT-GOLD MNR (SGDM): ETF Research Reports

ISHARS-M GL GLD (RING): ETF Research Reports

PWRSH-GLBL GOLD (PSAU): ETF Research Reports

Newmont Mining Corporation (NEM) : Free Stock Analysis Report

Barrick Gold Corporation (ABX) : Free Stock Analysis Report

Goldcorp Inc. (GG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report