Is Palo Alto Attractive Amid Economic Uncertainties?

Technology stocks have been on a wild ride this year due to rising inflation and interest rates. The Nasdaq Composite is down more than 23% this year.

Although this lackluster performance has spooked many investors, this challenging environment provides opportunities for long-term investors as many of the best technology stocks have now become affordable. While fears of economic uncertainty continue to drive the market down, picking up undervalued tech stocks could help investors unlock market-beating investment returns in the long run.

Palo Alto Networks Inc. (NASDAQ:PANW) is one potentially undervalued tech company with solid fundamentals and a long runway for growth, but there are a few risks investors need to evaluate before jumping on board.

About the company

Palo Alto offers network security solutions and services to enterprises, service providers and government agencies. Customers can use the company's cybersecurity products to secure their networks, work remotely, protect public and private clouds, advance their Security Operations Centers (SOC), prevent data leaks and perform a variety of other security tasks.

Palo Alto is one of the biggest network security companies in the world, serving over 80,000 enterprise customers. The company has increased its market share through strategic acquisitions including Bridgecrew, an automated cloud security platform.

Recent earnings confirm strong demand

On May 19, Palo Alto reported its fiscal third-quarter earnings, exceeding analyst expectations for both revenue and earnings. The company posted earnings per share of $1.79 compared to analyst expectations of $1.68. Revenue for the fiscal quarter ended April 30 increased by 29% year-over-year to $1.4 billion, aided by a 40% increase in billings to $1.8 billion.

Despite supply chain challenges leading to higher component costs and shipping charges, product revenue increased by 22% to nearly $352 million. Subscription and support revenue increased 32% to $1.04 billion, accounting for 75% of total quarterly revenue.

There has been a significant increase in interest in cybersecurity solutions since Russia invaded Ukraine. Because of the ever-changing security landscape, commercial and government customers are becoming more interested in focusing their efforts on mitigating cybersecurity risks before being exposed to data theft.

Palo Alto reported that 48% of its Global 2,000 customers transacted with all three of its major platforms: Strata, Prisma and Cortex. As a result, annual recurring revenue from next-generation security services increased by 65% to $1.6 billion in the most recent quarter. The number of $5 million deals also increased by 73%, which is a strong indication that enterprise customers are spending record amounts of money on strengthening their digital assets, networks and data.

Lack of profitability is a concern

High-growth companies that eventually turn profitable reward early investors handsomely in the long run. Unfortunately, there is never a guarantee that a cash-burning company will become profitable.

Palo Alto, despite stellar revenue growth in the last decade, has failed to turn consistent profits so far. Higher revenue has led to higher losses over the last 10 years, and this inability to convert sales into profits is concerning. Back in 2012, the company made a small profit of less than a million dollars on revenue of $255.1 million, and in fiscal 2021, Palo Alto booked a loss of $498.9 million on revenue of $4.25 billion. The company so far has not been able to improve its operating margins meaningfully to earn profits at the operating level, and this is an area investors need to keep a close eye on.

Palo Alto insiders have been net sellers of the stock this year too, which has been a reason of concern for investors of late. Although investment decisions of company insiders should never be used as concrete evidence of the value status of a company's shares, insider transactions can certainly have a massive impact on the market sentiment toward a stock.

Another key risk that needs to be monitored is price-based competition in the cybersecurity industry. As the industry matures, leading companies in this market will be forced to compete on price, which is likely to exert more downward pressure on Palo Alto's operating margins.

There is room for growth

The remote work and cloud revolutions that were greatly accelerated by the pandemic resulted in widespread cyberattacks, and this trend is continuing. Because of the growing number of cybersecurity threats that businesses and individuals face, there is an increasing demand for cybersecurity solutions. In an era of digital transformation, companies are likely to increase their IT spending budgets to defend their corporate networks from cyber threats.

Businesses are expected to invest $77 billion in security outsourcing in 2022, according to Gartner, with an 11% increase in cybersecurity spending expected in both 2022 and 2023.

Palo Alto is a market leader and one of the few companies that has managed to stay strong in the face of broader market headwinds. Increased IT spending, growing adoption of remote work and ongoing geopolitical conflicts have the potential to open new doors for Palo Alto to grow in the future.

The increasing complexity of the threats faced by global businesses is another driver of growth for Palo Alto as the company has established itself as one of the go-to enterprise security solutions providers in the world that offers 360-degree solutions. In the cybersecurity world, it is not easy to build a brand name without successfully defending the networks of large companies, and Palo Alto is considered one of the few companies that has shown its worth by protecting sensitive data from cyberattacks.

In a research note sent to clients, Morgan Stanley (NYSE:MS) analyst Hamza Fodderwala claimed earlier this month that Palo Alto is cheaply valued and that the company has a long runway for growth. Addressing investor concerns regarding Palo Alto's substantial stock-based compensation to executives, the analyst said that the company is in a good position to more than offset this through share repurchases in the coming years. The analyst went on to claim that Palo Alto is less than three quarters away from turning profits consistently going by the current rate of revenue growth.

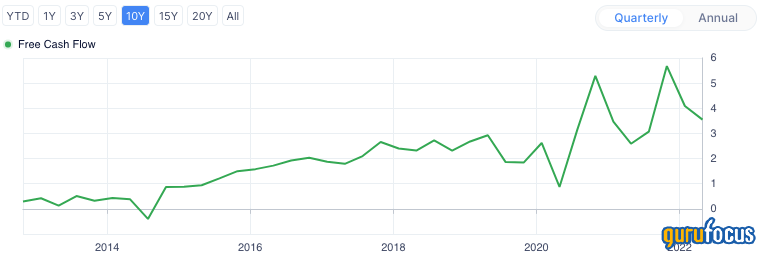

Despite Palo Alto's failure to earn profits, the company has always been consistent in generating positive free cash flows. This is a very good sign for investors as this cash can be used to create long-term shareholder wealth through strategic investments.

Takeaway

Cybersecurity companies can expect strong demand for their products and services as digitalization continues to gain traction in every corner of the world. The company is not cheaply valued at a price-sales ratio of 9.33, but the long runway for growth and its expertise in offering security solutions to protect sensitive data from complicated threats calls for a premium valuation in my opinion.

This article first appeared on GuruFocus.