Palo Alto Networks (PANW) Completes Expanse Buyout Deal

Palo Alto Networks PANW recently announced that it has completed the acquisition of Expanse, an attack surface management vendor. Notably, on Nov 11, Palo Alto Networks had announced entering into a definitive agreement to acquire Expanse in a cash-and-stock deal worth $800 million.

Per the agreement terms, Palo Alto Networks was required to pay $670 million in cash and the remaining $130 million in replacement equity awards.

Palo Alto Networks’ latest acquisition is well timed amid the coronavirus-led global lockdown, which has spurred the necessity of remote working. Owing to the global quarantine situation, organizations have accelerated digital transformation and are shifting to cloud so that their employees can work from homes uninterruptedly.

However, the transition of workload to the cloud has several concerns, security being the most important. In the current environment, where a massive global workforce is compelled to work remotely, the security risk multiplies several times.

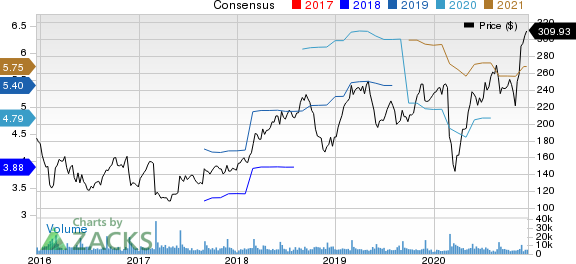

Palo Alto Networks, Inc. Price and Consensus

Palo Alto Networks, Inc. price-consensus-chart | Palo Alto Networks, Inc. Quote

The company said, “As companies embark on digital transformation, they often leave critical IT assets exposed to the internet, creating vulnerable points that attackers can exploit. This exposure has only accelerated with the rapid shift to the cloud and remote working.”

Here, with the Expanse solution, organizations will be able to understand and protect their attack surfaces. According to a TechCrunch report, “It works by giving the security team a view of how the company’s security profile could look to an attacker trying to gain access.”

Palo Alto intends to integrate Expanse with its Cortex product suite. The company stated that the integration will “enrich the Cortex product suite and create the ability to stitch together external, internal and threat data to provide organizations with a complete, integrated view of the enterprise.”

Palo Alto’s strategy of making acquisitions to boost growth is long documented. Since 2017, the firm has spent more than $3 billion for buying several small companies, specializing in a particular aspect of security.

Last year, the company acquired five companies, including Demisto and Twistlock. In addition to Expanse, Palo Alto has acquired two more companies so far this year, including CloudGenix and Crypsis Group.

These buyouts have helped the company expand its product portfolio and customer base, thereby bringing in incremental revenues. Markedly, it has registered stellar double-digit revenue growth in the trailing five years.

To remain competitive, companies in the security space acquire businesses to enhance their capabilities. Palo Alto’s close competitor Cisco Systems CSCO has acquired eight companies in 2020 so far, including Slido, Portshift and ThousandEyes.

So far this year, Fortinet FTNT has bought two companies — OPAQ Networksand Panopta. Another competitor, FireEye FEYE, acquired a cloud security company — Cloudvisory — for an undisclosed amount this January. Moreover, the company purchased Respond Software last month for $186 million.

Palo Alto currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research SherazMian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

FireEye, Inc. (FEYE) : Free Stock Analysis Report

To read this article on Zacks.com click here.