Pangaea Logistics Solutions' (NASDAQ:PANL) Shareholders Are Down 31% On Their Shares

Pangaea Logistics Solutions, Ltd. (NASDAQ:PANL) shareholders should be happy to see the share price up 11% in the last month. But in truth the last year hasn't been good for the share price. In fact, the price has declined 31% in a year, falling short of the returns you could get by investing in an index fund.

See our latest analysis for Pangaea Logistics Solutions

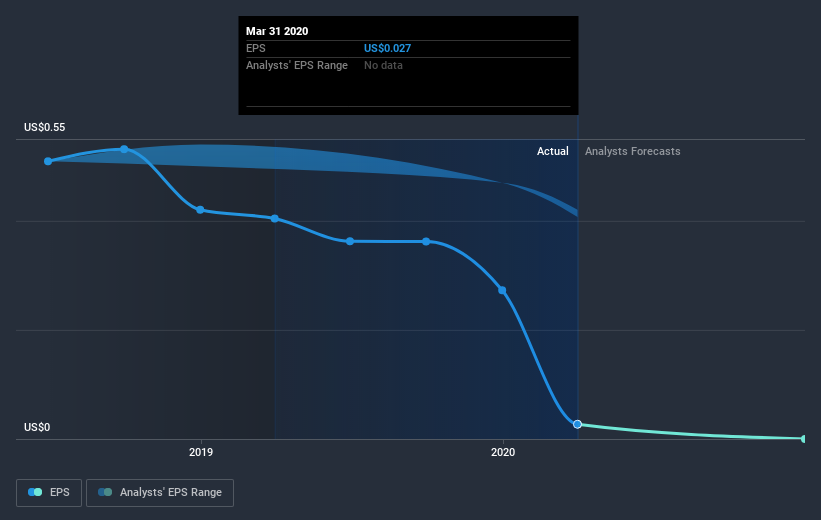

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately Pangaea Logistics Solutions reported an EPS drop of 93% for the last year. The share price fall of 31% isn't as bad as the reduction in earnings per share. So the market may not be too worried about the EPS figure, at the moment -- or it may have expected earnings to drop faster. Indeed, with a P/E ratio of 87.73 there is obviously some real optimism that earnings will bounce back.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Pangaea Logistics Solutions' total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Pangaea Logistics Solutions' TSR, which was a 30% drop over the last year, was not as bad as the share price return.

A Different Perspective

While the broader market gained around 19% in the last year, Pangaea Logistics Solutions shareholders lost 30%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4.6% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Pangaea Logistics Solutions better, we need to consider many other factors. For example, we've discovered 3 warning signs for Pangaea Logistics Solutions (1 is a bit unpleasant!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.