Paramount Global (PARA) Q4 Earnings Miss, Revenues Rise Y/Y

Paramount Global PARA delivered adjusted earnings of 8 cents per share in fourth-quarter 2022, which missed the Zacks Consensus Estimate by 55.6% and declined 69.2% year over year.

Revenues of $8.13 billion beat the Zacks Consensus Estimate by 0.5% and improved 1.6% year over year, owing to an increase in Direct-to-Consumer (DTC) revenues.

Adjusted OIBDA increased 10% from the year-ago quarter’s level to $614 million.

Selling, general and administrative expenses increased 2.2% year over year to $2.03 billion.

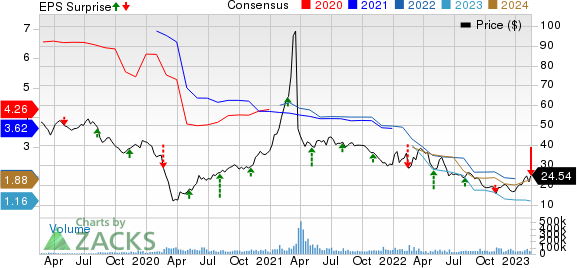

Paramount Global Price, Consensus and EPS Surprise

Paramount Global price-consensus-eps-surprise-chart | Paramount Global Quote

Revenues by Type

Advertising revenues of $3.14 billion decreased 5.2% year over year. Affiliate revenues of $2.86 billion increased 8% year over year.

Theatrical revenues totaled $97 million in the reported quarter compared with the year-ago quarter’s $39 million. Content-licensing revenues of $1.93 billion increased 1.6% year over year.

Segment Details

Direct-To-Consumer Details

Direct-To-Consumer revenues increased 30% year over year to $1.39 billion. Direct-To-Consumer subscription revenues soared 48% year over year to $936 million, reflecting paid subscriber growth on Paramount+.

Global streaming subscribers rose to nearly 77 million, which included the addition of 10.8 million DTC subscribers.

Paramount+ revenues grew 81% year over year. Paramount+ subscribers grew to nearly 56 million following a record quarterly increase of 9.9 million subscribers. Subscriber growth was driven by a strong content slate, including the NFL, the expansion of existing franchises like Top Gun: Maverick and 1923, the success of new franchises like Tulsa King and Smile, as well as CBS’ overall entertainment slate.

Internationally, Paramount+ saw strong engagement and consumption because of a variety of content, including Top Gun: Maverick and Yellowstone.

According to Antenna, Paramount+ is the #1 premium streaming service in domestic sign-ups and gross subscriber additions and had the most sign-ups in 2022 since launch.

Pluto TV increased global monthly active users by 6.5 million in the quarter, driven by growth in all markets and expansion into Canada. Pluto TV’s total global viewing hours grew by strong double-digits quarter over quarter and year over year.

DTC advertising revenues increased 4% year over year to $460 million, reflecting growth from Pluto TV and Paramount+, driven by increased pricing and impressions on both services.

TV Media Details

TV Media revenues decreased 7% year over year to $5.88 billion, which reflected a decline in advertising and affiliate revenues.

Advertising revenues decreased 7% year over year to $2.68 billion, as increases from political advertising and pricing only partially offset lower impressions and a 2% unfavorable impact from FX.

Affiliate and subscription revenues declined 4% year over year to $2.02 billion, as rate increases for domestic networks only partially offset net pay television subscriber declines. Moreover, the evolution of certain international affiliate agreements resulted in a shift of revenues from pay television services to streaming services.

Licensing and other revenues declined 11% year over year to $1.17 billion due to a lower volume of programming produced for third parties.

TV Media’s adjusted OIBDA increased 5% year over year to $1.29 billion, as the revenue decline was more than offset by lower costs.

Filmed Entertainment Details

Filmed Entertainment revenues increased 35% year over year to $936 million, as the strength of 2022 releases drove growth in both theatrical and licensing revenues.

Theatrical revenues of $97 million increased by $58 million year over year, driven by the box office success of Smile.

Licensing revenues were $849 million, up 28% year over year, benefiting from 2022 releases in the home entertainment window, led by the continued success of Top Gun: Maverick.

Balance Sheet

As of Dec 31, 2022, Paramount had cash and cash equivalents of $2.88 billion compared with $3.38 billion as of Sep 30, 2022.

Total debt as of Dec 31, 2022, was $15.8 billion, compared to a total debt of $15.7 billion as of Sep 30, 2022.

Zacks Rank & Stocks to Consider

Paramount currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Consumer Discretionary sector are Six Flags Entertainment SIX, Liberty Global LBTYA and Warner Bros. Discovery WBD, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Six Flags Entertainment, Liberty Global and Warner Bros. Discovery are scheduled to report their quarterly results on Feb 22, Feb 23 and Mar 2, respectively.

The Zacks Consensus Estimate for SIX’s fourth-quarter 2022 earnings is pegged at 23 cents per share, unchanged over the past 30 days.

The Zacks Consensus Estimate for LBTYA’s fourth-quarter 2022 earnings is pegged at 49 cents per share, unchanged over the past 30 days.

The Zacks Consensus Estimate for WBD’s fourth-quarter 2022 earnings is pegged at 8 cents per share, down 42.9% over the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Liberty Global PLC (LBTYA) : Free Stock Analysis Report

Warner Bros. Discovery, Inc. (WBD) : Free Stock Analysis Report

Six Flags Entertainment Corporation New (SIX) : Free Stock Analysis Report

Paramount Global (PARA) : Free Stock Analysis Report