Parexel Investors: Swimming With the Whales

- By Robert Abbott

Biopharm outsourcing company Parexel has a lot--a whole lot--of institutional ownership. GuruFocus reports that pension mutual funds and other big buyers and sellers own more than 99% of the company.

Parexel International Corp. (PRXL) is a major biopharmaceutical outsourcing services company; its main line of business is helping drug companies navigate their way through clinical trials to (hopefully) regulatory approval. It says it has been involved in developing 95% of the 200 top-selling biopharmaceuticals.

Warning! GuruFocus has detected 4 Warning Sign with Q. Click here to check it out.

The intrinsic value of Q

Perhaps that fact convinced institutional investors to buy Parexel so heavily. And perhaps this ownership profile explains why the price charts look like a cross-profile of the Rocky Mountains. Consider this one-year price chart from StockCharts:

Note there have been at least four gap-downs in the past 12 months, quite extraordinary given this is a solid, 4-Star Predictability stock. Investopedia defines a gap as "a break between prices on a chart that occurs when the price of a stock makes a sharp move up or down with no trading occurring in between."

Could these gap-downs be the result of institutional trading? When the professional investors go to market, they must, out of necessity, sell and buy big blocks of stock at a time. And, in many cases, they must wait for another institutional investor to pick up those shares, or most of them.

There is a lot of speculation in this thesis, but also a pertinent question for retail investors, particularly retail investors looking for value:

Do these gap-downs create opportunities for value investors?

History

Parexel was formed in 1982 to advise Japanese and German companies that wanted to get through the U.S. Food and Drug Administration approval process. Its principals were Josef von Rickenbach, a researcher at Schering-Plough in Lucerne, Switzerland, and organic chemist Anne B. Sayigh. The former has remained with the company and is now its chairman.

The company grew both organically and through acquisitions, more than 40 acquisitions by the end of fiscal 2016. This excerpt from its International Investor Day presentation on June 30, 2016, shows some of the major acquisitions, and its debut on NASDAQ in 1995:

It is a relatively young company that went public just over 20 years ago. In that time, Parexel has grown rapidly, absorbing more than one acquisition a year while also growing internally.

Parexel 's business

According to its annual filing with the SEC, Parexel calls itself the leading biopharmaceutical outsourcing services company.

It provides specialized expertise in:

clinical research

clinical logistics

medical communications

consulting

commercialization

advanced technology products and services

Its customers include the worldwide pharmaceutical, biotechnology and medical device industries, and it says it has helped develop 95% of the 200 top-selling biopharmaceuticals.

There are three reporting segments: CRS, PC and PI.

CRS: includes all phases of clinical research from "first-in-man" trials (first human testing) through post-marketing studies, after approval by a regulatory body. This is the company's core business; it brought in 77.6% of total revenue in fiscal 2016.

PC: consulting and technical expertise in non-clinical areas such as strategy, drug development, regulatory affairs, strategic compliance and targeted communications services in support of product launches.

PI: information technology designed to improve the product development processes of its clients. Solutions are sold individually or in combination, as elements of an eClinical suite.

Parexel notes in its filing that "Clinical trials represent one of the most expensive and time-consuming parts of the overall biopharmaceutical product development process." Hence, the opportunity for outsourcing specialists.

In the Investor Day presentation, it notes it has participated in more than 2,000 clinical trials involving more than 900,000 patients at more than 100,000 sites in the past five years.

This slide from the presentation shows how its people and facilities are geographically deployed:

Getting new drugs and pharmaceuticals is a highly complex and expensive process, so drug companies have turned to specialists such as Parexel for clinical trials and associated projects. While this is the company's original and core expertise, it has added complementary products and services that allow it to provide a broader and deeper range of services to clients.

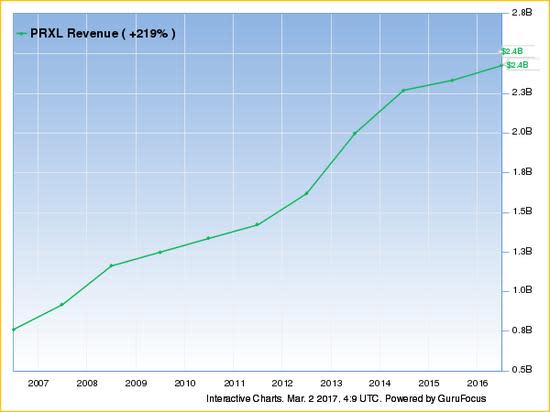

Revenue

GuruFocus reports Parexel had revenue of $2.426 billion in fiscal 2016. This chart shows the growth of revenue over the past decade:

Additionally, GuruFocus reports the company's revenue growth rate is well above the industry average:

In addition, it had a backlog of approximately $5.73 billion at the end of fiscal 2016 (June 30), an increase of 7.5% from a year earlier. The company expects to recognize some $1.6 billion of that backlog in fiscal 2017, the current year.

Five of its biggest clients accounted for 40% of its consolidated service revenue for fiscal 2016. One of them, Pfizer Inc. (PFE), accounted for 13% of consolidated service revenue. In fiscal 2015 and fiscal 2014, the big five accounted for 44% and 47% of consolidated revenue, so dependence on the big five is slowly being reduced.

The company offers this projection of its coming revenue growth:

Sources of revenue are roughly evenly divided between domestic and foreign operations:

Parexel had nearly two and half billion dollars of revenue in fiscal 2016 and has a good history of revenue growth. The sources are split between domestic and international, with much of the revenue coming from five big clients. The company is optimistic about future revenue growth.

Competition

Competitors include other biopharma outsourcing service companies and clinical research organizations (CROs). The large competitors it names are Quintiles Transnational Corp. (now named Quintiles IMS Holdings Inc. (NYSE:Q)), Laboratory Corp. of America (LH), Pharmaceutical Product Development Inc. (PPDI), inVentiv Health (VTIV), INC Research (INCR), PRA Health Sciences Inc. (PRAH) and Icon PLC (ICLR).

Parexel reports that competition for CSR, its core division, also comes from in-house departments of pharmaceutical companies and, to a lesser extent, universities, teaching hospitals and other site organizations.

Hoover's names its three main competitors as Quintiles IMS Holdings, Pharmaceutical Product Development and Covance Inc. (CVD).

Parexel faces competition from many companies, including a number of large publicly-traded companies. It claims to compete well in the space, a claim that is backed up by growing revenues.

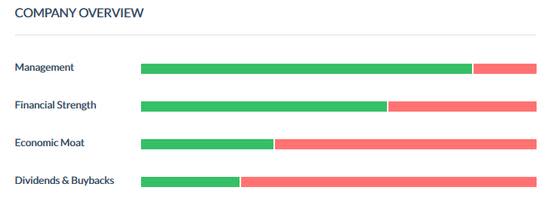

Moat

Morningstar awards Parexel a narrow moat rating based on "its exposure to the late-stage CRO market, in addition to its trial expertise and sticky strategic relationships. We believe the late-stage CRO business is highly conducive to moats for large players, given the few global competitors, minimal invested capital needed and the numerous ways for CROs to add value to the development process and command a premium price."

Vuru also comes in with a narrow moat rating:

The company says it competes favorably in all business areas and segments because of synergies through the integration of products and services in its different business units, its global infrastructure and depth of experience and expertise.

This GuruFocus table shows Parexel's operating margin has grown from the mid-single-digits to high single-digits over the past 10 years:

A narrow moat seems a reasonable consensus for this stock; to some extent, Parexel can widen the moat by targeting growth areas, expanding into products and services that face less competitive pressure than its core business.

Growth

The company says, "Since our inception, we have executed a focused growth strategy embracing internal expansion as well as strategic acquisitions to expand or enhance our portfolio of services, geographic presence, therapeutic area knowledge, information technology capabilities and client relationships."

Along with the increase in revenue, Parexel expects bottom-line growth through its Margin Accelertion Program (MAP). It says direct costs, as a percentage of total service revenue, dropped from 66.7% to 65% in fiscal 2016 because of more staffing efficiency and other MAP savings. Not that MAP is without its costs; for fiscal 2016, the company recorded a net $27.8 million restructuring charge related to MAP and recorded a net $19.8 million restructuring charge in fiscal 2015. These charges involved $38.5 million of employee separation benefits and $9.3 million of facility exit and other costs.

While the future of any individual company in the health care space must be speculative, we do know that demographics are driving growth in health care. Along with that growth comes demands to keep costs down, which should help the drug companies and their suppliers.

Other

Parexel is incorporated in Massachusetts and headquartered in Waltham, Massachusetts.

It has operations in 84 locations throughout 52 countries.

The annual year-end is June 30th.

According to the company website and Reuters.com , Chairman and CEO Josef von Rickenbach is one of the founders of the company. President and Chief Operating Officer Mark Goldberg joined the company in 1997. Emma Reeve serves as interim chief financial officer, corporate vice president and controller. The role of CFO will be taken over by Simon Harford on June 1.

Ownership

Ken Fisher (Trades, Portfolio) has the largest holding of Parexel among the investing gurus followed by GuruFocus. He owns 2,244,444 shares, giving him a nearly 4.5% share of company ownership. The Vanguard Health Care Fund (Trades, Portfolio) and Jana Partners (Trades, Portfolio) are the second and third-largest holders among the gurus.

It is a somewhat complicated ownership picture, but we can safely say institutional investors (mutual, pension and hedge funds) like this company a lot:

This five-year chart shows short interests are near the lower boundary of the range established over the half-decade:

Among insiders, senior management is well represented, as this excerpt from a Yahoo Finance table shows:

If we can trust the professional money managers, this is a stock to own and hold for the long term.

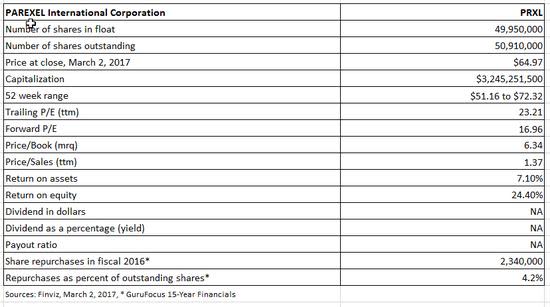

By the numbers

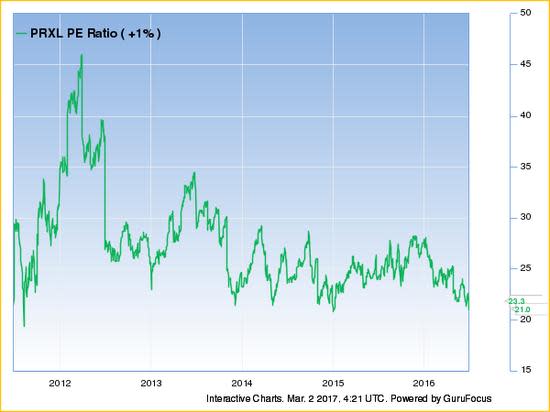

The current price (close of trading on March 2) is 10.36% below the 52-week high; price-earnings (P/E) is in the mid-20s; ROE is above 24%; no dividend; bought back more than 4% of outstanding shares last fiscal year.

Financial strength

Parexel receives a middling score for financial strength and a good score for profitability and growth in the GuruFocus system:

The red tabs in the Financial Strength column alert to a debt situation. This chart shows the growth of long-term debt over the past 10 years:

And this GuruFocus chart shows debt in the context of operating cash flow:

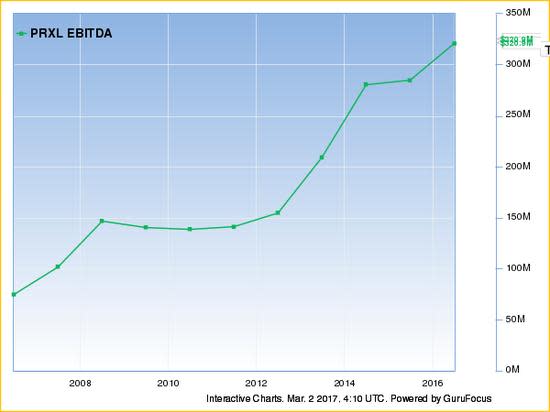

Revenue has grown along with the debt:

EBITDA (earnings before interest, taxes, depreciation and amortization) is up:

And, earnings per share (EPS) has also grown:

As noted in the revenue section above, operating margins have grown from mid-single-digits to high single-digits in the past decade.

Parexel is a growth-oriented company and long-term debt has helped it finance that expansion. Revenue and earnings have generally kept up with the growth in debt.

Valuations

Parexel receives a 4-Star (out of five) rating for predictability, or consistency of earnings growth. A quick check with the All-In-One screener shows that only 403 companies, among the thousands listed, have at least that level of financial strength. Four and 5-Star stocks have a greater probability of delivering capital gains and avoiding losses than lesser-ranked stocks.

Whether Parexel can maintain its rating is a highly relevant question at the moment. In reporting its second-quarter fiscal 2017 results on Feb. 1, management reduced its full-year guidance, from between $3.55 and $3.89 to between $2.30 and $2.58. That is a significant drop and explains the most recent gap-down.

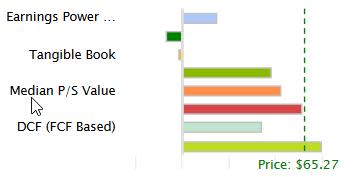

Only one of the valuation tools (earnings-based DCF) at GuruFocus finds the current price to be an undervaluation:

The stock has a 23.34 P/E ratio, which is near the bottom of the range established over the past five years:

Its PEG ratio is 1.07, which is at the bottom end of the fair value range (between 1.0 and 1.9 is considered fairly valued).

The analysts followed by Nasdaq.com have a 12-month consensus price target of $64.50, which is below the current (closing, March 1) price of $65.27; collectively, they have a neutral outlook:

This five-year chart shows the current price very close to the 200-day Simple Moving Average:

The P/E and PEG ratios, as well as the 200-day Simple Moving Average, suggest the current price is a fair valuation, but the other metrics suggest the company is overvalued.

Conclusion

To answer the question posed at the beginning of this article: Value investors with long time horizons should be able to profit from the gap-downs of Parexel, assuming there are more of them in the future.

It appears the ownership structure (an extremely high level of institutional ownership) makes the share price volatile. Specifically, it leads to gap-downs from time to time.

At the same time, Parexel is a robust and growing company, although it may lose its 4-Star Predictability rating if earnings for fiscal 2017 come in as forecasted in the company's guidance. But, as a long-term holding, the problems of 2017 become a speed bump rather than a defining obstacle.

Putting together the volatility and the underlying strength, Parexel might be an interesting choice for the right kind of value investor when, or if, the stock gaps down again.

Disclosure: I do not own shares in any of the companies listed here, nor do I expect to buy any in the next 72 hours.

Start a free 7-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Sign with Q. Click here to check it out.

The intrinsic value of Q