Parnassus Endeavor Fund Buys AbbVie, Boosts Biogen

- By Tiziano Frateschi

The Parnassus Endeavor Fund (Trades, Portfolio) bought shares of the following stocks during the first quarter.

Warning! GuruFocus has detected 4 Warning Signs with ABBV. Click here to check it out.

The intrinsic value of ABBV

The fund established a stake in AbbVie Inc. (ABBV), buying 1.7 million shares. The trade had an impact of 3.64% on the portfolio.

The biopharmaceutical company has a market cap of $114.25 billion and an enterprise value of $112.09 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on assets of 8.55% is outperforming 78% of companies in the Drug Manufacturers - Major industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 2.52 is above the industry median of 2.03.

The largest guru shareholder of the company is Pioneer Investments (Trades, Portfolio) with 0.22% of outstanding shares, followed by Parnassus with 0.11% and Ken Fisher (Trades, Portfolio) with 0.05%.

The fund boosted its position in Biogen Inc. (BIIB) by 80%, impacting the portfolio by 1.76%.

The biotech company has a market cap of $44.41 billion and an enterprise value of $46.43 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 34.85% and return on assets of 18.33% are outperforming 90% of companies in the Drug Manufacturers - Major industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 0.66 is below the industry median of 2.03.

The company's largest guru shareholder is PRIMECAP Management (Trades, Portfolio) with 7.48% of outstanding shares, followed by the Vanguard Health Care Fund (Trades, Portfolio) with 1.91% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.52%.

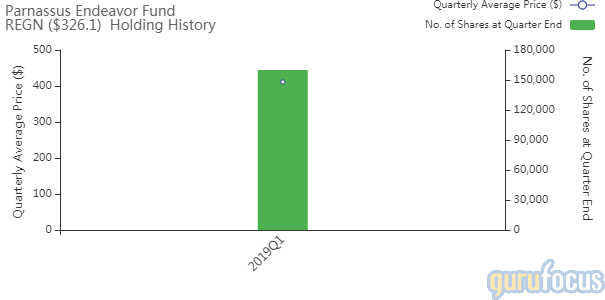

Parnassus bought 160,000 shares of Regeneron Pharmaceuticals Inc. (REGN), impacting the portfolio by 1.74%.

The company, which manufactures products that fight eye-related diseases, has a market cap of $35.35 billion and an enterprise value of $33.25 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 33.46% and return on assets of 24.14% are outperforming 94% of companies in the Biotechnology industry. Its financial strength is rated 8 out of 10. The cash-debt ratio of 3.97 is below the industry median of 64.02.

The company's largest guru shareholder is Frank Sands (Trades, Portfolio) with 1.90% of outstanding shares, followed by Vanguard with 1.88% and Bill Nygren (Trades, Portfolio) with 1.15%.

The Endeavor Fund boosted its Perrigo Co. PLC (PRGO) stake by 77.27%, impacting the portfolio by 1.09%.

The pharmaceutical company has a market cap of $6.65 billion and an enterprise value of $9.34 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 2.21% and return on assets of 1.16% are underperforming 56% of companies in the Drug Manufacturers - Specialty and Generic industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.17 is below the industry median of 2.03.

Another notable guru shareholder of the company is First Eagle Investment (Trades, Portfolio) with 0.52% of outstanding shares, followed by Pioneer Investments with 0.08% and Steven Cohen (Trades, Portfolio) with 0.07%.

The fund added 42.86% to its Apple Inc. (AAPL) holding, impacting the portfolio by 0.61%.

The consumer electronics manufacturer has a market cap of $933.37 billion and an enterprise value of $965.91 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 49.91% and the return on assets of 15.90% are outperforming 94% of companies in the Consumer Electronics industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.71 is below the industry median of 1.26.

The company's largest guru shareholder is Warren Buffett (Trades, Portfolio) with 5.29% of outstanding shares, followed by Fisher with 0.28%, Pioneer Investments with 0.21% and Spiros Segalas (Trades, Portfolio) with 0.10%.

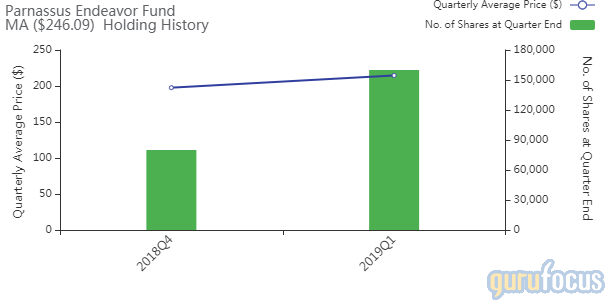

The fund boosted its Mastercard Inc. (MA) holding by 100%, impacting the portfolio by 0.50%.

The credit card company has a market cap of $250.31 billion and an enterprise value of $249.46 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 114.09% and return on assets of 26.59% are outperforming 95% of companies in the Credit Services industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 1.14 is below the industry median of 8.43.

The largest guru shareholder of the company is Tom Russo (Trades, Portfolio) with 0.79% of outstanding shares, followed by Segalas with 0.52%, Chuck Akre (Trades, Portfolio) with 0.52% and Buffett with 0.48%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Stocks With Low Price-Earnings Ratios

Yacktman Asset Management Buys Alphabet, Walt Disney

Largest Insider Trades of the Week

N ot a Premium Member of GuruFocus? Sign up for a free 7-day trial here .

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Signs with ABBV. Click here to check it out.

The intrinsic value of ABBV