Parnassus Endeavor Fund Invests in Insurance and Logistics in 4th Quarter

The Parnassus Endeavor Fund (Trades, Portfolio) released its fourth-quarter portfolio earlier this week, listing two new holdings.

The fund, which is part of Jerome Dodson (Trades, Portfolio)'s San Francisco-based Parnassus Investments, avoids investing in fossil fuel-related stocks. Rather, it concentrates on companies that have exemplary work environments and are socially and environmentally responsible. With the goal of capital appreciation, the portfolio managers invest in discounted large-cap companies that have strong competitive advantages, relevant products or services and quality management teams.

Based on these criteria, the fund established positions in Progressive Corp. (NYSE:PGR) and Expeditors International of Washington Inc. (NASDAQ:EXPD).

Progressive

The Endeavor Fund invested in 1.47 million shares of Progressive, dedicating 3.2% of the equity portfolio to the stake. The stock traded for an average price of $72.04 per share during the quarter.

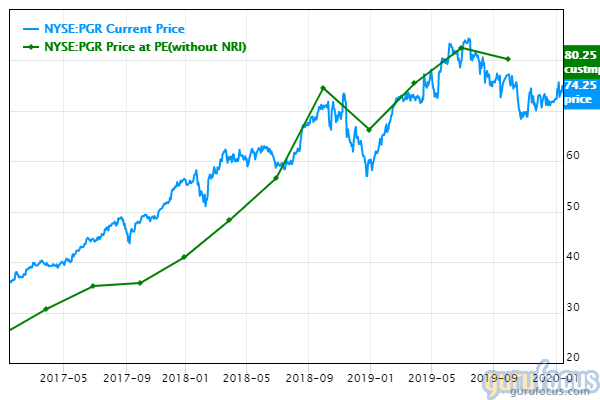

The Mayfield, Ohio-based insurance company has a $3.34 billion market cap; its shares were trading around $74.25 on Wednesday with a price-earnings ratio of 13.87, a price-book ratio of 3.18 and a price-sales ratio of 1.2.

The Peter Lynch chart shows the stock is trading below its fair value, suggesting it is undervalued.

GuruFocus rated Progressive's financial strength 3 out of 10. In addition to a low cash-debt ratio of 0.01, the company's assets are building at a faster rate than its revenue is growing, which may indicate it is becoming less efficient.

The company's profitability fared better, scoring a 7 out of 10 on the back of high margins and returns that outperform a majority of competitors and a business predictability rank of one out of five stars. According to GuruFocus, companies with this rank typically see their stocks gain an average of 1.1% per annum over a 10-year period.

Of the gurus invested in Progressive, Jim Simons (Trades, Portfolio)' Renaissance Technologies has the largest stake with 0.99% of outstanding shares. Other top guru shareholders include Pioneer Investments (Trades, Portfolio), PRIMECAP Management (Trades, Portfolio), John Rogers (Trades, Portfolio), Steven Cohen (Trades, Portfolio), Andreas Halvorsen (Trades, Portfolio), Tom Gayner (Trades, Portfolio), Ray Dalio (Trades, Portfolio) and Jeremy Grantham (Trades, Portfolio).

Expeditors International

The fund picked up 300,000 shares of Expeditors International, allocating 0.70% of the equity portfolio to the position. During the quarter, shares traded for an average price of $75.

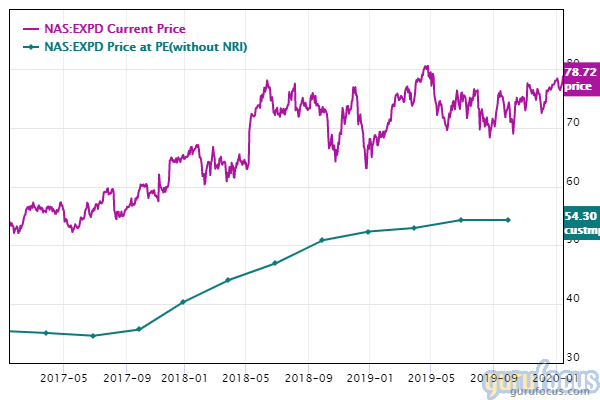

The logistics and freight forwarding company, which is headquartered in Seattle, has a market cap of $13.44 billion; its shares were trading around $78.72 on Wednesday with a price-earnings ratio of 21.81, a price-book ratio of 6.09 and a price-sales ratio of 1.65.

According to the Peter Lynch chart, the stock is overvalued.

Expeditors International's financial strength was rated 7 out of 10 by GuruFocus, driven by a high cash-debt ratio of 3.24 and comfortable interest coverage. The company also has a robust Altman Z-Score of 9.75, which suggests it is in good financial standing.

The company's profitability scored a 9 out of 10 rating on the back of operating margin expansion, strong returns that outperform a majority of industry peers and a moderate Piotroski F-Score of 5, which indicates business conditions are stable. Boosted by consistent earnings and revenue growth, Expeditors also has a four-star business predictability rank. GuruFocus says companies with this rank typically see their stocks gain an average of 9.8% per year.

With 0.87% of outstanding shares, Pioneer is the company's largest guru shareholder. Simons' firm, Joel Greenblatt (Trades, Portfolio), Ruane Cunniff (Trades, Portfolio), Ken Fisher (Trades, Portfolio) and Paul Tudor Jones (Trades, Portfolio) also own the stock.

Additional trades

During the quarter, Parnassus also added to a number of holdings, including Cisco Systems Inc. (NASDAQ:CSCO), Agilent Technologies Inc. (NYSE:A), W.W. Grainger Inc. (NYSE:GWW), Gilead Sciences Inc. (NASDAQ:GILD), Charles Schwab Corp. (NYSE:SCHW), Alphabet Inc. (NASDAQ:GOOGL), American Express Co. (NYSE:AXP) and Hanesbrands Inc. (NYSE:HBI).

Nearly half of the fund's $3.34 billion equity portfolio, which is composed of 29 stocks, is invested in the technology sector. The financial services space is second with a weight of 17.70% and health care makes up 16.13% of the portfolio.

According to its website, the Endeavor Fund posted a return of 33.29% in 2019, topping the S&P 500 Index's 31.49% return.

Disclosure: No positions.

Read more here:

Jana Partners Pares Stake in Conagra Brands

Wallace Weitz Slims Down Long-Held Stake in Intelligent Systems

Hennessy Japan Small Cap Fund Adds 5 Stocks to Portfolio

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.