Parnassus Fund Exits Cerner, Waste Connections

- By Tiziano Frateschi

Jerome Dodson (Trades, Portfolio)'s Parnassus Fund sold shares of the following stocks during the first quarter, which ended on March 31.

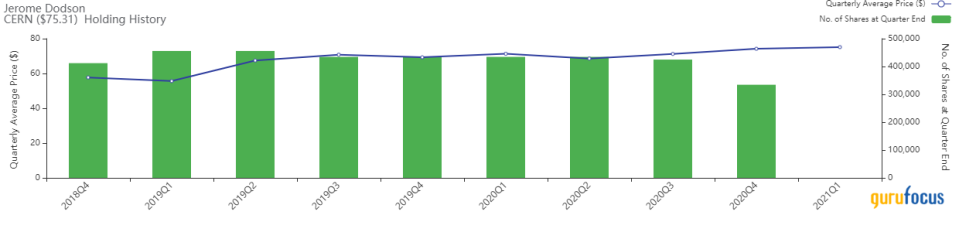

Cerner

The Cerner Corp. (NASDAQ:CERN) position was closed, impacting the portfolio by -2.48%.

The provider of health care IT solutions has a market cap of $29.77 billion and an enterprise value of $23.04 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 18.5% and return on assets of 11.02% are outperforming 85% of companies in the health care providers and services industry. Its financial strength is rated 6 out of 10 with a cash-debt ratio of 0.79.

The largest guru shareholder of the company is the Vanguard Health Care Fund (Trades, Portfolio) with 2.88% of outstanding shares, followed by Al Gore (Trades, Portfolio) with 0.99% and the Parnassus Endeavor Fund (Trades, Portfolio) with 0.26%.

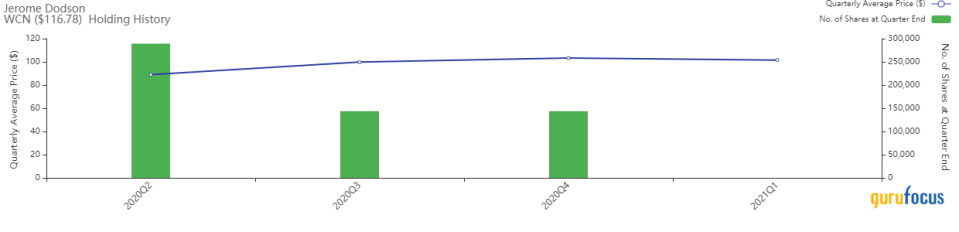

Waste Connections

The fund exited its position in Waste Connections Inc. (NYSE:WCN), impacting the portfolio by -1.39%.

The provider of solid waste and recycling services has a market cap of $30.66 billion and an enterprise value of $34.96 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 3.04% and return on assets of 1.47% are underperforming 59% of companies in the waste management industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.13 is below the industry median of 0.44.

The largest guru shareholders of the company include Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.49% of outstanding shares, Ron Baron (Trades, Portfolio) with 0.29% and Mario Gabelli (Trades, Portfolio)'s GAMCO Investors with 0.09%.

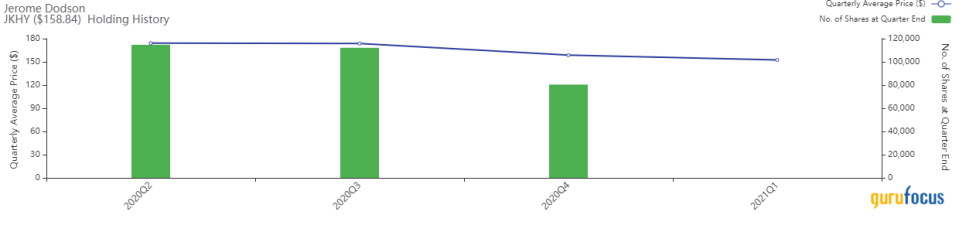

Jack Henry & Associates

The firm closed its position in Jack Henry & Associates Inc. (NASDAQ:JKHY). The trade had an impact of -1.23% on the portfolio.

The provider of payment processing services has a market cap of $12.08 billion and an enterprise value of $ 11.94 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 19.53% and return on assets of 13.01% are outperforming 83% of companies in the software industry. Its financial strength is rated 9 out of 10 with a cash-debt ratio of 555.

The largest guru shareholders of the company are Pioneer Investments (Trades, Portfolio) with 0.21% of outstanding shares, Simons' firm with 0.19% and Chuck Royce (Trades, Portfolio) with 0.13%.

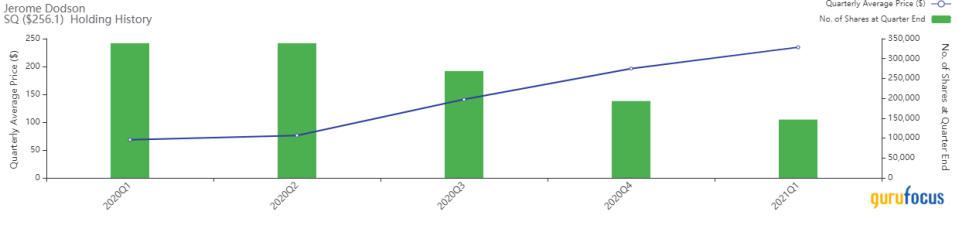

Square

The firm curbed its Square Inc. (NYSE:SQ) stake by 24.15%. The portfolio was impacted by -0.96%.

The provider of online payment services has a market cap of $116.43 billion and an enterprise value of $114.03 billion.

GuruFocus gives the company a profitability and growth rating of 3 out of 10. The return on equity of 10.45% and return on assets of 2.93% are outperforming 55% of companies in the software industry. Its financial strength is rated 5 out of 10 with a cash-debt ratio of 1.69.

The largest guru shareholder of the company is Frank Sands (Trades, Portfolio) with 3.67% of outstanding shares, followed by Catherine Wood (Trades, Portfolio) with 1.57% and Philippe Laffont (Trades, Portfolio) with 1.36%.

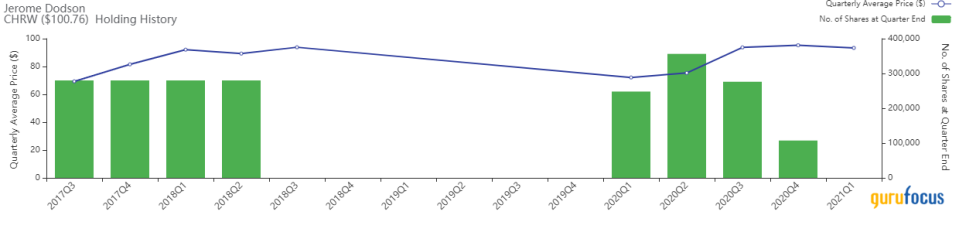

C.H. Robinson Worldwide

The firm closed its C.H. Robinson Worldwide Inc. (NASDAQ:CHRW) stake. The portfolio was impacted by -0.95%.

The logistic services provider has a market cap of $13.21 billion and an enterprise value of $14.40 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 29.05% and return on assets of 10.32% are outperforming 96% of companies in the transportation industry. Its financial strength is rated 6 out of 10 with a cash-debt ratio of 0.17.

The largest guru shareholder of the company is First Eagle Investment (Trades, Portfolio) with 7.77% of outstanding shares, followed by Mairs and Power (Trades, Portfolio) with 0.95% and Baillie Gifford (Trades, Portfolio) & Co. with 0.42%.

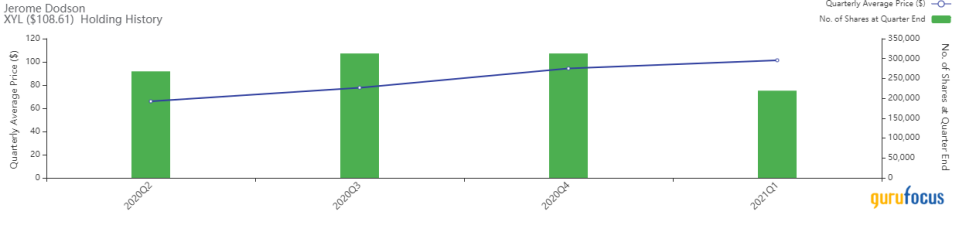

Xylem

The firm trimmed its Xylem Inc. (NYSE:XYL) stake by 29.91%. The portfolio was impacted by -0.90%.

The water technology company has a market cap of $19.55 billion and an enterprise value of $20.83 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 8.78% and return on assets of 3.1% are outperforming 57% of companies in the industrial products industry. Its financial strength is rated 5 out of 10 with a cash-debt ratio of 0.6.

The largest guru shareholder of the company is Pioneer Investments with 0.76% of outstanding shares, followed by Baillie Gifford with 0.63% and Gabelli's firm with 0.48%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Popular Retailers Gurus Are Buying

5 Financial Companies Growing Fast

5 Predictable Guru Stocks

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.