The past won't help outline a post-COVID future: Morning Brief

Tuesday, November 17, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

‘Traditional business cycle analysis doesn’t apply to the COVID shock.’

The light at the end of the COVID-19 tunnel grew brighter on Monday.

For the second time in as many weeks, Monday morning greeted investors with positive news on COVID vaccine development.

Early Monday, Moderna (MRNA) announced that its COVID-19 vaccine candidate had an efficacy rate of 94.5% in a Phase 3 trial of more than 30,000 volunteers, with just 11 severe COVID cases coming up among participants. All 11 severe cases were in the placebo group.

Additionally, the company announced that this vaccine candidate need not be kept in super cold storage, alleviating some logistical concerns that emerged in the wake of Pfizer’s (PFE) announcement last week that its own vaccine candidate had an efficacy of 90%.

Now, like all concerned citizens, investors want to see a vaccine widely distributed to end the pandemic that has so far claimed more than 240,000 lives in the U.S.

But the prospect of a vaccine also asks urgent questions about how what a post-COVID economy will look like. And it’s not clear that anything we’ve learned from economic history will help us discern what may or may not happen next.

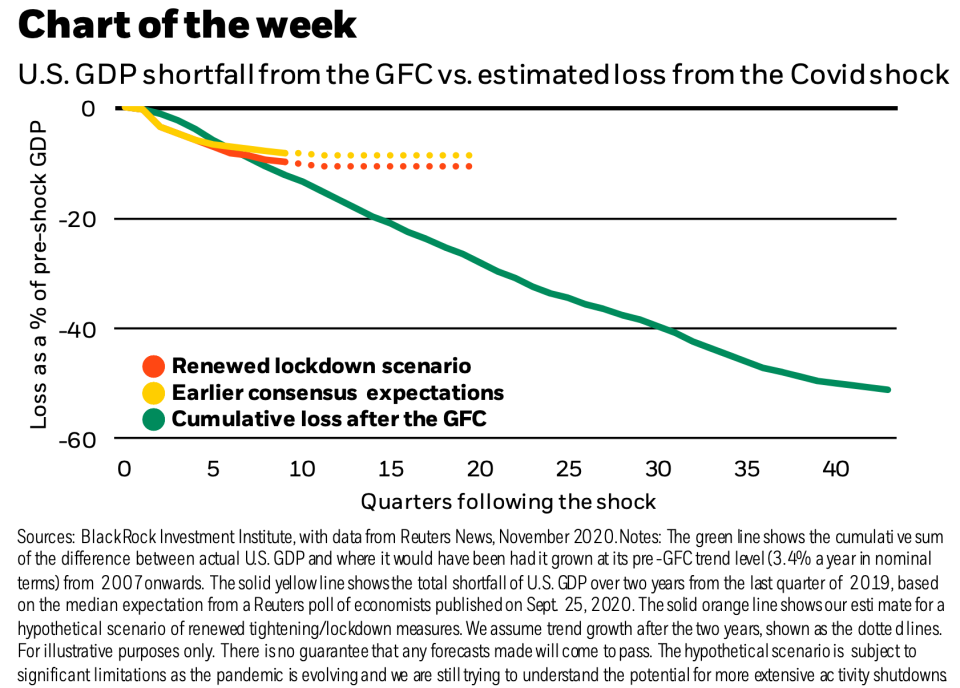

“Positive news on COVID vaccines gives us greater confidence that the economic restart can re-accelerate in 2021 — and that the cumulative activity loss from the virus shock will ultimately be a fraction of that seen after the global financial crisis,” said strategists at the BlackRock Investment Institute in a note published Monday.

“Traditional business cycle analysis doesn’t apply to the COVID shock, in our view,” the firm adds.

“We see the latter as more akin to the shock of a natural disaster: With the vaccine news, we have even greater visibility on how the cumulative activity loss will likely be limited — just a fraction of that seen after the GFC in our estimate — even as we expect a renewed surge in infections and resulting restrictions to disrupt the restart in the near term.”

The stock market’s huge rally since March shows how investors are looking past the health emergency, and more clarity vaccine development should help buoy nervous markets through what is expected to be a grim winter for infections, hospitalizations, and COVID-related deaths.

Writing Monday just hours before Moderna announced its vaccine news, Neil Shearing at Capital Economics said, “Much will depend on the procurement and distribution of vaccines but, if all goes well, it’s possible that major economies will return to pre-virus levels of output around six months earlier than we had previously thought.”

Which would certainly be welcome news.

Though as the team at BlackRock flags in their outlook, a stronger and faster than expected rebound in the U.S. economy risks a “retrenching” in U.S. fiscal policy at a time when tens of millions of workers are receiving some form of unemployment assistance each week.

Leaving the economy and investors to try and make sense of an unprecedented split between what the next three months and the next six months are likely to have in store.

“There is an increasing dichotomy between the near- and medium-term outlooks for the economy,” Deutsche Bank economist Brett Ryan said in a note published Friday.

“On the one hand, economic disruptions from renewed virus growth will inevitably dampen the pace of economic improvement in the current quarter and into the beginning of next year. Ongoing political uncertainty about the next phase of fiscal stimulus could exacerbate this situation.

“On the other hand, better-than-expected vaccine developments and the potential for earlier deployment could provide a much-needed boost to the global economy next year.”

By Myles Udland, reporter and anchor for Yahoo Finance Live. Follow him at @MylesUdland

What to watch today

Economy

8:30 a.m. ET: Retail sales advance month-over-month, October (0.5% expected, 1.9% in September)

8:30 a.m. ET: Retail sales excluding autos and gas month-over-month, October (0.6% expected, 1.5% in September)

8:30 a.m. ET: Import price index month-over-month, October (0.2% expected, 0.3% in September)

8:30 a.m. ET: Import price index year-over-year, October (-1.1% in September)

8:30 a.m. ET: Export price index month-over-month, October (0.3% expected, 0.6% in September)

8:30 a.m. ET: Export price index year-over-year, October (-1.8% in September)

9:15 a.m. ET: Industrial production month-over-month, October (1.0% expected, -0.6% in September)

9:15 a.m. ET: Capacity utilization, October (72.3% expected, 71.5% in September

10:00 a.m. ET: NAHB Housing Market Index, November (85 expected, 85 in October)

4:00 p.m. ET: Net long-term TIC flows, September ($27.8 billion in August)

4:00 p.m. ET: Total net TIC flows, September ($86.3 billion in August)

Earnings

Pre-market

6:00 a.m. ET: Home Depot (HD) is expected to report adjusted earnings of $3.05 per share on revenue of $31.81 billion

7:00 a.m. ET: Walmart (WMT) is expected to report adjusted earnings of $1.18 per share on revenue of $132.42 billion

7:00 a.m. ET: Kohl’s (KSS) is expected to report an adjusted loss of 44 cents per share on revenue of $3.87 billion

Post-market

4:15 p.m. ET: Nio (NIO) is expected to report an adjusted loss of 4.77 yuan per share on revenue of 15.25 billion yuan

Top News

Tesla is getting added to the S&P 500, shares surge on the news [Yahoo Finance]

European market momentum slows following a second COVID-19 vaccine rally [Yahoo Finance UK]

Airbnb files to go public, the latest hot name in an unlikely booming market for IPOs [Yahoo Finance]

Warren Buffett's Berkshire loads up on Pfizer, other pharma stocks in Q3; exits Costco [Yahoo Finance]

Warren Buffett dumps all his Costco stock — 3 reasons why that is a big surprise [Yahoo Finance]

Section 230 controversy: Lawmakers to question Facebook, Twitter chiefs over content moderation [Yahoo Finance]

YAHOO FINANCE HIGHLIGHTS

Possible Biden picks for Treasury Secretary: a who's who

'Betsy DeVos made a mess' of the U.S. student loan system, teachers' union boss says

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay