Patterson Companies, Inc. (PDCO) Hedge Funds Are Snapping Up

A market correction in the fourth quarter, spurred by a number of global macroeconomic concerns and rising interest rates ended up having a negative impact on the markets and many hedge funds as a result. The stocks of smaller companies were especially hard hit during this time as investors fled to investments seen as being safer. This is evident in the fact that the Russell 2000 ETF underperformed the S&P 500 ETF by 4 percentage points during the first half of the fourth quarter. We also received indications that hedge funds were trimming their positions amid the market volatility and uncertainty, and given their greater inclination towards smaller cap stocks than other investors, it follows that a stronger sell-off occurred in those stocks. Let's study the hedge fund sentiment to see how those concerns affected their ownership of Patterson Companies, Inc. (NASDAQ:PDCO) during the quarter.

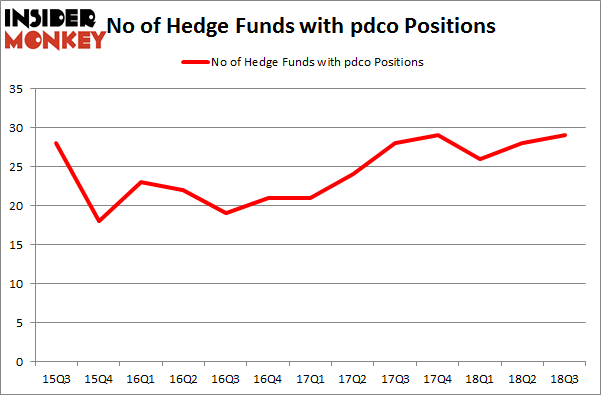

Is Patterson Companies, Inc. (NASDAQ:PDCO) a first-rate investment today? Prominent investors are in a bullish mood. The number of bullish hedge fund positions advanced by 1 in recent months. Our calculations also showed that pdco isn't among the 30 most popular stocks among hedge funds. PDCO was in 29 hedge funds' portfolios at the end of the third quarter of 2018. There were 28 hedge funds in our database with PDCO positions at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey's flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That's why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let's take a look at the new hedge fund action surrounding Patterson Companies, Inc. (NASDAQ:PDCO).

Hedge fund activity in Patterson Companies, Inc. (NASDAQ:PDCO)

Heading into the fourth quarter of 2018, a total of 29 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 4% from the second quarter of 2018. On the other hand, there were a total of 29 hedge funds with a bullish position in PDCO at the beginning of this year. So, let's see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, GAMCO Investors held the most valuable stake in Patterson Companies, Inc. (NASDAQ:PDCO), which was worth $50.9 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $39.2 million worth of shares. Moreover, Two Sigma Advisors, Millennium Management, and GLG Partners were also bullish on Patterson Companies, Inc. (NASDAQ:PDCO), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, key hedge funds were breaking ground themselves. Alyeska Investment Group, managed by Anand Parekh, initiated the biggest position in Patterson Companies, Inc. (NASDAQ:PDCO). Alyeska Investment Group had $15.4 million invested in the company at the end of the quarter. Andrew Feldstein and Stephen Siderow's Blue Mountain Capital also initiated a $8.7 million position during the quarter. The other funds with brand new PDCO positions are Joel Greenblatt's Gotham Asset Management, Amy Mulderry's Tavio Capital, and John W. Rende's Copernicus Capital Management.

Let's now take a look at hedge fund activity in other stocks similar to Patterson Companies, Inc. (NASDAQ:PDCO). These stocks are Scientific Games Corp (NASDAQ:SGMS), Harsco Corporation (NYSE:HSC), Meredith Corporation (NYSE:MDP), and BEST Inc. (NYSE:BSTI). This group of stocks' market caps are similar to PDCO's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position SGMS,25,714551,-5 HSC,22,134198,0 MDP,17,311204,5 BSTI,12,53685,2 Average,19,303410,0.5 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $303 million. That figure was $285 million in PDCO's case. Scientific Games Corp (NASDAQ:SGMS) is the most popular stock in this table. On the other hand BEST Inc. (NYSE:BSTI) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Patterson Companies, Inc. (NASDAQ:PDCO) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index