Patterson Companies (PDCO) Q3 Earnings Top Estimates, Up Y/Y

Patterson Companies, Inc. PDCO reported adjusted earnings per share (EPS) of 58 cents in third-quarter fiscal 2021, which beat the Zacks Consensus Estimate of 51 cents by 13.7%. Moreover, the bottom line improved 23.4% from the prior-year quarter. The upside can be attributed to sustained expense discipline during quarter under review, better operating margins across both business segments and solid sales execution.

Revenue Details

Net sales in the quarter were $1.55 billion, outpacing the Zacks Consensus Estimate by 4.1%. Also, the top line increased 6.5% year over year.

Segmental Analysis

The company currently distributes products through subsidiaries — Patterson Dental and Patterson Animal Health.

Dental Segment

This segment provides a complete range of consumable dental products, equipment, software, turnkey digital solutions and value-added services to dentists, and laboratories throughout North America.

In the fiscal third quarter, dental sales grew 3.6% year over year to $648.9 million.

Dental Consumable

Sales in the sub-segment totaled $342.6 million, up 13.6% year over year.

Dental Equipment & Software

Sales in the segment fell 6.2% on a year-over-year basis to $237.1 million.

Other

This segment comprises technical service, parts and labor, software support services and office supplies. Sales at the segment declined 3.9% on a year-over-year basis to $69.3 million.

Animal Health Segment

This segment is a leading distributor of veterinary supplies to clinics, public and private institutions and shelters across the United States.

In the fiscal third quarter, the segment sales rose 9.4% on a year-over-year basis to $894.3 million.

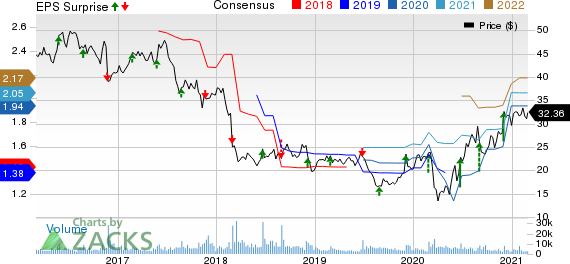

Patterson Companies, Inc. Price, Consensus and EPS Surprise

Patterson Companies, Inc. price-consensus-eps-surprise-chart | Patterson Companies, Inc. Quote

Corporate

Sales at the segment were $7.9 million, which plunged 35.1% from $12.3 million in the year-ago quarter.

Margin Analysis

Gross profit in the reported quarter was $324.5 million, up 4.1% year over year. As a percentage of revenues, gross margin of 20.9% contracted 50 basis points (bps) on a year-over-year basis.

Operating expenses in the reported quarter totaled $262.9 million, declining 1.9% from the prior-year quarter.

The company reported operating income of $61.7 million, up 40.8% from the year-ago quarter. As a percentage of revenues, operating margin of 3.9% expanded 90 bps on a year-over-year basis.

Financial Position

The company exited the fiscal third quarter with cash and cash equivalents of $155.9 million, up from $139.5 million on a sequential basis.

Cumulative net cash used in operating activities in the fiscal third quarter were $604.9 million, significantly wider than the year-ago quarter’s net cash utilized in operating activities of $168.9 million.

Guidance

Patterson Companies refrained from issuing fourth-quarter fiscal 2021 financial guidance at this time citing the persistent uncertainty with respect to the COVID-19 pandemic and its impact on business operations.

Our Take

Patterson Companies ended third-quarter fiscal 2021 on a strong note, wherein both earnings and revenues beat the consensus mark. Moreover, the company witnessed improved performance across its segments in the quarter under review. Prudent cost savings approach and solid sales execution worked in favor of the stock.

Also, a broad spectrum of products cushions the company against economic downturns in the MedTech space. We believe that a diverse product portfolio, strong veterinary business prospects, accretive acquisitions and strategic partnerships are key catalysts.

However, contraction in gross margin remains a headwind.

Zacks Rank

Patterson Companies has a Zacks Rank #4 (Sell).

Earnings of Other MedTech Majors at a Glance

Some better-ranked stocks in the broader medical space that have already announced their quarterly results are HillRom Holdings, Inc. HRC, Abbott Laboratories ABT and AngioDynamics, Inc. ANGO, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hill-Rom reported first-quarter fiscal 2021 adjusted EPS of $1.53, beating the Zacks Consensus Estimate by 45.7%. Revenues of $741.1 million surpassed the consensus mark by 13.2%.

Abbott reported fourth-quarter 2020 adjusted EPS of $1.45, which beat the Zacks Consensus Estimate by 6.6%. Fourth-quarter worldwide sales of $10.7 billion outpaced the consensus mark by 7.9%.

AngioDynamics reported second-quarter fiscal 2021 adjusted EPS of a penny against the Zacks Consensus Estimate of a loss per share of 2 cents. Revenues of $72.8 million beat the consensus mark by 8%.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AngioDynamics, Inc. (ANGO) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

Abbott Laboratories (ABT) : Free Stock Analysis Report

HillRom Holdings, Inc. (HRC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research