PayPal (PYPL) to Report Q4 Earnings: What's in the Cards?

PayPal Holdings, Inc. PYPL is scheduled to report fourth-quarter 2020 results on Feb 3.

For the fourthquarter, the company expects revenue results to reflect a year-over-year improvement of 20-25% at both the current spot rate and FX-neutral basis.The Zacks Consensus Estimate for revenues is pegged at $6.1 billion, indicating an improvement of 22.3% from the prior-year quarter’s reported figure.

The company anticipates non-GAAP earnings growth of 17-18% for the quarter under review. The Zacks Consensus Estimate for earnings stands at $1.00 per share, suggesting growth of 16.3% from the year-ago reported figure.

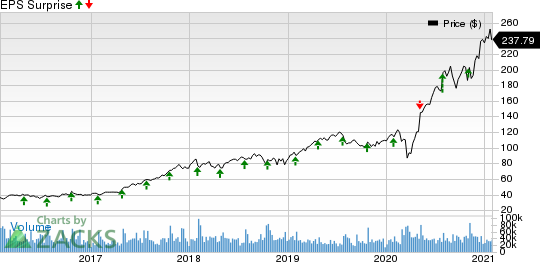

Notably, the company surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed the same once. It has a trailing four-quarter earnings surprise of 8.21%, on average.

PayPal Holdings, Inc. Price and EPS Surprise

PayPal Holdings, Inc. price-eps-surprise | PayPal Holdings, Inc. Quote

Key Factors to Note

Impacts of PayPal’s robust product portfolio, including One Touch and Venmo, are anticipated to get reflected in fourth-quarter results.

Further, strengthening user engagements on the company’s platform, owing to shifting customer preference toward contactless payments amid the coronavirus pandemic, is expected to have accelerated its payments volume in the to-be-reported quarter.

Moreover, it is likely to have accelerated growth of the company’s net new active accounts in the fourth quarter.

Additionally, solid momentum in P2P, courtesy of its innovative and advanced products and services, is anticipated to have driven the above-mentioned metrics.

Furthermore, increasing e-commerce spending during this pandemic is anticipated to have bolstered the company’s number of payment transactions and payment volume in the fourthquarter.

Also, PayPal is likely to have benefited from improving risk-management capabilities in the to-be-reported quarter.

Key Metrics to Consider

Total payment volume (TPV), active customer accounts, payment transactions per active account and total number of payment transactions are considered to be the key metrics for analyzing PayPal’s business growth.

For fourth-quarter 2020, the Zacks Consensus Estimate for active customer accounts is pegged at 373 million, suggesting a 22.3% rise from the year-ago quarter’s reported figure.

The consensus mark for payment transactions per active user is pegged at 41.3 million, suggesting growth of 1.6% from the year-ago quarter’s reported number.

Further, the consensus estimate for total number of payment transactions stands at 4.5 billion, indicating an improvement of 29.5% from the prior-year quarter.

Furthermore, the Zacks Consensus Estimate for TPV is pegged at $267.3 billion, suggesting growth of 34% on a year-over-year basis.

What Our Model Says

Our proven model conclusively predicts an earnings beat for PayPal this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

PayPal has an Earnings ESP of +1.93% and a Zacks Rank #3.

Other Stocks to Consider

Here are some other stocks you may consider, as our proven model shows that thesetoo have the right combination of elements to post abeat this earnings season.

Microchip Technology Incorporated MCHP has an Earnings ESP of +1.14% and it currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Synaptics Incorporated SYNA has an Earnings ESP of +0.77% and a Zacks Rank of 2 at present.

Carrier Global Corporation CARR currently has an Earnings ESP of +10.96% and a Zacks Rank #3.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microchip Technology Incorporated (MCHP) : Free Stock Analysis Report

Synaptics Incorporated (SYNA) : Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

Carrier Global Corporation (CARR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research