Penn National (PENN) Q2 Earnings Beat, Revenues Lag Estimates

Penn National Gaming, Inc. PENN reported mixed results for the second quarter of 2018, wherein earnings surpassed analysts’ expectations while revenues lagged the same.

Adjusted earnings of 57 cents per share surpassed the Zacks Consensus Estimate of 49 cents by 16.3%. Earnings also increased by the same percentage from the year-ago quarter on higher net income and adjusted EBITDA.

Net revenues of $826.9 million lagged the consensus mark of $837.1 million by 1.2% and also declined 1.5% from the year-ago quarter.

The company’s margin improvement initiatives hugely paid off in the second quarter, owing to which, the company continued to remain on a strong growth trajectory.

Shares of Penn National have rallied 61.4% in the past year, outperforming the industry’s collective growth of 11.6%.

Let us delve deeper into the numbers.

Inside the Headlines

Penn National’s income from operations in the reported quarter totaled $163.4 million, up 13.7% from the prior-year quarter. Adjusted EBITDA increased 8.7% from the year-ago quarter to $247.1 million. Adjusted EBITDA margins increased 133 basis points to 29.9%, with 18 of the 23 gaming operations posting improved margins.

Traditional net debt ratio declined to 1.94 from 2.25, while gross and net leverage — including master lease obligations — decreased to 5.21x and 4.99x, respectively, from 5.45x and 5.20x as of Mar 31, 2017.

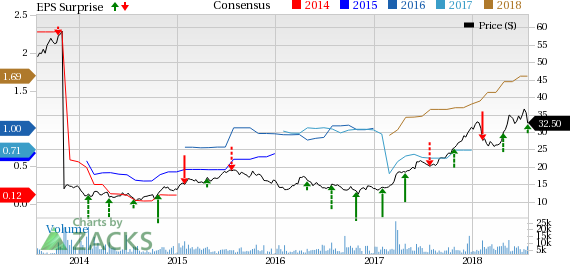

Penn National Gaming, Inc. Price, Consensus and EPS Surprise

Penn National Gaming, Inc. Price, Consensus and EPS Surprise | Penn National Gaming, Inc. Quote

Third-Quarter and Full-Year Guidance

For the third quarter, net revenues are expected to be $807.1 million, up 0.1% from the year-ago quarter. Full-year revenues are expected to be $3.21 billion, down from the previously anticipated $3.23 billion. Revenues are projected to rise 2.3% year over year.

EPS for the third quarter is predicted to be 44 cents, down from $8.43 recorded in the third quarter of 2017. Meanwhile, earnings for 2018 are anticipated to be $1.75, up from the previous guidance of $1.62 per share. However, earnings are projected to fall 65.5% year over year.

Penn National carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Peer Releases

Las Vegas Sands LVS reported lower-than-expected second-quarter 2018 earnings, after beating estimates in the trailing five quarters. However, revenues surpassed the Zacks Consensus Estimate for the sixth straight quarter. However, adjusted earnings of 74 cents per share increased 1.4% year over year on higher revenues.

Melco's MLCO second-quarter earnings of 19.8 cents lagged the consensus estimate but increased 23.8% year over year.

Upcoming Peer Release

Wynn Resorts WYNN is expected to release its quarterly numbers on Aug 1. The consensus estimate for earnings in the second quarter is pegged at $2.03, suggesting 72% year-over-year growth.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Las Vegas Sands Corp. (LVS) : Free Stock Analysis Report

Wynn Resorts, Limited (WYNN) : Free Stock Analysis Report

Penn National Gaming, Inc. (PENN) : Free Stock Analysis Report

Melco Resorts & Entertainment Limited (MLCO) : Free Stock Analysis Report

To read this article on Zacks.com click here.