People's United (PBCT) Q3 Earnings Disappoint, Revenues Up

People's United Financial Inc. PBCT delivered a negative earnings surprise of 2.9% in third-quarter 2018. Net earnings of 33 cents per share lagged the Zacks Consensus Estimate by a penny. However, the reported figure improved 26.9% year over year.

Elevated expenses and provisions remained major drags. However, rising rates and higher fee income supported its results. Improvement in deposit balances reflected organic growth, with its capital position remaining strong.

Net income available to common shareholders came in at $113.5 million compared with $87.3 million reported in the prior-year quarter.

Revenue Growth Offsets Higher Expenses

Net revenues, on a fully-taxable basis, were up 5.2% year over year to $405.3 million in the quarter. Moreover, the figure surpassed the Zacks Consensus Estimate of $404.7 million.

Net interest income, on a fully-taxable basis, totaled $313 million, up 5.8% year over year. Further, net interest margin expanded 11 basis points (bps) year over year to 3.15%.

Non-interest income climbed 3.4% year over year to $92.3 million. The rise in almost all components of income drove the results. These were partially offset by lower bank service charges.

Non-interest expenses flared up 2.9% on a year-over-year basis to $240.8 million. Rise in all components, except professional and outside services expenses as well as amortization of other acquisition-related intangible assets, led to higher expenses.

Efficiency ratio was 56.7% compared with 57.3% recorded in the prior-year period. A decrease in the ratio indicates improved profitability.

As of Sep 30, 2018, total loans were $32.2 billion, slightly down from the prior-year quarter. Furthermore, total deposits increased approximately 2.2% to $33.2 billion from the year-ago quarter.

Credit Quality: A Mixed Bag

As of Sep 30, 2018, non-performing assets were $173.2 million, down 9.4% year over year. Ratio of non-performing loans to total originated loans contracted 6 bps from the year-earlier quarter to 0.53%.

However, net loan charge-offs climbed 34.6% year over year to $7 million. Net loan charge-offs as a percentage of average total loans were 0.09% on an annualized basis, up 3 bps year over year. Provision for loan losses came in at $8.2 million, up 17.1% year over year.

Capital Position and Profitability Ratios Improve

Capital ratios of People’s United remained strong. As of Sep 30, 2018, total risk-based capital ratio increased to 12.8% from 12% recorded in the comparable quarter last year. Tangible equity ratio was 7.6%, up from 7.1% in the year-ago quarter.

The company’s profitability ratios improved. Return on average tangible stockholders’ equity was 14.5%, up from 11.8% in the prior-year quarter. Return on average assets of 1.06% inched up from 0.84% reported in the year-earlier quarter.

Our Viewpoint

People’s United’s organic growth continued given a steady rise in revenues, mainly aided by high deposit balances. Though escalating non-interest expenses are expected to restrict bottom-line expansion in the upcoming quarters, the company is steadily growing via acquisitions, which are likely to continue in the near future as well, given its strong balance-sheet position.

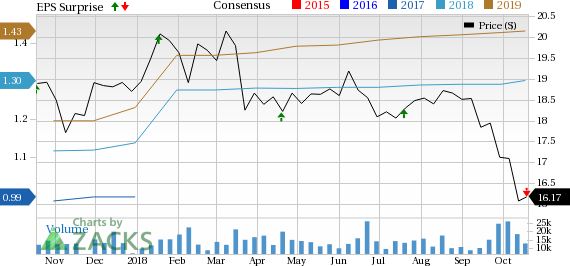

People's United Financial, Inc. Price, Consensus and EPS Surprise

People's United Financial, Inc. Price, Consensus and EPS Surprise | People's United Financial, Inc. Quote

Currently, People’s United carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other banks

Driven by stellar revenues, PNC Financial PNC delivered a positive earnings surprise of 3.3% in third-quarter 2018. Earnings per share of $2.82 beat the Zacks Consensus Estimate of $2.73. Moreover, the bottom line reflected a 30.6% jump from the prior-year figure. Continued easing of pressure on net interest margin led to higher net interest income during the reported quarter. Though mortgage banking revenues declined, overall non-interest income witnessed year-over-year growth. Lower provisions remained another tailwind. However, escalated costs hurt results to some extent.

Riding on higher revenues and lower provisions, U.S. Bancorp’s USB third-quarter 2018 earnings per share of $1.06 outpaced the Zacks Consensus Estimate of $1.04. Also, the results came ahead of the prior-year earnings of 88 cents. Higher revenues along with loan growth and lower provisions were recorded in the quarter. Though lower mortgage banking revenues and escalating expenses were disappointing, easing margin pressure on rising rates and overall higher fee income acted as tailwinds.

Northern Trust Corporation’s NTRS third-quarter 2018 earnings per share of $1.58 missed the Zacks Consensus Estimate of $1.60, owing to high costs. Earnings compared favorably with $1.20 recorded in the year-ago quarter. Escalating operating expenses acted as a headwind in the reported quarter. However, higher revenues and strong capital position were positives. Additionally, the third quarter registered a rise in assets under custody, as well as assets under management. Moreover, credit metrics mostly marked a significant improvement.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

U.S. Bancorp (USB) : Free Stock Analysis Report

Northern Trust Corporation (NTRS) : Free Stock Analysis Report

People's United Financial, Inc. (PBCT) : Free Stock Analysis Report

To read this article on Zacks.com click here.