People's United (PBCT) Q2 Earnings Beat on Reserve Release

People's United Financial Inc. PBCT has reported second-quarter 2021 operating earnings of 41 cents per share, which surpassed the Zacks Consensus Estimate of 32 cents. The bottom line is above the year-ago quarter’s figure of 24 cents.

Results reflect improved fee revenues and controlled expenses. A recovery in provision for credit losses and a strong capital position also supported the company. However, lower revenues and reduced loans were headwinds.

Net income available to common shareholders was $167.3 million compared with $86.4 million reported in the prior-year quarter.

Revenues & Deposits Fall, Expenses Rise

Revenues were down 3.1% year over year to $479.9 million in the second quarter. The top line missed the Zacks Consensus Estimate of $483.3 million.

Net interest income, on a fully taxable basis, totaled $388.7 million, down 5.9% year over year. Also, the net interest margin declined to 2.70% from the prior-year quarter’s 3.05%.

Non-interest income grew 10.5% year over year to $99 million. A rise in bank service charges, commercial banking lending fees, investment management fees and cash management fees were offset by a decline in operating lease income, net customer interest rate swap income and other non-interest income.

Non-interest expenses rose marginally on a year-over-year basis to $305 million. A rise in compensation and benefits, occupancy and equipment, and professional and outside service expenses led to the decline.

The company’s efficiency ratio was 57.4% compared with the prior-year quarter’s 53.5%. An increase in the ratio indicates lower profitability.

As of Mar 31, 2021, total loans were $41.7 billion, down 3.2% from the prior quarter. Also, total deposits declined 1.7% sequentially to $52.6 billion.

Credit Quality: A Mixed Bag

As of Mar 31, 2021, non-performing assets were $338.7 million, up 7.7% year over year. Ratio of non-performing loans to total loans expanded 14 bps from the year-earlier quarter to 0.79%.

Net loan charge-offs climbed 21.2% year over year to $10.3 million. Net loan charge-offs, as a percentage of average total loans, were 0.10% on an annualized basis, expanding 2 bps.

Negative provision for loan losses was $40.7 million against provision expenses of $80.8 million in the year-ago quarter.

Capital Position and Profitability Ratios

As of Mar 31, 2021, total risk-based capital ratio increased to 13.5% from 12.3% recorded in the year-earlier period. Tangible equity ratio of 7.7% was up from 7.3% in the year-ago period.

Return on average tangible stockholders’ equity was 14.7%, up from the prior-year quarter’s 8.1%. As of Jun 30, 2021, return on average assets was 1.07% compared with the year-ago quarter’s 0.58%.

Dividend Update

People’s United’s board of directors announced a quarterly common stock dividend of 18.25 cents per share. The dividend will be paid out on Aug 15 to common shareholders of record as of Aug 1, 2021.

Our Viewpoint

Though a fall in revenues and a decline in loan balance might restrict bottom-line expansion in the upcoming quarters, People’s United’s steady growth through acquisitions is encouraging. This is likely to continue in the near future as well, supported by the company’s robust balance sheet position and controlled expenses.

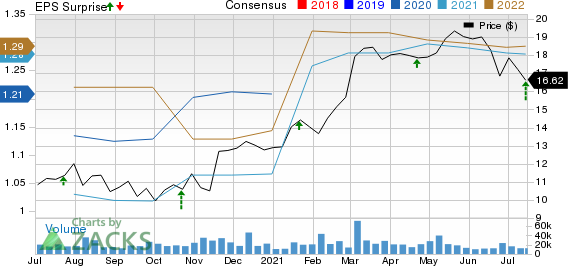

Peoples United Financial, Inc. Price, Consensus and EPS Surprise

Peoples United Financial, Inc. price-consensus-eps-surprise-chart | Peoples United Financial, Inc. Quote

Currently, People’s United carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We now look forward to the earnings releases of KeyCorp KEY, BankUnited, Inc. BKU and BancorpSouth Bank BXS on Jul 20, Jul 22 and Jul 21, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

KeyCorp (KEY) : Free Stock Analysis Report

Peoples United Financial, Inc. (PBCT) : Free Stock Analysis Report

BankUnited, Inc. (BKU) : Free Stock Analysis Report

BancorpSouth Bank (BXS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research