Is Percy Street Capital Corporation (TSXV:PSCP) Still A Cheap Financial Stock?

Percy Street Capital Corporation (TSXV:PSC.P), a CAD$400.00K small-cap, is a capital market firm operating in an industry, which now face the choice of either being disintermediated or proactively disrupting their own business models to thrive in the future. Financial services analysts are forecasting for the entire industry, negative growth in the upcoming year, and Today, I’ll take you through the sector growth expectations, as well as evaluate whether PSC.P is lagging or leading in the industry. Check out our latest analysis for Percy Street Capital

What’s the catalyst for PSC.P's sector growth?

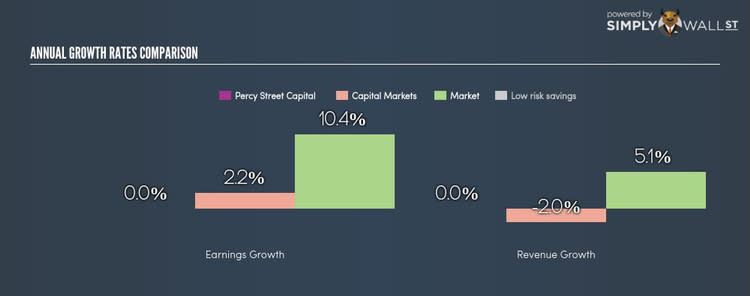

The threat of disintermediation in the capital markets industry is both real and imminent, taking profits away from traditional incumbent financial institutions. In the past year, the industry delivered negative growth of -3.30%, underperforming the Canadian market growth of -19.21%. Given the lack of analyst consensus in PSC.P’s outlook, we could potentially assume the stock’s growth rate broadly follows its capital markets industry peers. This means it is an attractive growth stock relative to the wider Canadian stock market.

Is PSC.P and the sector relatively cheap?

The capital markets industry is trading at a PE ratio of 16x, relatively similar to the rest of the Canadian stock market PE of 17x. This illustrates a fairly valued sector relative to the rest of the market, indicating low mispricing opportunities. Furthermore, the industry returned a similar 7.78% on equities compared to the market’s 9.49%. Since PSC.P’s earnings doesn’t seem to reflect its true value, its PE ratio isn’t very useful. A loose alternative to gauge PSC.P’s value is to assume the stock should be relatively in-line with its industry.

What this means for you:

Are you a shareholder? Capital markets stocks are currently expected to grow slower than the average stock on the index. This means if you’re overweight in this sector, your portfolio will be tilted towards lower-growth. If growth was one of your main investment catalyst in the sector, now would be the time to revisit your holdings in PSC.P. Keep in mind the sector is trading relatively in-line with the rest of the market, which may mean you’ll be selling out at a reasonable price.

Are you a potential investor? The financial sector’s below-market growth and average valuation hardly makes it an exciting investment case. If you’re looking for a high-growth stock with potential mispricing, it seems like capital markets companies like PSC.P isn’t the right place to look. However, if you’re interested in the stock for other reasons, I suggest you research more into the company’s cash flow as well as its financial health in order to gain a holistic view of the stock.

For a deeper dive into Percy Street Capital's stock, take a look at the company's latest free analysis report to find out more on its financial health and other fundamentals. Interested in other financial stocks instead? Use our free playform to see my list of over 600 other financial companies trading on the market.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.