Is Perrigo Company plc (PRGO) A Good Stock To Buy?

The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their December 31 holdings, data that is available nowhere else. Should you consider Perrigo Company plc (NYSE:PRGO) for your portfolio? We'll look to this invaluable collective wisdom for the answer.

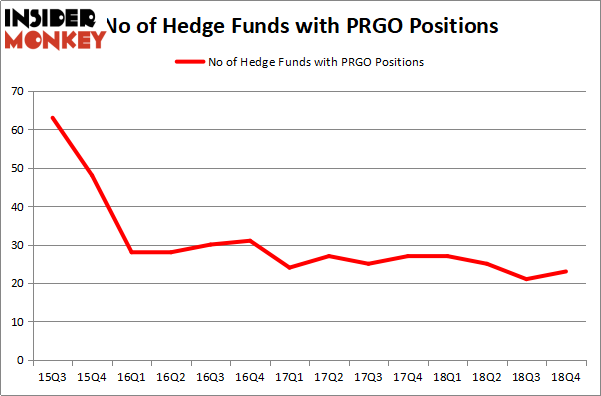

Perrigo Company plc (NYSE:PRGO) investors should be aware of an increase in support from the world's most elite money managers of late. Our calculations also showed that PRGO isn't among the 30 most popular stocks among hedge funds.

If you'd ask most investors, hedge funds are seen as unimportant, outdated financial tools of yesteryear. While there are greater than 8000 funds in operation at present, Our experts look at the crème de la crème of this group, about 750 funds. These money managers shepherd most of the smart money's total capital, and by keeping track of their first-class picks, Insider Monkey has unearthed numerous investment strategies that have historically surpassed the S&P 500 index. Insider Monkey's flagship hedge fund strategy defeated the S&P 500 index by nearly 5 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let's take a peek at the fresh hedge fund action surrounding Perrigo Company plc (NYSE:PRGO).

What does the smart money think about Perrigo Company plc (NYSE:PRGO)?

At the end of the fourth quarter, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 10% from the previous quarter. On the other hand, there were a total of 27 hedge funds with a bullish position in PRGO a year ago. So, let's review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Starboard Value LP, managed by Jeffrey Smith, holds the most valuable position in Perrigo Company plc (NYSE:PRGO). Starboard Value LP has a $389.1 million position in the stock, comprising 12% of its 13F portfolio. Coming in second is Stephen DuBois of Camber Capital Management, with a $85.3 million position; the fund has 4% of its 13F portfolio invested in the stock. Other professional money managers that hold long positions comprise D. E. Shaw's D E Shaw, Ken Griffin's Citadel Investment Group and Peter Muller's PDT Partners.

With a general bullishness amongst the heavyweights, key hedge funds were leading the bulls' herd. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, initiated the most valuable position in Perrigo Company plc (NYSE:PRGO). Marshall Wace LLP had $7 million invested in the company at the end of the quarter. Steve Cohen's Point72 Asset Management also initiated a $3.7 million position during the quarter. The other funds with new positions in the stock are David Harding's Winton Capital Management, John Overdeck and David Siegel's Two Sigma Advisors, and Matthew Hulsizer's PEAK6 Capital Management.

Let's now review hedge fund activity in other stocks similar to Perrigo Company plc (NYSE:PRGO). These stocks are Healthcare Trust Of America Inc (NYSE:HTA), Park Hotels & Resorts Inc. (NYSE:PK), Helmerich & Payne, Inc. (NYSE:HP), and H&R Block, Inc. (NYSE:HRB). This group of stocks' market values match PRGO's market value.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position HTA,17,394094,1 PK,17,482603,2 HP,27,428815,-6 HRB,18,251709,0 Average,19.75,389305,-0.75 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.75 hedge funds with bullish positions and the average amount invested in these stocks was $389 million. That figure was $556 million in PRGO's case. Helmerich & Payne, Inc. (NYSE:HP) is the most popular stock in this table. On the other hand Healthcare Trust Of America Inc (NYSE:HTA) is the least popular one with only 17 bullish hedge fund positions. Perrigo Company plc (NYSE:PRGO) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on PRGO as the stock returned 26.9% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index