Social media is spoiling Millennial and Gen Z finances, Charles Schwab survey finds

Social media encourages bad financial habits among millennials and Gen Zers, according to a new study by Charles Schwab.

In its latest Modern Wealth Survey — which polled 1,000 respondents between the ages of 18 and 75 — the bank highlighted how the Millennial and Gen Z generations “are spending more than they can really afford because they wanna keep up with their friends,” Charles Schwab Vice President and Senior Financial Consultant Abel Oonnoonny told Yahoo Finance’s The Final Round (video above).

Pew Research defines “Millennials” as those born between 1981 and 1996, with “Gen Z” representing those born in 1997 and after.

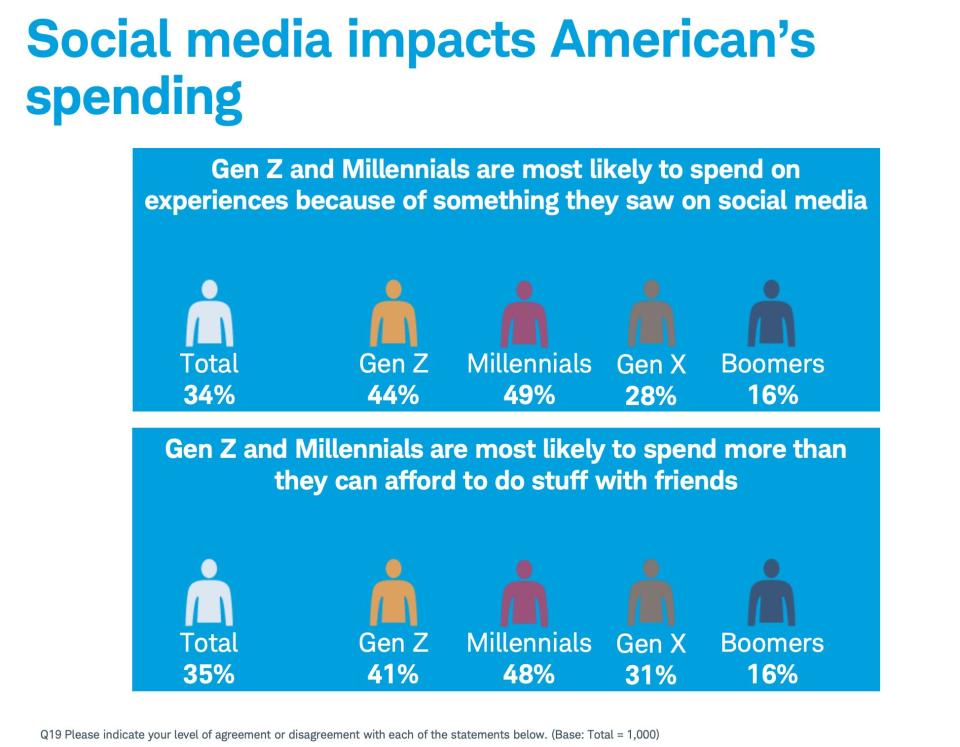

And while the prevailing sentiment among all the age groups was that social media generally had the worst negative influence on their spending — as compared to other influences like family, friends, or co-workers — Gen Zers and millennials confessed that they were also more likely to act on these urges and to spend big on experiences.

Charles Schwab found that 49% of millennials surveyed confessed to spending on experiences based on something they saw on social media, while 44% of Gen Z said the same.

At the same time, 48% of millennials said they were most likely to spend more than they can afford to do stuff with their friends. 41% of millennials said the same.

‘Dopamine’ and money

In 2016, researchers from the University of California, Los Angeles, analyzed the brains of 34 teenagers and found that a large number of likes on their Instagram post stimulated significant activity across a wide variety of regions in their brain.

That activity — which former Facebook executive Chamath Palihapitiya called “short-term, dopamine-driven feedback loops” — could be driving millennials and Gen Z to bad financial habits.

Gen Z also relied heavily on social media for travel ideas, according to a separate study by Expedia, with 84% using various platforms to find deals, promotions, pictures or videos from friends or experts.

‘It's really just about budgeting’

Despite 59% of Americans surveyed calling themselves savers — the demographics were not broken down for this section — the same percentage lives paycheck to paycheck, and 44% carry a credit balance or struggle to keep up with bills or payments.

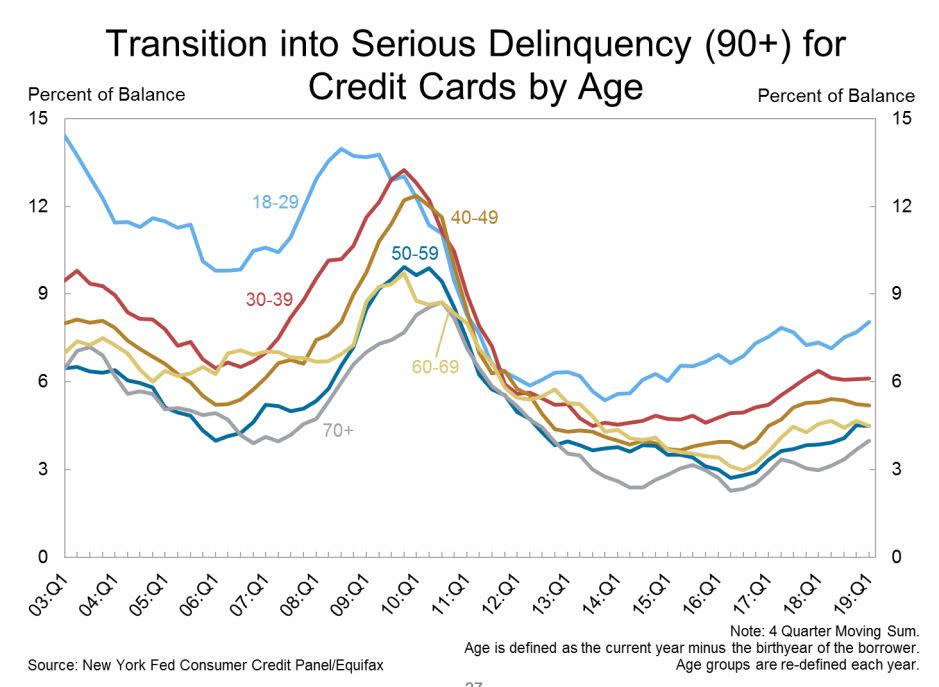

Millennials and Gen Z both in particular are contributing to higher levels of credit card delinquency rates, while at the same time, a new batch of layaway companies like Afterpay and Klarna have come along to finance their habits by offering buy now, pay later services.

But the debt issue could quickly go south, as Gen Z racks up even more debt.

According to CompareCards, 32% of college students have more than one credit card. Out of all the students with at least one credit card, 62% don’t pay their bill in full each month, and 52% have worried about their ability to make a payment.

And missed deadlines — by all demographics — are causing pain all the way up the chain, with banks responding to increasing levels of serious delinquencies by tightening credit limits.

Oonnoonny noted that the key for anyone wanting to manage their personal spending is to have a plan.

“It's really just about budgeting,” he said. “And I think once you understand what you have, what you can pay for, and what's left over, then you can make some good choices around, you know, how am I going to hit that next incremental goal.”

He added that “it's about breaking down the goals and being able to get to where you want to go.”

—

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

Household debt hits $13.6 trillion as student loan and credit card delinquencies rise

Elizabeth Warren unveils 'broad cancellation plan' for student debt

'The clock is ticking' on U.S. consumer loans — and that could mean a slowdown, Deutsche Bank warns

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.