Petrobras (PBR) Q3 Earnings Beat, Revenues Miss, FCF Soars

Brazil's state-run energy giant Petroleo Brasileiro S.A., or Petrobras PBR announced third-quarter earnings per ADS of 36 cents, beating the Zacks Consensus Estimate of 28 cents and the year-ago quarter profit of 26 cents. Adjusted EBITDA rose to $8,209 million from $7,559 million a year ago. The outperformances could be attributed to impressive production growth and lower lifting costs.

However, the Brazilian state-run energy giant’s revenues of $19,416 million missed the Zacks Consensus Estimate of $20,307 million and fell from the year-earlier sales of $22,547 million. The unfavorable comparisons stem from lower average realized commodity prices and decline in oil product sales.

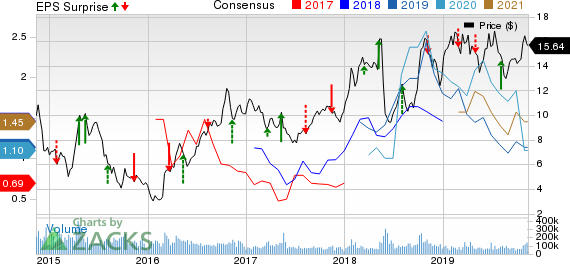

Petroleo Brasileiro S.A.- Petrobras Price, Consensus and EPS Surprise

Petroleo Brasileiro S.A.- Petrobras price-consensus-eps-surprise-chart | Petroleo Brasileiro S.A.- Petrobras Quote

Let's take a deeper look at the recent performances from the company's two main segments: Upstream (Exploration & Production) and Downstream (or Refining, Transportation and Marketing).

Upstream: The Rio de Janeiro-headquartered company’s total oil and gas production during the third quarter reached 2,878 thousand barrels of oil equivalent per day (MBOE/d) – 79% liquids – up from 2,513 Mbbl/d in the same period of 2018.

Compared with the third quarter of 2018, Brazilian oil and natural gas production – constituting 97% of the overall output – increased 16.5% to 2,794 MBOE/d. The improvement was driven by ramp-up of new projects that began operations in 2018 and 2019.

In the July to September period, the average sales price of oil in Brazil slumped 17.2% from the year-earlier period to $58.10 per barrel. While the falling crude prices reduced upstream segment earnings significantly, it was partly offset by higher production. A tight leash on pre-salt lifting costs, which fell 22% from the third quarter of 2018 to a record $5.03 per barrel, also provided some support.

Overall, the segment’s revenues edged down to $12,551 million in the quarter under review from $13,115 million in the year-ago period. Moreover, profits fell to $2,979 million from the year-ago figure of $3,120 million.

Downstream: Revenues from the segment totaled $17,124 million, lower than the year-ago figure of $19,312 million. Petrobras' downstream earnings tanked to $106 million from the year-ago level of $903 million, owing to weaker domestic oil products sales margins and inventory turnover effects.

Costs

During the period, Petrobras’ sales, general and administrative expenses stood at $1,759 million, 2.7% lower than the year-ago period. Selling expenses also fell by 3.5% to $1,252 million. Consequently, total operating expenses declined by 8.2% year over year to $4,069 million.

Financial Position

During the three months ended Sep 30, 2019, Petrobras’ capital investments and expenditures totaled $2,612 million, 33.2% lower than the $3,908 million incurred in the year-ago period.

Importantly, the company generated positive free cash flow for the 18th consecutive quarter, with the metric surging to $6,480 million from $2,049 million recorded in last year’s corresponding period. This was primarily driven by proceeds from the sale of BR Distribuidora – the company’s former fuel distribution segment.

Meanwhile, adjusted EBITDA rose to $8,209 million from the year-ago figure of $7,559 million.

At the end of the quarter, Petrobras had a net debt of $75,419 million, increasing from $72,888 million a year ago. The company ended the third quarter with cash and cash equivalents of $13,179 million.

On a positive note, Petrobras managed to trim its net debt to the trailing 12 months EBITDA ratio to 2.40 from 2.62 in the previous year.

Zacks Rank & Key Picks

Petrobras carries a Zacks Rank #3 (Hold).

Meanwhile, investors interested in the energy space could look at some better options like Phillips 66 PSX, Murphy USA Inc. MUSA and SilverBow Resources, Inc. SBOW that carry a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Petroleo Brasileiro S.A.- Petrobras (PBR) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

Phillips 66 (PSX) : Free Stock Analysis Report

SilverBow Resources Inc. (SBOW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research