Pharma Catches Another Case Of M&A Fever

Is it 2018 all over again? While most investors will probably flinch at the suggestion, history is repeating itself somewhat in the pharmaceutical industry in the form of a frenzy of M&A announcements.

Specifically, January 2019 kicked off with two massive M&A deals. First, Bristol-Myers Squibb Co. (NYSE: BMY) announced its agreement to buyout Celgene Corp. (NASDAQ: CELG) in an industry record deal that could fall short of $100 billion. This was followed just days later by news that Eli Lilly & Co. (NYSE: LLY) will acquire Loxo Oncology Inc. (NASDAQ: LOXO) for a slightly more modest $8 billion as well as rumors that Amarin Corporation PLC (NASDAQ: AMRN) was a potential acquisition target for Pfizer Inc. (NYSE: PFE).

This mirrors January 2018’s onrush of big pharma purchases which saw Celgene purchase both Impact Biomedicines for $7 billion Juno Therapeutics for $9 billion, while French pharma Sanofi SA (NASDAQ: SNY) acquired Dutch antibody firm Ablynx for $4.8 billion and hemophilia-focused drugmaker Bioverativ for $11.6 billion. That was eventually followed up by even more truly massive deals from GlaxoSmithKline PLC (NYSE: GSK) and Takeda Pharmaceutical Co Ltd (NYSE:TAK). In all, the first six months of 2018 generated more than $100 billion in M&A deals in the biotech industry.

So, good news for pharma investors, right?

Well, yes with an “if” and no with a “but.”

First, the good. Not only was 2018 a massive year of pharmaceutical mergers, but was also a stellar year for biotech IPOs. The 56 biotechs companies that hit the market in 2018 with a cap above $30 million raised a total of about $7 billion in the funding round prior to their IPO. Compare that to the 40 IPOs in 2017 totaling about $4 billion in capital raised.

The 2018 contingent of biotech IPOs could provide fertile ground for additional M&A purchasing if the large pharma companies continue to seek expansion.

However, that’s an open question for the pharma giants. While 2018 revenue was uniformly up from the previous year among big names like Pfizer, Eli Lilly and Bristol-Myers, the appetite for expansion these companies showed in 2018 might begin to wane in 2019. For one, interest rates are higher, which makes cash on hand that much more valuable. Next, projections of slowing U.S. growth likely have companies thinking more strategically about what growth might look like by 2020.

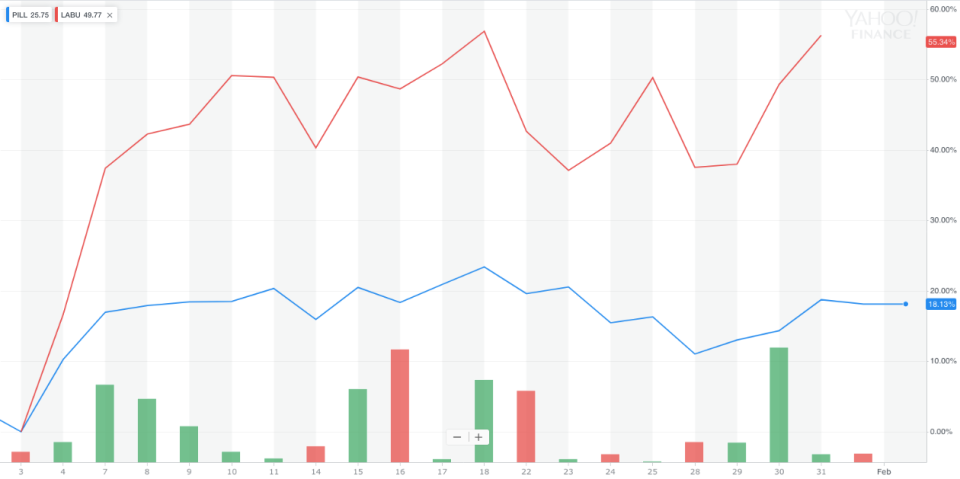

More importantly, the investment landscape is also very different than it was in the opening weeks of 2018. If we look at the Direxion Daily Pharmaceutical & Medical Bull 3X Shares (NYSE: PILL) dating back to December 2017, the real contrast between the years emerges.

Source: Yahoo Finance

The biggest difference in PILL’s chart between 2018 and 2019 is where the market was prior to their respective January's. Unlike the bull market conditions that propelled the ETF to new highs in early 2018, big pharma, like much of the market circa 2019, is digging itself out of a hole. While that doesn’t discount the viability of continued M&A through Q1 and into Q2, the particular momentum that 2018 provided was likely extended by overall market confidence.

But, one thing investors can monitor for a sense of the pharma industry relative strength is investor interest in the biotech space. Like PILL, the Direxion Daily S&P Biotech Bull 3X Shares (NYSE: LABU) has been doing stellar in the initial weeks of the year, climbing 40 percent since the start of the year. Historically, the ETF has performed fairly closely to PILL, although with a bit more volatility.

Source: Yahoo Finance

If trend is set to reverse in either of these industries, expect LABU to show the first signs of weakness, particularly if M&A slows heading into Q2.

See more from Benzinga

© 2019 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.